Answered step by step

Verified Expert Solution

Question

1 Approved Answer

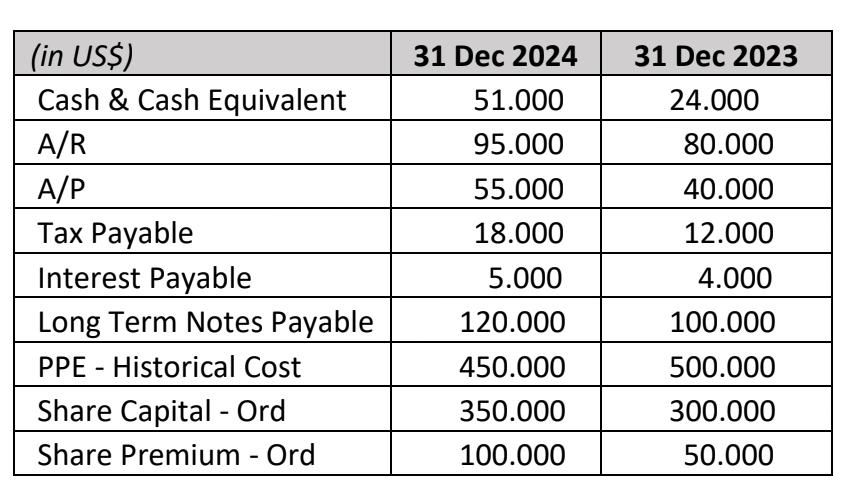

On December 3 1 , 2 0 2 4 and 2 0 2 3 , Wonderwoman Inc. presents comparative data in the financial position report

On December and Wonderwoman Inc. presents comparative data in

the financial position report is as follows:

Additional data:

During Wonderwoman Inc. recorded a net loss Net Loss of $

The company records depreciation expense of $ for

Changes in the value of PPE occur as a result of the sale of equipment that has value

accumulated depreciation of $ The money received as a result of this sale was $

There will be no additional PPE in

There are no dividends either Cash Dividend or Share Dividend announced by the Company.

At the beginning of the company has paid off the loan debt Notes Payable worth

$ The company will make another loan in mid

Task:

Prepare a cash flow statement for Wonderwoman Inc. for the year ending December

using the indirect method Indirect Method

tablein US$ Dec Dec Cash & Cash Equivalent,ARAPTax Payable,Interest Payable,Long Term Notes Payable,PPE Historical Cost,Share Capital Ord,Share Premium Ord,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started