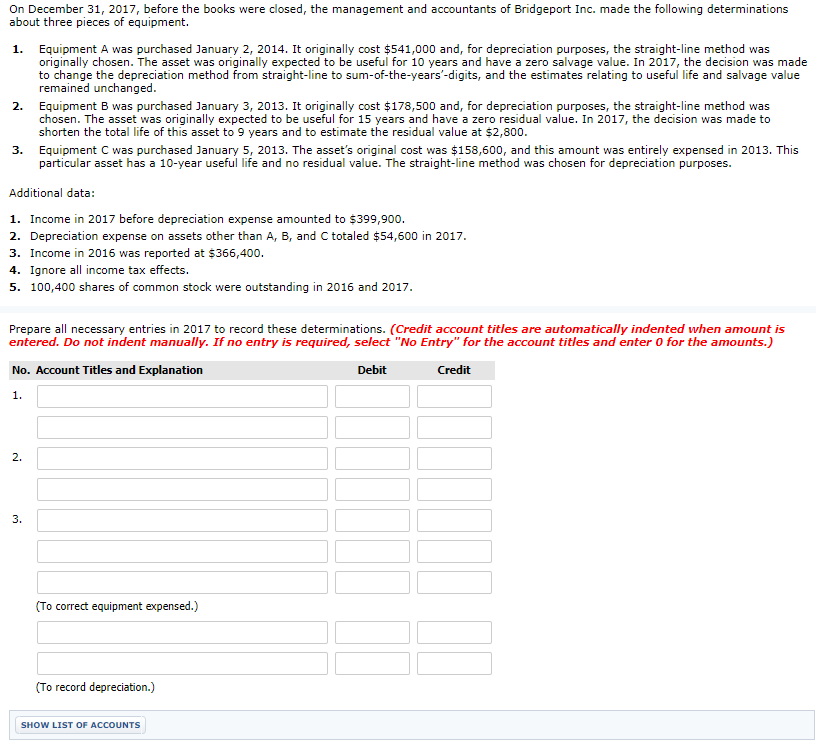

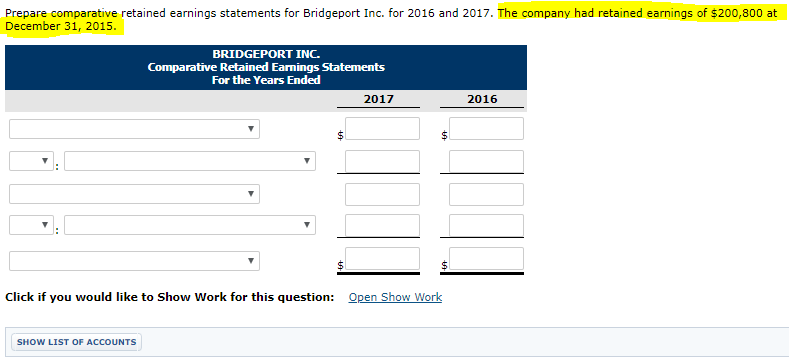

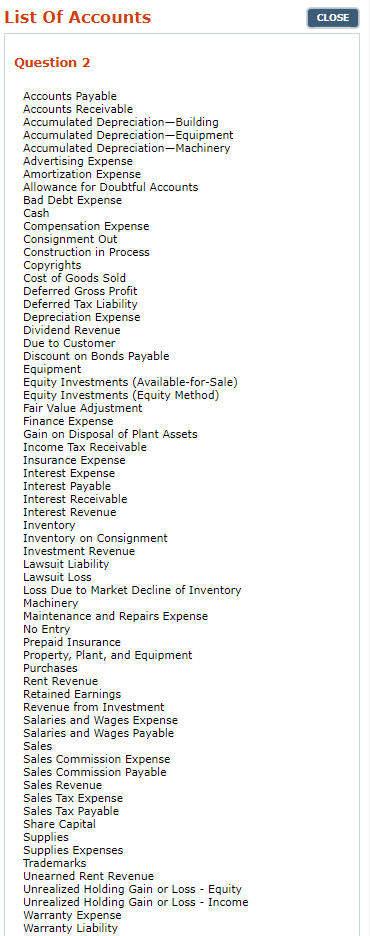

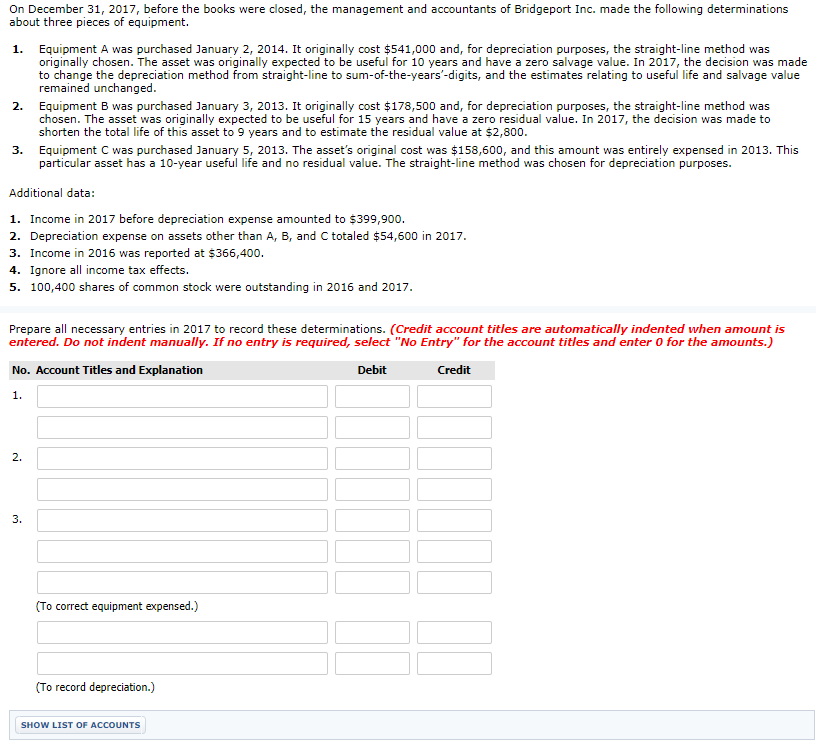

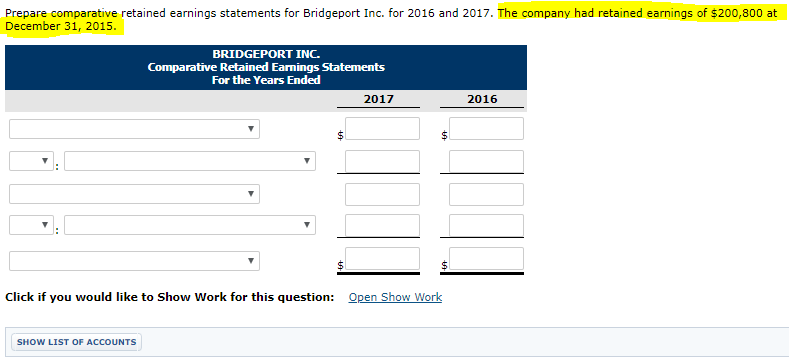

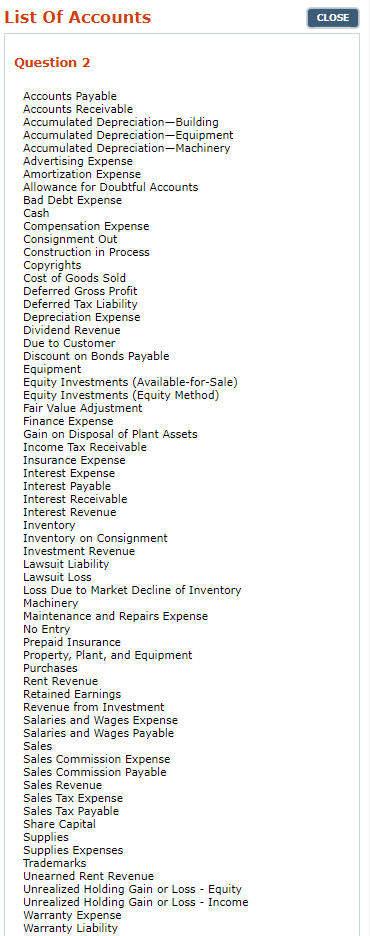

On December 31, 2017, before the books were closed, the management and accountants of Bridgeport Inc. made the following determinations about three pieces of equipment. Equipment A was purchased January 2, 2014. It originally cost $541,000 and, for depreciation purposes, the straight-line method was originally chosen. The asset was originally expected to be useful for 10 years and have a zero salvage value. In 2017, the decision was made to change the depreciation method from straight-line to sum-of-the-years'-digits, and the estimates relating to useful life and salvage value remained unchanged Equipment B was purchased January 3, 2013, It originally cost $178,500 and, for depreciation purposes, the straight-line method was chosen. The asset was originally expected to be useful for 15 years and have a zero residual value. In 2017, the decision was made to shorten the total life of this asset to 9 years and to estimate the residual value at $2,800 Equipment C was purchased January 5, 2013. The asset's original cost was $158,600, and this amount was entirely expensed in 2013. This particular asset has a 10-year useful life and no residual value. The straight-line method was chosen for depreciation purposes 1. 2. 3. Additional data: 1. Income in 2017 before depreciation expense amounted to $399,900 2. Depreciation expense on assets other than A, B, and C totaled $54,600 in 2017 3. Income in 2016 was reported at $366,400 4. Ignore all income tax effects 5. 