Question

On December 31, 2018, Alpha Corporation, valued at $10,000,000, acquired BetaCo when BetaCo was valued at $5,000,000. BetaCo holds a capital loss carry forward of

On December 31, 2018, Alpha Corporation, valued at $10,000,000, acquired BetaCo when BetaCo was valued at $5,000,000. BetaCo holds a capital loss carry forward of $220,000. At the end of 2019, Alpha reports taxable income before any carryovers of $750,000, consisting of $150,000 capital gains and $600,000 operating income. The applicable Federal long-term rate is 4%, and Alpha earns an 8% after-tax rate of return.

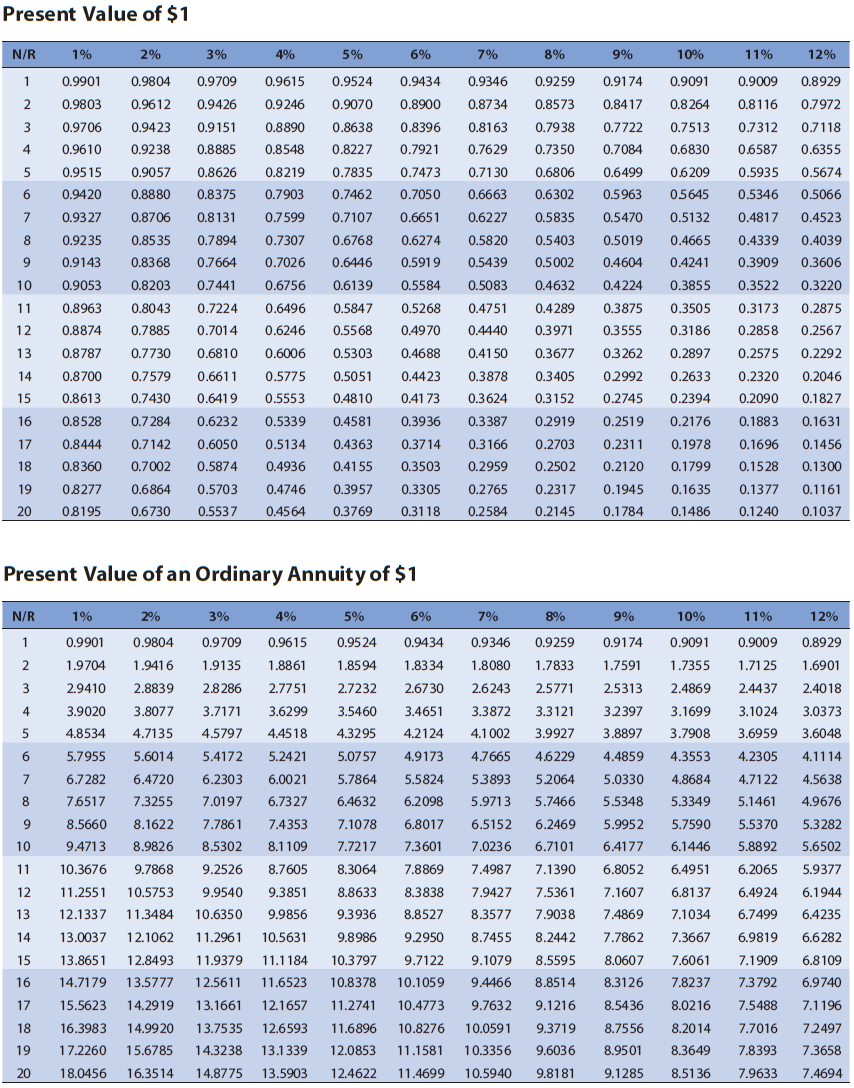

PRESENT VALUE TABLES

a. How much of the BetaCo carryovers may Alpha utilize in 2019?

Alpha may use $______________- of the capital loss carryover.

b. Alpha expects to generate $600,000 of taxable operating income for 2020 and 2021. In 2022, it expects to record $700,000 taxable income, including $100,000 of capital gains. What is the value of the capital loss carryforward to Alpha after 2019?

Use a marginal state and Federal income tax rate of 25%. If required, round your answers to the nearest dollar.

