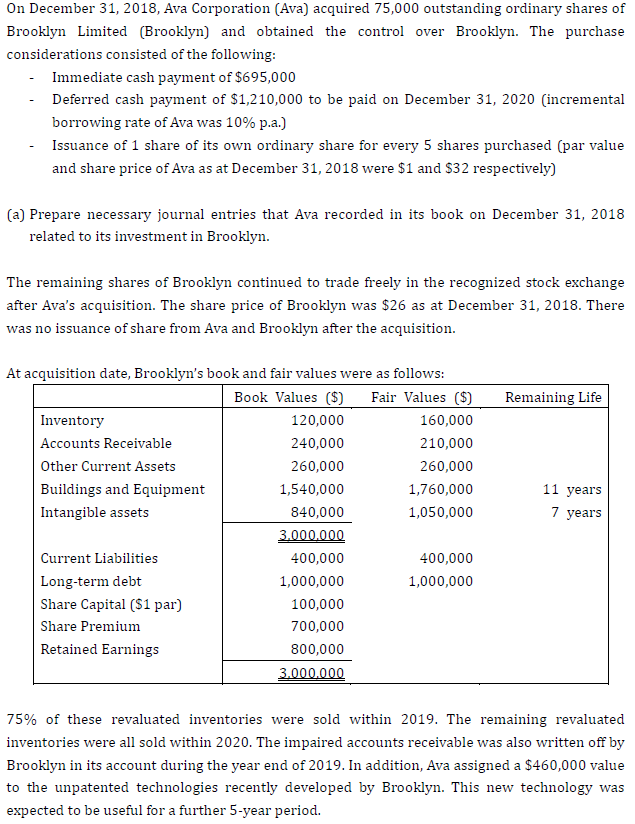

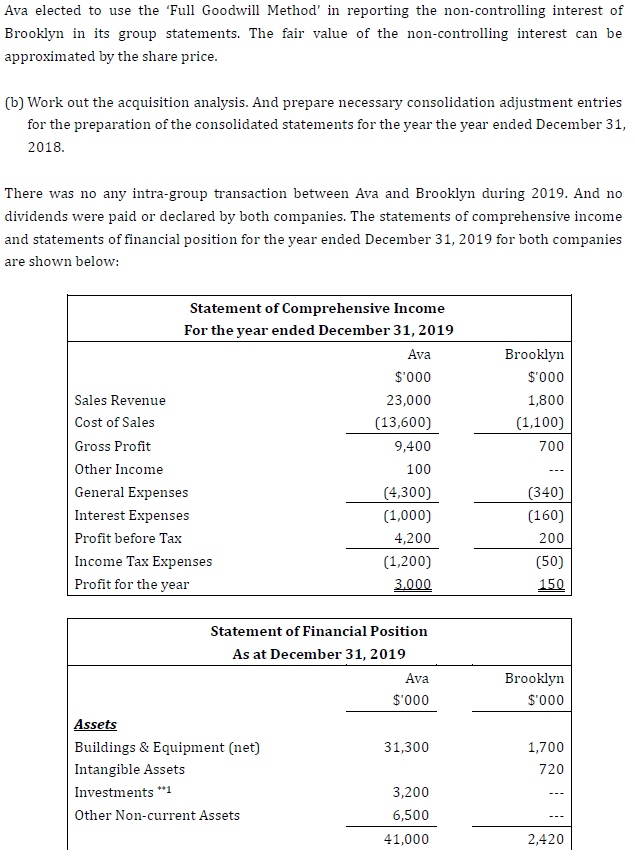

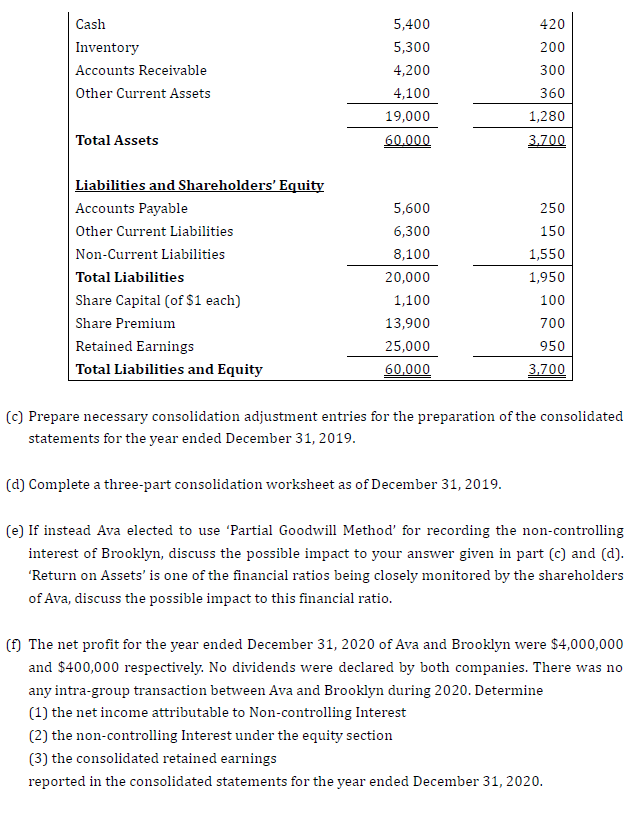

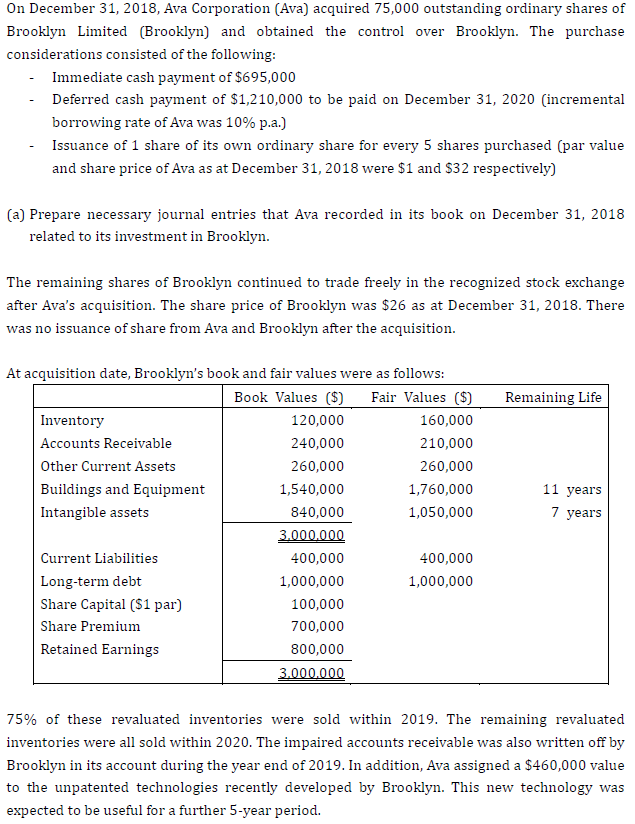

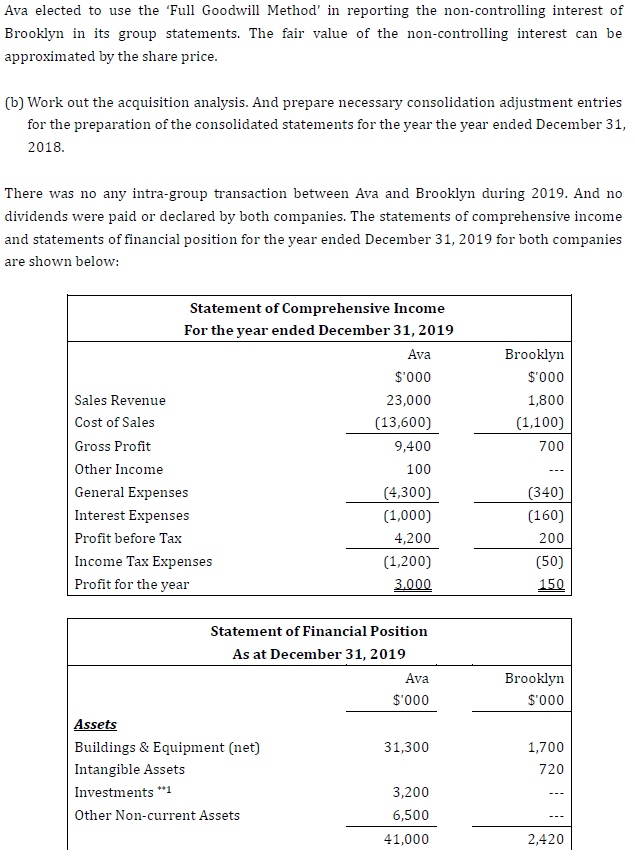

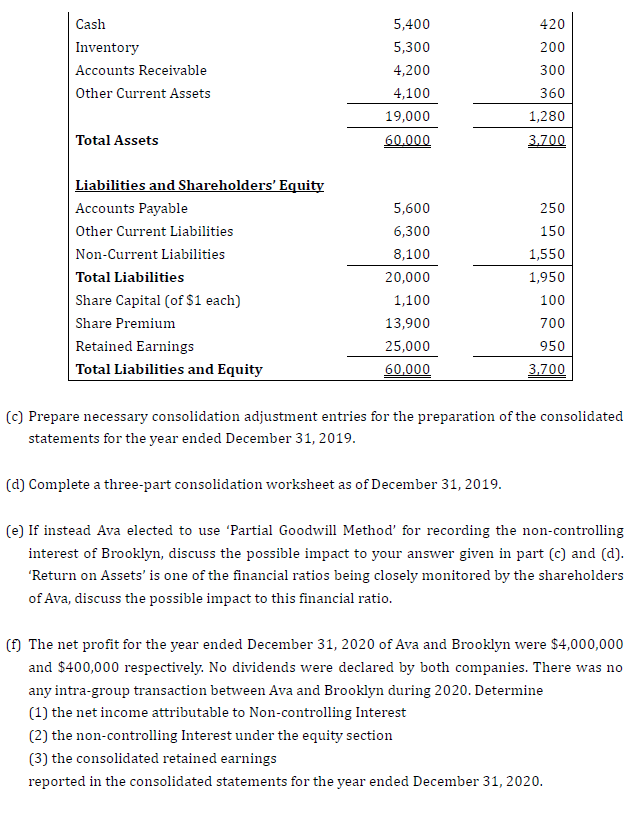

On December 31, 2018, Ava Corporation (Ava) acquired 75,000 outstanding ordinary shares of Brooklyn Limited (Brooklyn) and obtained the control over Brooklyn. The purchase considerations consisted of the following: - Immediate cash payment of $695,000 Deferred cash payment of $1,210,000 to be paid on December 31, 2020 (incremental borrowing rate of Ava was 10% p.a.) Issuance of 1 share of its own ordinary share for every 5 shares purchased (par value and share price of Ava as at December 31, 2018 were $1 and $32 respectively) (a) Prepare necessary journal entries that Ava recorded in its book on December 31, 2018 related to its investment in Brooklyn. The remaining shares of Brooklyn continued to trade freely in the recognized stock exchange after Ava's acquisition. The share price of Brooklyn was $26 as at December 31, 2018. There was no issuance of share from Ava and Brooklyn after the acquisition. Remaining Life 11 years 7 years At acquisition date, Brooklyn's book and fair values were as follows: Book Values ($) Fair Values ($) Inventory 120,000 160,000 Accounts Receivable 240,000 210,000 Other Current Assets 260,000 260,000 Buildings and Equipment 1,540,000 1,760,000 Intangible assets 840,000 1,050,000 3.000.000 Current Liabilities 400,000 400,000 Long-term debt 1,000,000 1,000,000 Share Capital ($1 par) 100,000 Share