Question

On December 31, 2017, Oriole Inc. rendered services to Beghun Corporation at an agreed price of $116,591, accepting $45,700 down and agreeing to accept the

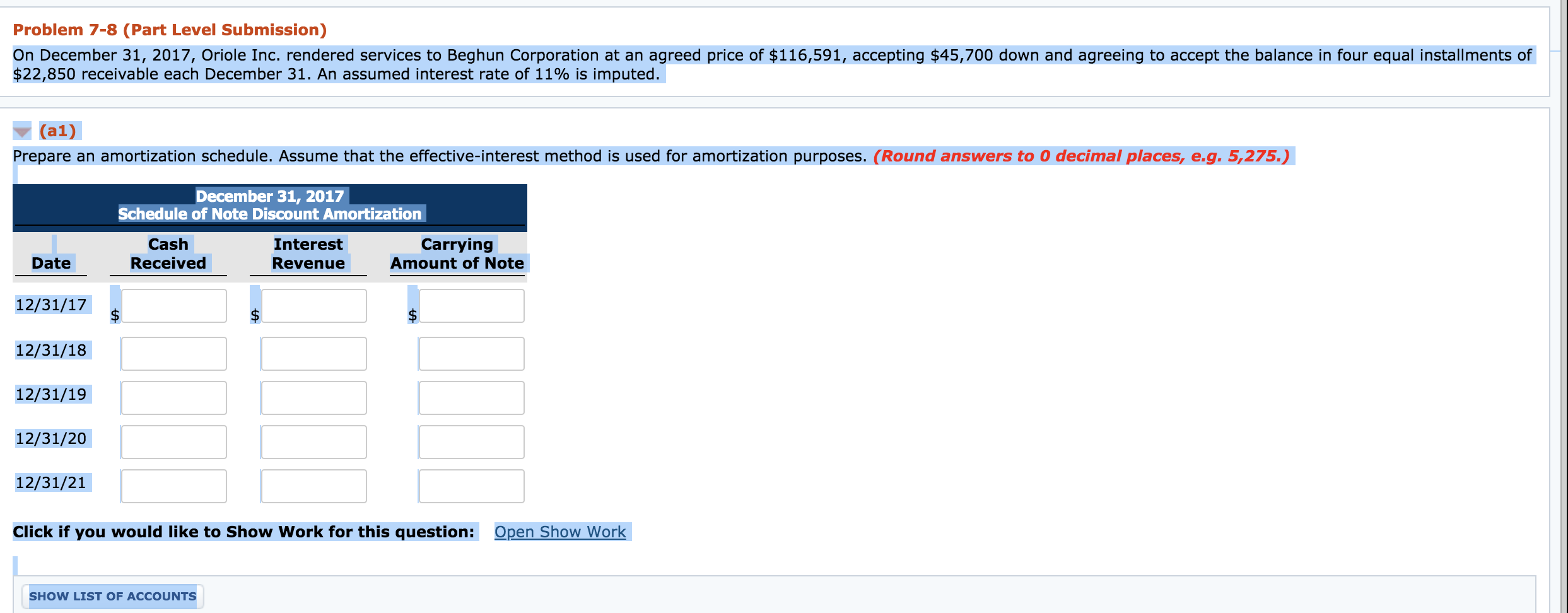

On December 31, 2017, Oriole Inc. rendered services to Beghun Corporation at an agreed price of $116,591, accepting $45,700 down and agreeing to accept the balance in four equal installments of $22,850 receivable each December 31. An assumed interest rate of 11% is imputed. Collapse question part (a1) Prepare an amortization schedule. Assume that the effective-interest method is used for amortization purposes. (Round answers to 0 decimal places, e.g. 5,275.) December 31, 2017 Schedule of Note Discount Amortization Date Cash Received Interest Revenue Carrying Amount of Note 12/31/17 $ $ $ 12/31/18 12/31/19 12/31/20 12/31/21 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS

On December 31, 2017, Oriole Inc. rendered services to Beghun Corporation at an agreed price of $116,591, accepting $45,700 down and agreeing to accept the balance in four equal installments of $22,850 receivable each December 31. An assumed interest rate of 11% is imputed. Collapse question part (a1) Prepare an amortization schedule. Assume that the effective-interest method is used for amortization purposes. (Round answers to 0 decimal places, e.g. 5,275.) December 31, 2017 Schedule of Note Discount Amortization Date Cash Received Interest Revenue Carrying Amount of Note 12/31/17 $ $ $ 12/31/18 12/31/19 12/31/20 12/31/21 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started