Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preparing a Statement of Stockholders' Equity with a Prior Period Error In 2015, the first year of operations for Sprint Co, the company reported

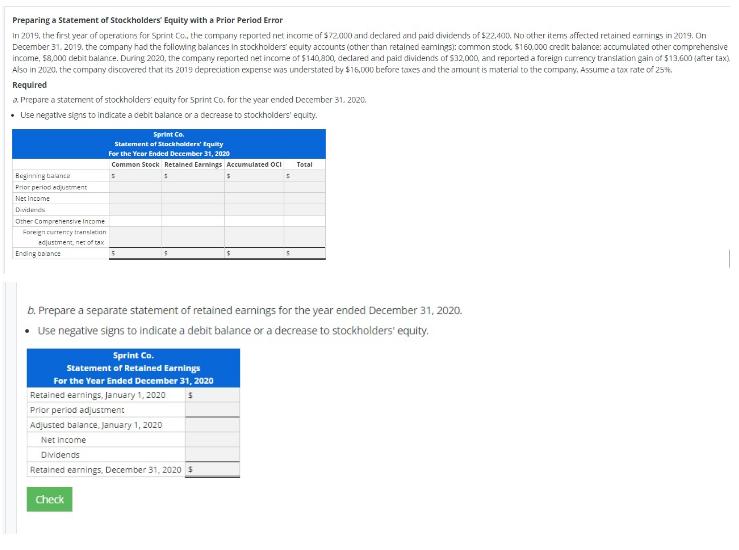

Preparing a Statement of Stockholders' Equity with a Prior Period Error In 2015, the first year of operations for Sprint Co, the company reported net income of $72,000 and declared and paid dividends of $22.400, No other items affected retained earnings in 2019. On December 31, 2019, the company had the following balances in stockholders' equity accounts (other than retained earnings): common stock $160.000 credit balance: accumulated other comprehensive income, $8,000 debit balance. During 2020, the company reported net income of $140,800, declared and paid dividends of $32,000, and reported a foreign currency translation gain of $13.600 (after tax) Also in 2020, the company discovered that its 2019 depreciation expense was understated by $15,000 before taxes and the amount is material to the company, Assume a tax rate of 25% Required a. Prepare a statement of stockholders' equity for Sprint Co. for the year ended December 31, 2020. Use negative signs to indicate a debit balance or a decrease to stockholders' equity. Beginning balanca Prior period adjustment Net Income Dividends Other Comprehensive Income Foreign currency translation adjustment, net of tax Ending balance Sprint Co. Statement of Stockholders' Equity For the Year Ended December 31, 2020 Common Stock Retained Earnings Accumulated OCI Total 5 $ b. Prepare a separate statement of retained earnings for the year ended December 31, 2020. Use negative signs to indicate a debit balance or a decrease to stockholders' equity. Sprint Co. Statement of Retained Earnings For the Year Ended December 31, 2020 Check Retained earnings, January 1, 2020 Prior period adjustment Adjusted balance, January 1, 2020 Net Income Dividends Retained earnings, December 31, 2020 $ $

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started