100,400 shares of common stock were outstanding in 2016 and 2017 Prepare all necessary entries in 2017 to record these determinations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit 2. 3. (To correct equipment expensed.) (To record depreciation.) SHOW LIST OF ACCOUNTS Prepare comparative retained earnings statements for Bridgeport Inc. for 2016 and 2017. The company had retained earnings of $200,800 at December 31, 2015 BRIDGEPORT INC. Comparative Retained Earnings Statements For the Years Ended 2017 2016 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS List Of Accounts CLOSE Question 2 Accounts Payable Accounts Receivable Accumulated Depreciation-Building Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Advertising Expense Amortization Expense Allowance for Doubtful Accounts Bad Debt Expense Cash Compensation Expense Consignment Out Construction in Process Copyrights Cost of Goods Sold Deferred Gross Profit Deferred Tax Liability Depreciation Expense Dividend Revenue Due to Customer Discount on Bonds Payable Equipment Equity Investments (Available-for-Sale) Equity Investments (Equity Method) Fair Value Adjustment Finance Expense Gain on Disposal of Plant Assets Income Tax Receivable Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Inventory on Consignment Investment Revenue Lawsuit Liability Lawsuit Loss Loss Due to Machinery Maintenance and Repairs Expense No Entry Prepaid Insurance Property, Plant, and Equipment Purchases Rent Revenue Retained Earnings Revenue from Investment Salaries and Wages Expense Salaries and Wages Payable Sales Sales Commission Expense Sales Commission Payable Sales Revenue Sales Tax Expense Sales Tax Payable Share Capital Supplies Supplies Expenses Trademarks Unearned Rent Revenue Unrealized Holding Gain or Loss Equity Unrealized Holding Gain or Loss Income Warranty Expense Warranty Liability Market Decline of Inventory