Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2017, Short Co. is in financial difficulty and cannot pay a note due that day. It is a $2,000,000 face value

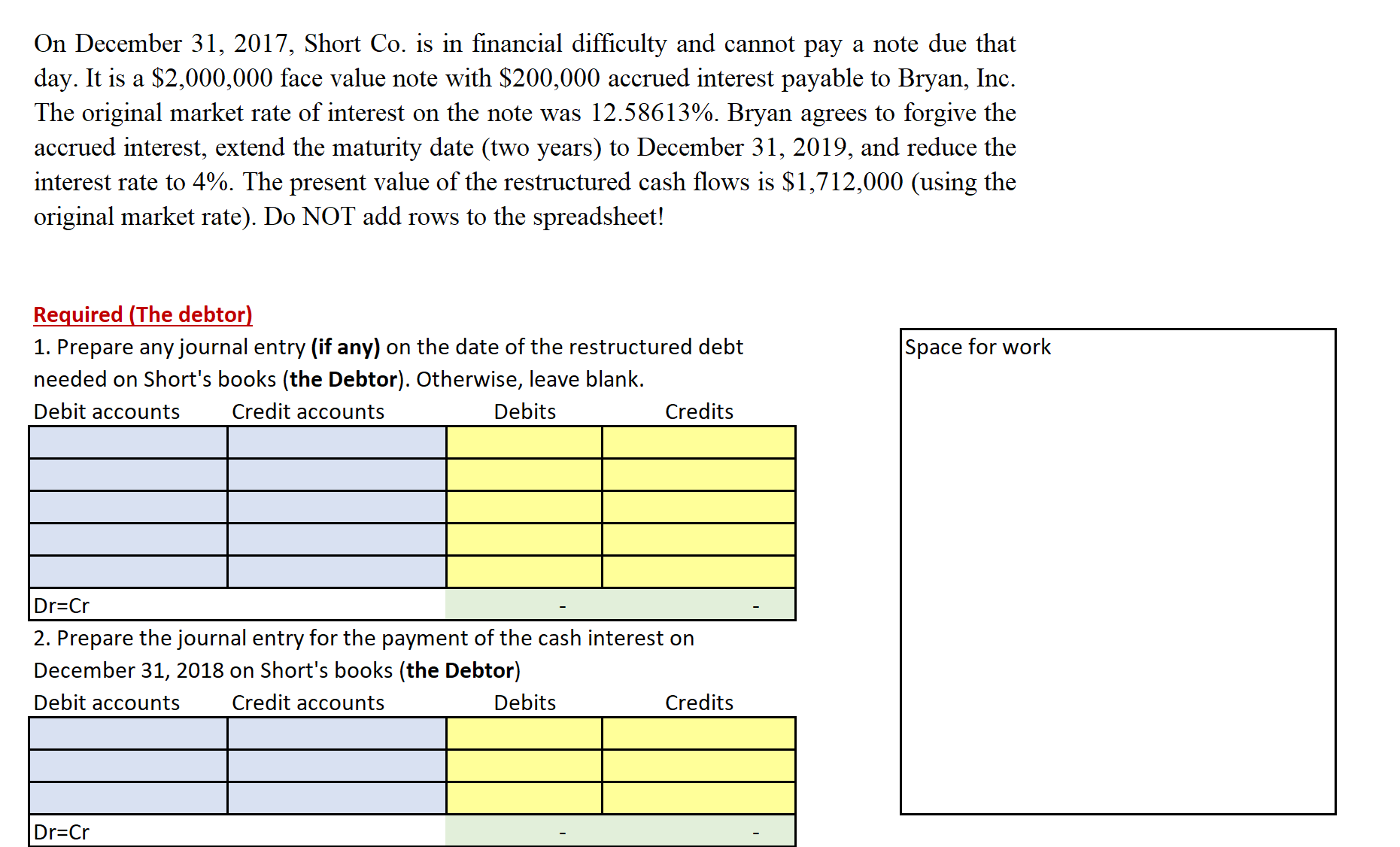

On December 31, 2017, Short Co. is in financial difficulty and cannot pay a note due that day. It is a $2,000,000 face value note with $200,000 accrued interest payable to Bryan, Inc. The original market rate of interest on the note was 12.58613%. Bryan agrees to forgive the accrued interest, extend the maturity date (two years) to December 31, 2019, and reduce the interest rate to 4%. The present value of the restructured cash flows is $1,712,000 (using the original market rate). Do NOT add rows to the spreadsheet! Required (The debtor) 1. Prepare any journal entry (if any) on the date of the restructured debt needed on Short's books (the Debtor). Otherwise, leave blank. Debit accounts Credit accounts Debits Credits Dr=Cr 2. Prepare the journal entry for the payment of the cash interest on December 31, 2018 on Short's books (the Debtor) Debit accounts Dr=Cr Credit accounts Debits Credits Space for work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started