Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 3 1 , Year 1 , the Board of Directors of Maxy Manufacturing, Inc. committed to a plan to discontinue the operations of

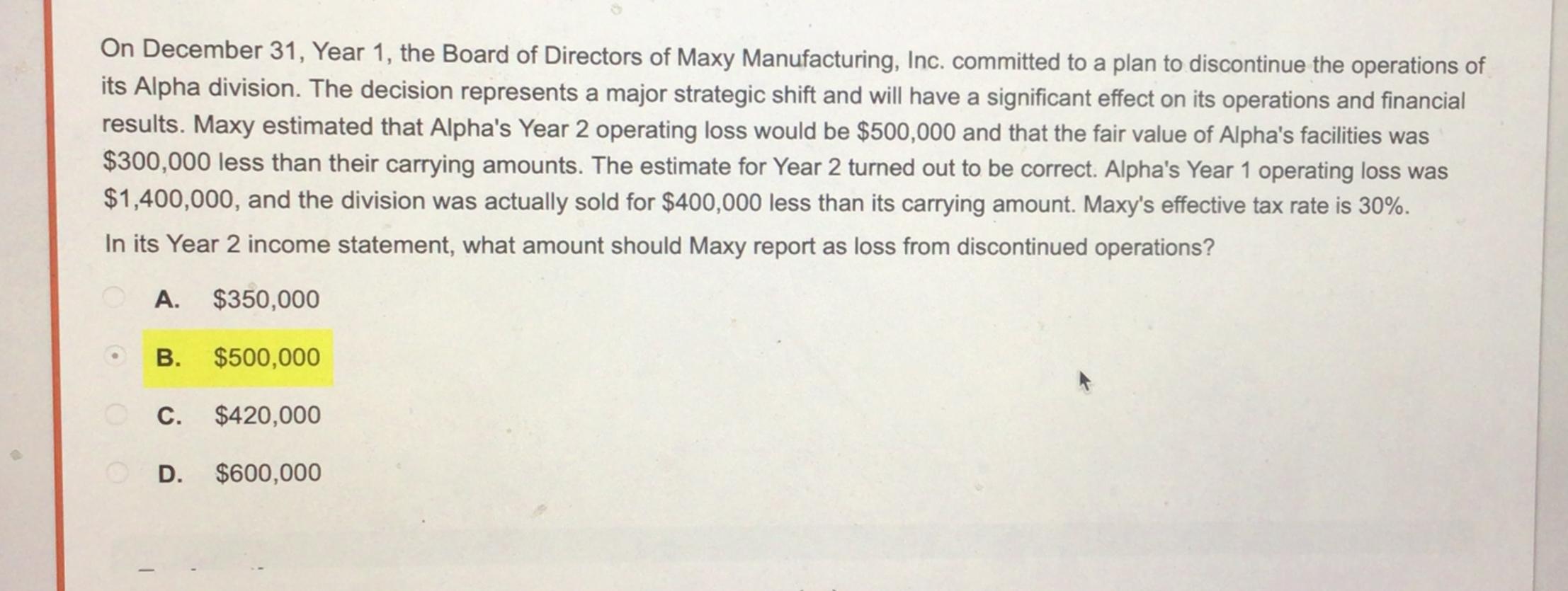

On December Year the Board of Directors of Maxy Manufacturing, Inc. committed to a plan to discontinue the operations of its Alpha division. The decision represents a major strategic shift and will have a significant effect on its operations and financial results. Maxy estimated that Alpha's Year operating loss would be $ and that the fair value of Alpha's facilities was $ less than their carrying amounts. The estimate for Year turned out to be correct. Alpha's Year operating loss was $ and the division was actually sold for $ less than its carrying amount. Maxy's effective tax rate is

In its Year income statement, what amount should Maxy report as loss from discontinued operations? And why is the loss on disposal $

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started