Question

On December 31, 2011, Mohammed and Meshal formed a partnership, and they agreed to share profit or loss equally. The partnership net income is

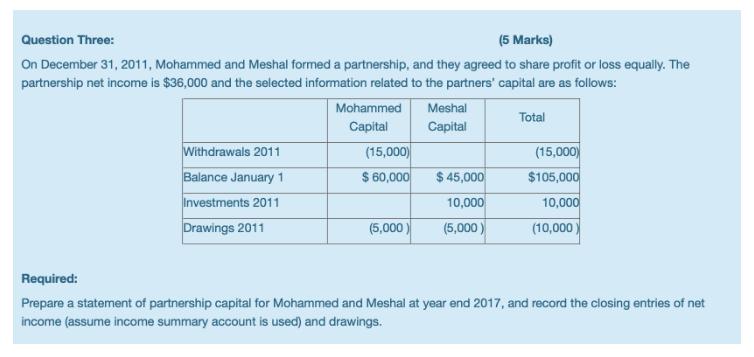

On December 31, 2011, Mohammed and Meshal formed a partnership, and they agreed to share profit or loss equally. The partnership net income is $36,000 and the selected information related to the partners' capital are as follows: Total Withdrawals 2011 Balance January 1 Investments 2011 Drawings 2011 Mohammed Capital (15,000) $ 60,000 (5,000) Meshal Capital $45,000 10,000 (5,000) (15,000) $105,000 10,000 (10,000) Required: Prepare a statement of partnership capital for Mohammed and Meshal at year end 2017, and record the closing entries of net income (assume income summary account is used) and drawings.

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App