Answered step by step

Verified Expert Solution

Question

1 Approved Answer

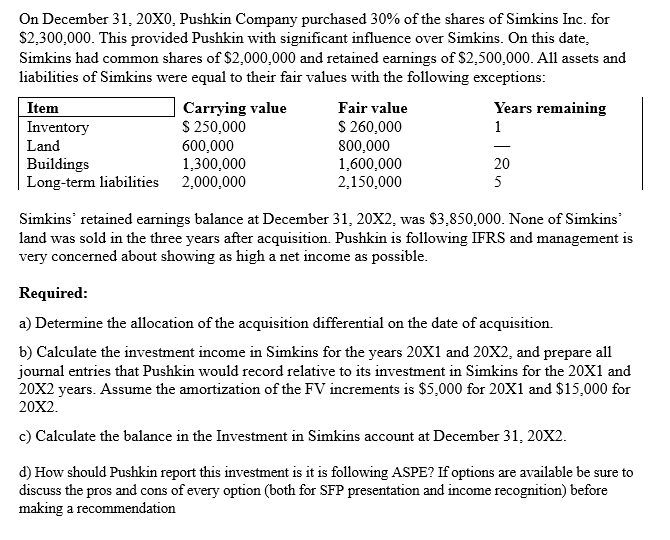

On December 3 1 , 2 0 X 0 , Pushkin Company purchased 3 0 % of the shares of Simkins Inc. for $ 2

On December X Pushkin Company purchased of the shares of Simkins Inc. for

$ This provided Pushkin with significant influence over Simkins. On this date,

Simkins had common shares of $ and retained earnings of $ All assets and

liabilities of Simkins were equal to their fair values with the following exceptions:

Simkins' retained earnings balance at December was $ None of Simkins"

land was sold in the three years after acquisition. Pushkin is following IFRS and management is

very concerned about showing as high a net income as possible.

Required:

a Determine the allocation of the acquisition differential on the date of acquisition.

b Calculate the investment income in Simkins for the years X and X and prepare all

journal entries that Pushkin would record relative to its investment in Simkins for the X and

years. Assume the amortization of the FV increments is $ for and $ for

c Calculate the balance in the Investment in Simkins account at December

d How should Pushkin report this investment is it is following ASPE? If options are available be sure to

discuss the pros and cons of every option both for SFP presentation and income recognition before

making a recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started