The present value of the capital loss carryforward after 2019 is $___________

Present Value of $1 1% 2% 4% 0.9804 0.9709 0.9901 0.9615 0.9803 0.9612 0.9426 0.9246 0.9070 0.9706 0.9423 0.9151 0.8890 0.8638 0.9610 0.9238 0.8885 0.8548 0.8227 5 0.9515 0.9057 0.8626 0.8219 0.7835 6 0.9420 0.7903 0.7462 0.8880 0.8375 0.8706 0.8131 0.7599 7 0.93 27 8 0.9235 0.8535 0.7894 0.7307 0.6768 9 0.9143 0.8368 0.7664 0.7026 0.6446 10 0.9053 11 0.8963 0.8203 0.7441 0.6756 0.6139 0.8043 0.7224 0.6496 0.5847 0.7885 0.7014 0.6246 12 0.8874 0.5568 13 0.6810 0.6006 0.5303 0.8787 0.7730 0.8700 0.7579 0.6611 14 0.5775 0.5051 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.41 73 16 0.8528 0.7284 0.6232 0.5339 0.4581 17 0.8444 0.7142 0.6050 0.5134 0.4363 0.3936 0.3387 0.2919 0.3714 0.3166 0.2703 0.2502 0.2317 18 0.3503 0.2959 0.8360 0.7002 0.5874 0.4936 0.4155 0,8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.8195 0.6730 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 N/R 1 2 3 4 19 20 N/R 1 2 3 4 5 6 3% Present Value of an Ordinary Annuity of $1 7 5% 6% 0.9524 0.9434 0.9346 0.9259 9% 10% 11% 0.9174 0.9091 0.9009 0.8929 0.8573 0.8417 0.8264 0.8116 0.7972 0.7513 0.7312 0.7118 0.8900 0.8734 0.8396 0.8163 0.7629 0.7130 0.6806 0.6499 0.6209 0.7938 0.7722 0.7350 0.7084 0.6830 0.7921 0.6587 0.6355 0.7473 0.5935 0.5674 0.7050 0.6663 0.6302 0.5963 05645 0.5346 0.5066 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.5919 0.5002 0.4604 0.4241 0.3909 0.3606 0.5439 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.5268 0.4751 0.4289 0.3173 0.2875 0.4970 0.4440 0.3971 0.3875 0.3505 0.3555 0.3186 0.2858 0.2567 0.2292 0.4688 0.41 50 0.3677 0.3262 0.2897 0.2575 0.4423 0.3405 0.2992 0.3878 0.3624 0.3152 0.2745 8 7% 8% 12% 0.2633 0.2394 0.2519 0.2176 1% 2% 3% 4% 5% 6% 11% 12% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 1.9704 1.9416 1.9135 1.8861 1.8594 1.8334 2.9410 2.8839 2.8286 2.7751 2.7232 2.67 30 7% 8% 9% 10% 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 1.8080 1.7833 1.7591 1.7355 1.7125 1.6901 2.6243 2.5771 2.5313 2.4869 2.4437 2.4018 3.3121 3.2397 3.1699 3.1024 3.9927 3.8897 4.7665 4.6229 4.4859 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.0373 4.8534 4.7135 4.5797 4.4518 4.3295 4.2124 4.1002 3.7908 3.6959 3.6048 5.7955 5.6014 5.4172 5.2421 5.07 57 4.9173 4.3553 4.2305 4.1114 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 9 8.5660 8.1622 7.7861 7.4353 7.1078 10 9.4713 8.5302 8.1109 7.7217 9.2526 8.7605 7.1390 6.8052 6.4951 6.2065 5.9377 6.8137 6.4924 6.1944 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 5.3282 8.9826 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.6502 11 10.3676 9.7868 8.3064 7.8869 7.4987 12 11.2551 10.5753 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 7.1607 13 12.1337 11.3484 10.6350 9.9856 9.3936 8.8527 8.3577 7.9038 7.4869 7.1034 6.7499 6.4235 14 13.0037 12.1062 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667 6.9819 6.6282 15 13.8651 12.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 8.0607 7.6061 7.1909 6.8109 16 14.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 7.3792 6.9740 17 15.5623 14.2919 13.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216 7.5488 7.1196 18 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 7.7016 7.2497 19 17.2260 15.6785 14.3238 13.1339 8.9501 8.3649 7.8393 7.3658 20 14.8775 13.5903 9.1285 8.5136 7.9633 12.0853 11.1581 10.3356 9.6036 18.0456 16.3514 12.4622 11.4699 10.5940 9.8181 7.4694 0.2320 0.2046 0.2090 0.1827 0.1883 0.1631 0.1696 0.1456 0.1799 0.1528 0.1300 0.2311 0.1978 0.2120 0.1945 0.1635 0.1377 0.1161 0.1784 0.1486 0.1240 0.1037

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started