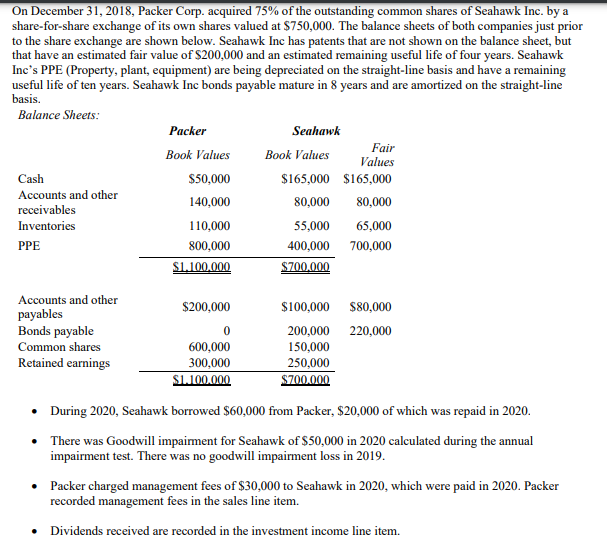

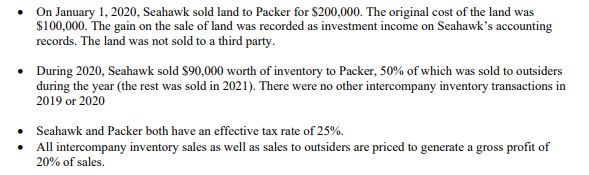

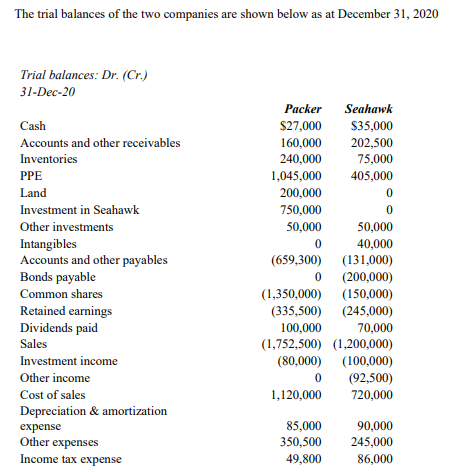

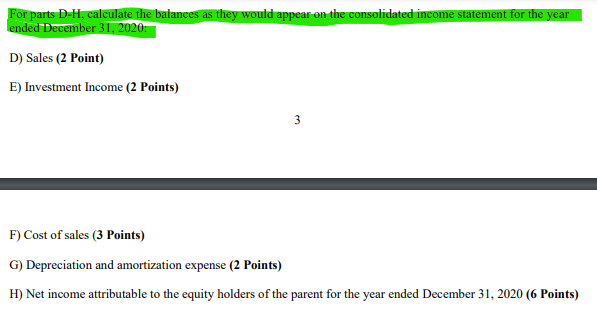

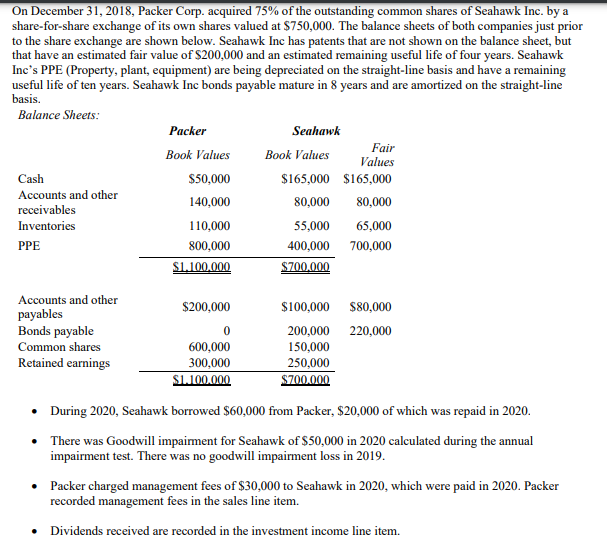

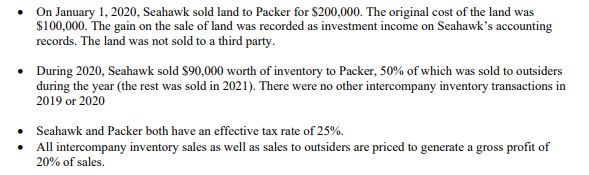

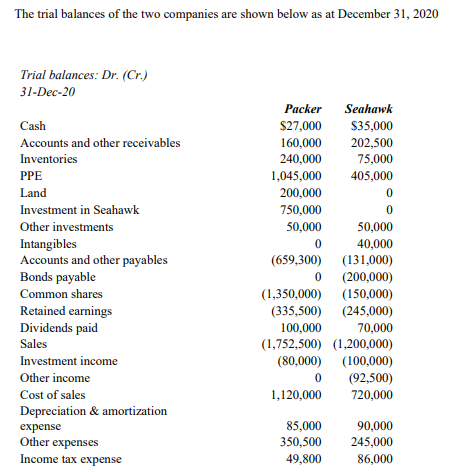

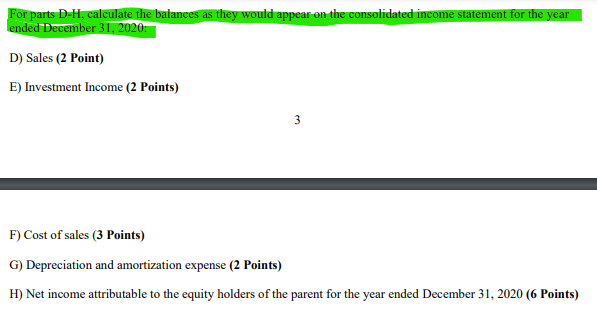

On December 31, 2018, Packer Corp. acquired 75% of the outstanding common shares of Seahawk Inc. by a share-for-share exchange of its own shares valued at $750,000. The balance sheets of both companies just prior to the share exchange are shown below. Seahawk Inc has patents that are not shown on the balance sheet, but that have an estimated fair value of $200,000 and an estimated remaining useful life of four years. Seahawk Inc's PPE (Property, plant, equipment) are being depreciated on the straight-line basis and have a remaining useful life of ten years. Seahawk Inc bonds payable mature in 8 years and are amortized on the straight-line basis. Balance Sheets: Packer Seahawk Book Values Book Values Fair Values Cash $50,000 $165,000 $165,000 Accounts and other 140,000 80,000 80,000 receivables Inventories 110,000 55,000 65,000 PPE 800,000 400,000 700,000 S1.100.000 $700.000 Accounts and other payables Bonds payable Common shares Retained earnings $200,000 0 600,000 300,000 $1.100.000 $100,000 $80,000 200,000 220,000 150,000 250,000 $700.000 During 2020, Seahawk borrowed $60,000 from Packer, $20,000 of which was repaid in 2020. There was Goodwill impairment for Seahawk of $50,000 in 2020 calculated during the annual impairment test. There was no goodwill impairment loss in 2019. Packer charged management fees of $30,000 to Seahawk in 2020, which were paid in 2020. Packer recorded management fees in the sales line item. Dividends received are recorded in the investment income line item. On January 1, 2020, Seahawk sold land to Packer for $200,000. The original cost of the land was $100,000. The gain on the sale of land was recorded as investment income on Seahawk's accounting records. The land was not sold to a third party. During 2020, Seahawk sold $90,000 worth of inventory to Packer, 50% of which was sold to outsiders during the year (the rest was sold in 2021). There were no other intercompany inventory transactions in 2019 or 2020 Seahawk and Packer both have an effective tax rate of 25%. All intercompany inventory sales as well as sales to outsiders are priced to generate a gross profit of 20% of sales. The trial balances of the two companies are shown below as at December 31, 2020 Trial balances: Dr. (Cr.) 31-Dec-20 Cash Accounts and other receivables Inventories PPE Land Investment in Seahawk