Answered step by step

Verified Expert Solution

Question

1 Approved Answer

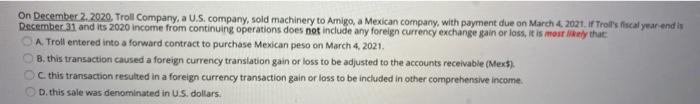

On December 2.2020. Troll Company, a U.S.company, sold machinery to Amigo, a Mexican company, with payment due on March 4, 2021. If Troll's fiscal year

On December 2.2020. Troll Company, a U.S.company, sold machinery to Amigo, a Mexican company, with payment due on March 4, 2021. If Troll's fiscal year end in December 31 and its 2020 income from continuing operations does not include any foreign currency exchange gain or loss, it is most likely that Troll entered into a forward contract to purchase Mexican peso on March 4, 2021. 8. this transaction caused a foreign currency translation gain or loss to be adjusted to the accounts receivable (Mex$). this transaction resulted in a foreign currency transaction gain or loss to be included in other comprehensive income D. this sale was denominated in U.S. dollars

On December 2.2020. Troll Company, a U.S.company, sold machinery to Amigo, a Mexican company, with payment due on March 4, 2021. If Troll's fiscal year end in December 31 and its 2020 income from continuing operations does not include any foreign currency exchange gain or loss, it is most likely that Troll entered into a forward contract to purchase Mexican peso on March 4, 2021. 8. this transaction caused a foreign currency translation gain or loss to be adjusted to the accounts receivable (Mex$). this transaction resulted in a foreign currency transaction gain or loss to be included in other comprehensive income D. this sale was denominated in U.S. dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started