Premium 700,000 Retained Earnings 800,000 3.000.000 75% of these revaluated inventories were sold within 2019. The remaining revaluated inventories were all sold within 2020. The impaired accounts receivable was also written off by Brooklyn in its account during the year end of 2019. In addition, Ava assigned a $460,000 value to the unpatented technologies recently developed by Brooklyn. This new technology was expected to be useful for a further 5-year period. Ava elected to use the 'Full Goodwill Method' in reporting the non-controlling interest of Brooklyn in its group statements. The fair value of the non-controlling interest can be approximated by the share price. (b) Work out the acquisition analysis. And prepare necessary consolidation adjustment entries for the preparation of the consolidated statements for the year the year ended December 31, 2018. There was no any intra-group transaction between Ava and Brooklyn during 2019. And no dividends were paid or declared by both companies. The statements of comprehensive income and statements of financial position for the year ended December 31, 2019 for both companies are shown below: Statement of Comprehensive Income For the year ended December 31, 2019 Ava $'000 Sales Revenue 23,000 Cost of Sales (13,600) Gross Profit 9,400 Other Income 100 General Expenses (4,300) Interest Expenses (1,000) Profit before Tax 4,200 Income Tax Expenses (1,200) Profit for the year Brooklyn $'000 1,800 (1,100) 700 (340) (160) 200 (50) 150 3.000 Brooklyn $'000 Statement of Financial Position As at December 31, 2019 Ava $'000 Assets