Answered step by step

Verified Expert Solution

Question

1 Approved Answer

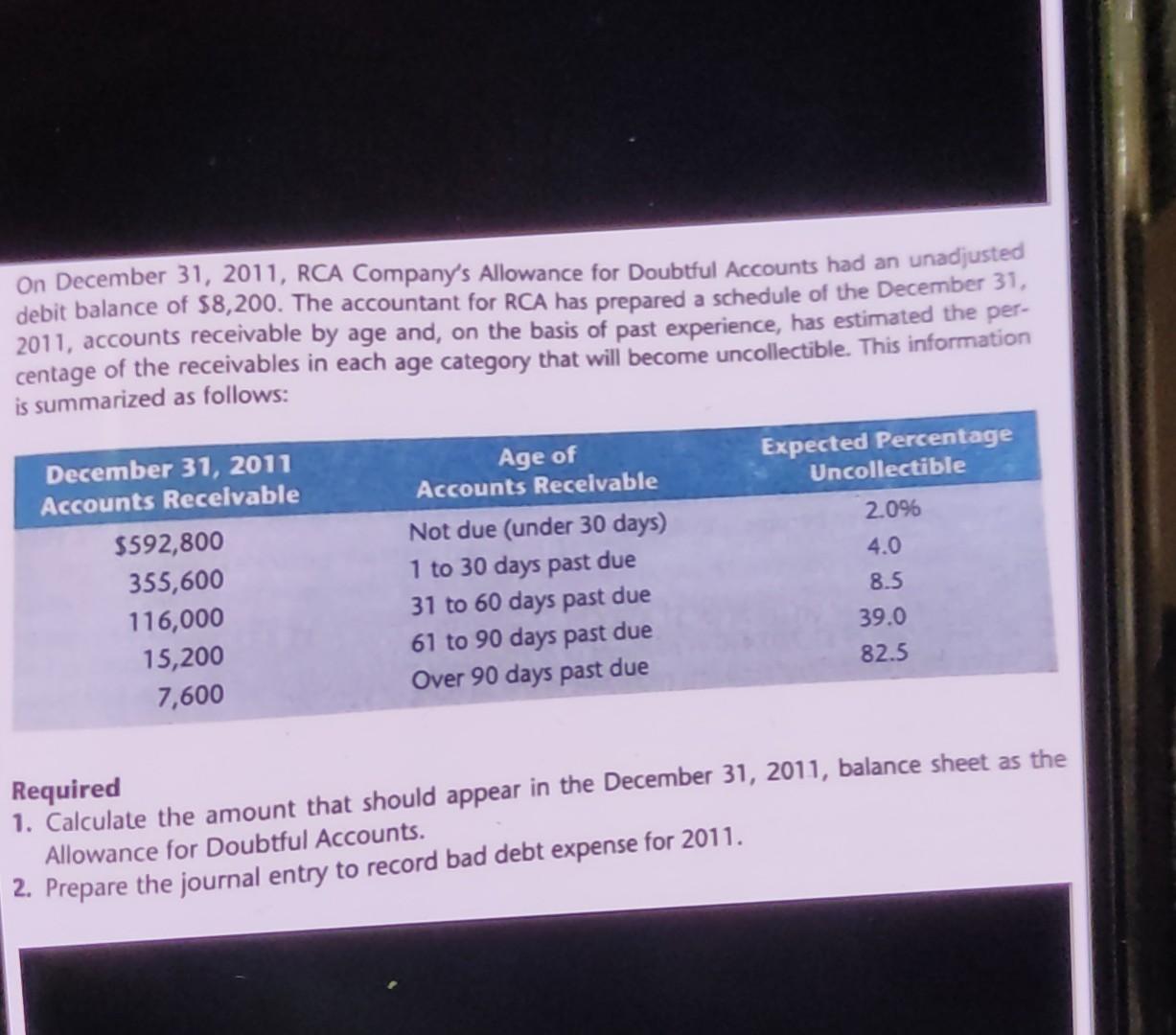

On December 31, 2011, RCA Company's Allowance for Doubtful Accounts had an unadjusted debit balance of $8,200. The accountant for RCA has prepared a schedule

