Question

On December 31, 2017, GE paid an annual dividend per share of $0.96. They also announced on the same day that they will reduce

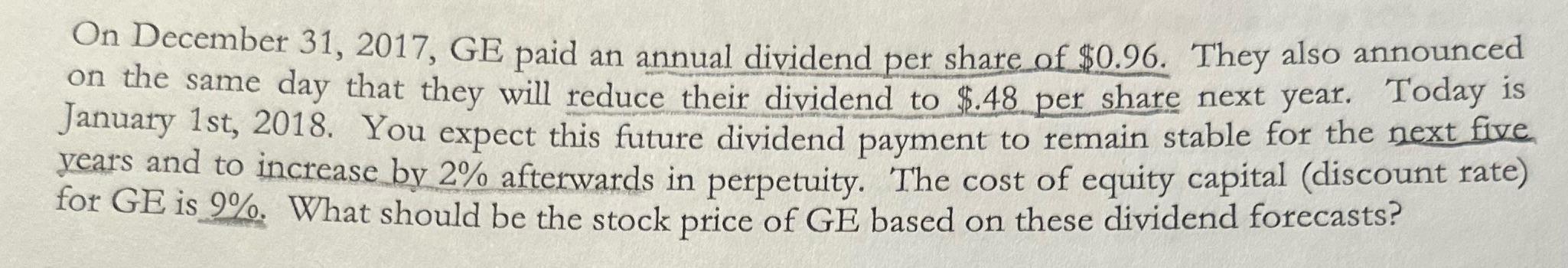

On December 31, 2017, GE paid an annual dividend per share of $0.96. They also announced on the same day that they will reduce their dividend to $.48 per share next year. Today is January 1st, 2018. You expect this future dividend payment to remain stable for the next five years and to increase by 2% afterwards in perpetuity. The cost of equity capital (discount rate) for GE is 9%. What should be the stock price of GE based on these dividend forecasts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the stock price of GE based on the given dividend forecasts we can use the dividend discount model DDM This involves calculating the pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managing Business Ethics Making Ethical Decisions

Authors: Alfred A. Marcus, Timothy J. Hargrave

1st Edition

1506388590, 978-1506388595

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App