Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2018, ILR, Inc. classified one of its plant assets (land) as held for sale. The carrying value of the land as

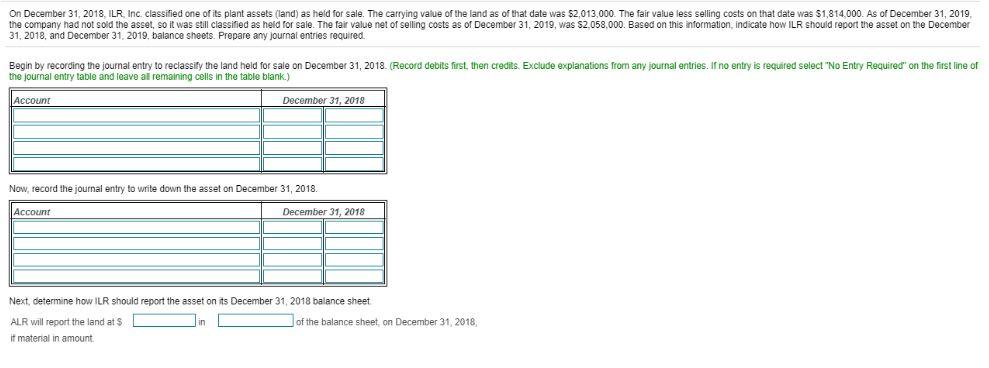

On December 31, 2018, ILR, Inc. classified one of its plant assets (land) as held for sale. The carrying value of the land as of that date was $2,013.000. The fair value less selling costs on that date was S1,814,000. As of December 31, 2019, the company had not sold the asset, so it was still classified as held for sale. The fair value net of selling costs as of December 31, 2019, was $2.058,000. Based on this information, indicate how ILR should report the asset on the December 31, 2018, and December 31, 2019, balance sheets. Prepare any journal entries required. Begin by recording the journal entry to reclassify the land held for sale on December 31, 2018. (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Account December 31, 2018 Now, record the journal entry to write down the asset on December 31, 2018. Account December 31, 2018 Next, determine how ILR should report the asset on its December 31, 2018 balance sheet ALR will report the land at $ Jin Jof the balance sheet, on December 31, 2018, it material in amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Account December 312018 Land Held for sale 2013000 To Land 2013000 To r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started