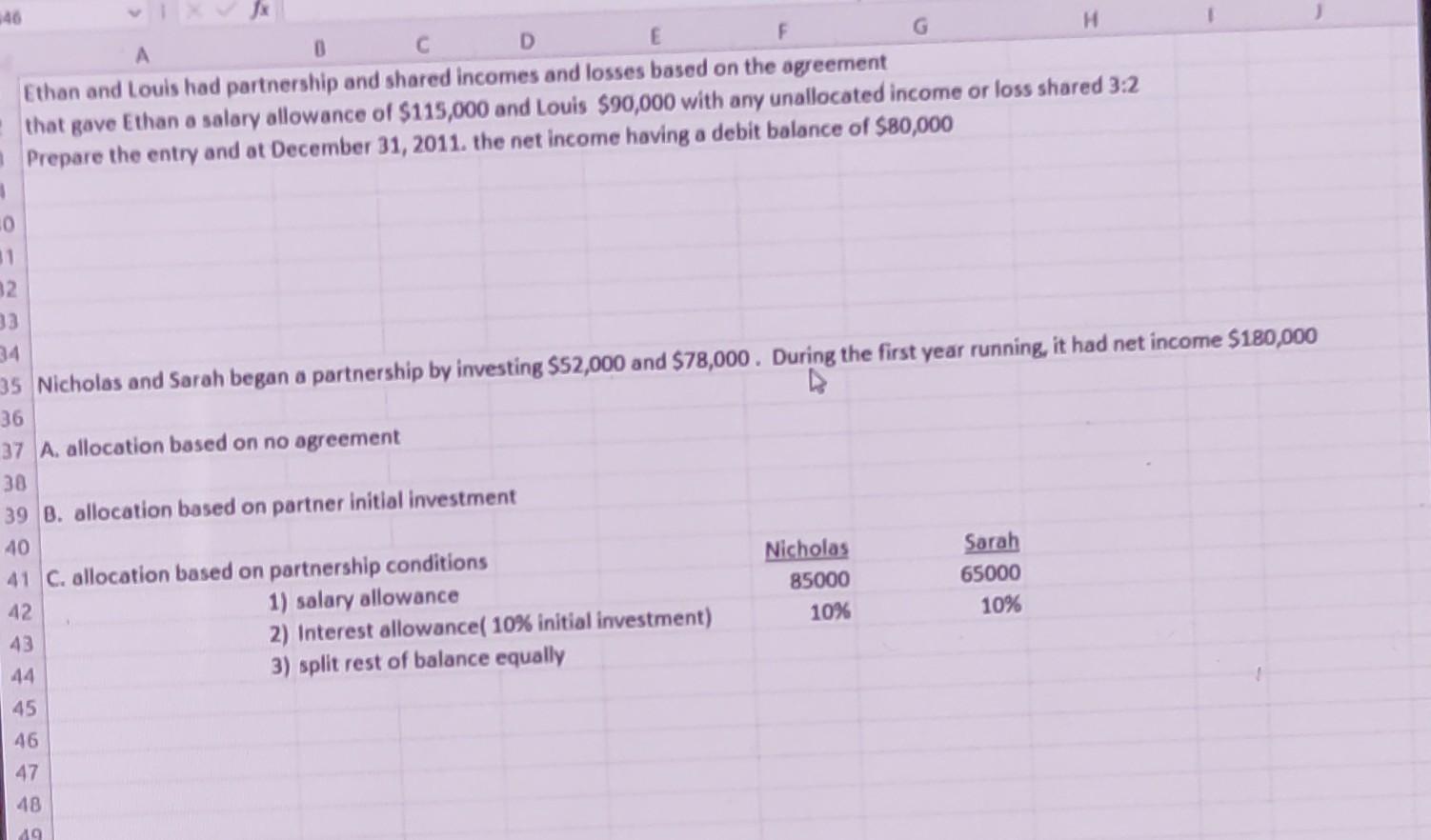

On December 31, 2011, RCA Company's Allowance for Doubtful Accounts had an unadjusted debit balance of $8,200. The accountant for RCA has prepared a schedule of the December 31, 2011, accounts receivable by age and, on the basis of past experience, has estimated the per- centage of the receivables in each age category that will become uncollectible. This information is summarized as follows: Expected Percentage Uncollectible December 31, 2011 Accounts Receivable $592,800 355,600 116,000 15,200 7,600 Age of Accounts Receivable Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due 2.096 4.0 8.5 39.0 82.5 Required 1. Calculate the amount that should appear in the December 31, 2011, balance sheet as the Allowance for Doubtful Accounts. 2. Prepare the journal entry to record bad debt expense for 2011. 46 0 D E F G H Ethan and Louis had partnership and shared incomes and losses based on the agreement that gave Ethan a salary allowance of $115,000 and Louis $90,000 with any unallocated income or loss shared 3:2 Prepare the entry and at December 31, 2011, the net income having a debit balance of $80,000 10 31 32 33 34 35 Nicholas and Sarah began a partnership by investing $52,000 and $78,000. During the first year running, it had net income $180,000 36 37 A. allocation based on no agreement 30 39 B. allocation based on partner initial investment 40 Nicholas Sarah 41 C. allocation based on partnership conditions 42 1) salary allowance 85000 65000 10% 43 10% 2) Interest allowancel 10% initial investment) 44 3) split rest of balance equally 45 46 47 48 19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started