Buildings & Equipment (net) 31,300 Intangible Assets Investments *1 3,200 Other Non-current Assets 6,500 41,000 1,700 720 2,420 Cash Inventory Accounts Receivable Other Current Assets 5,400 5,300 4,200 4,100 19,000 60.000 360 1,280 3.700 Total Assets Liabilities and Shareholders' Equity Accounts Payable Other Current Liabilities Non-Current Liabilities Total Liabilities Share Capital (of $1 each) Share Premium Retained Earnings Total Liabilities and Equity 5,600 6,300 8,100 20,000 1,100 13,900 25,000 60,000 250 150 1,550 1,950 100 700 950 3.700 (c) Prepare necessary consolidation adjustment entries for the preparation of the consolidated statements for the year ended December 31, 2019. (d) Complete a three-part consolidation worksheet as of December 31, 2019. (e) If instead Ava elected to use 'Partial Goodwill Method for recording the non-controlling interest of Brooklyn, discuss the possible impact to your answer given in part (c) and (d). 'Return on Assets' is one of the financial ratios being closely monitored by the shareholders of Ava, discuss the possible impact to this financial ratio. (f) The net profit for the year ended December 31, 2020 of Ava and Brooklyn were $4,000,000 and $400,000 respectively. No dividends were declared by both companies. There was no any intra-group transaction between Ava and Brooklyn during 2020. Determine (1) the net income attributable to Non-controlling Interest (2) the non-controlling Interest under the equity section (3) the consolidated retained earnings reported in the consolidated statements for the year ended December 31, 2020