Other investments Intangibles Accounts and other payables Bonds payable Common shares Retained earnings Dividends paid Sales Investment income Other income Cost of sales Depreciation & amortization expense Other expenses Income tax expense Packer Seahawk $27,000 $35,000 160,000 202,500 240,000 75,000 1,045,000 405,000 200,000 0 750,000 0 50,000 50,000 0 40,000 (659,300) (131,000) 0 (200,000) (1,350,000) (150,000) (335,500) (245,000) 100,000 70,000 (1,752,500) (1,200,000) (80,000) (100,000) 0 (92,500) 1,120,000 720,000 85,000 350,500 49,800 90,000 245,000 86,000 For parts D-H, calculate the balances as they would appear on the consolidated income statement for the year ended December 31, 2020: D) Sales (2 Point) E) Investment Income (2 Points) 3 F) Cost of sales (3 Points) G) Depreciation and amortization expense (2 Points) H) Net income attributable to the equity holders of the parent for the year ended December 31, 2020 (6 Points) On December 31, 2018, Packer Corp. acquired 75% of the outstanding common shares of Seahawk Inc. by a share-for-share exchange of its own shares valued at $750,000. The balance sheets of both companies just prior to the share exchange are shown below. Seahawk Inc has patents that are not shown on the balance sheet, but that have an estimated fair value of $200,000 and an estimated remaining useful life of four years. Seahawk Inc's PPE (Property, plant, equipment) are being depreciated on the straight-line basis and have a remaining useful life of ten years. Seahawk Inc bonds payable mature in 8 years and are amortized on the straight-line basis. Balance Sheets: Packer Seahawk Book Values Book Values Fair Values Cash $50,000 $165,000 $165,000 Accounts and other 140,000 80,000 80,000 receivables Inventories 110,000 55,000 65,000 PPE 800,000 400,000 700,000 S1.100.000 $700.000 Accounts and other payables Bonds payable Common shares Retained earnings $200,000 0 600,000 300,000 $1.100.000 $100,000 $80,000 200,000 220,000 150,000 250,000 $700.000 During 2020, Seahawk borrowed $60,000 from Packer, $20,000 of which was repaid in 2020. There was Goodwill impairment for Seahawk of $50,000 in 2020 calculated during the annual impairment test. There was no goodwill impairment loss in 2019. Packer charged management fees of $30,000 to Seahawk in 2020, which were paid in 2020. Packer recorded management fees in the sales line item. Dividends received are recorded in the investment income line item. On January 1, 2020, Seahawk sold land to Packer for $200,000. The original cost of the land was $100,000. The gain on the sale of land was recorded as investment income on Seahawk's accounting records. The land was not sold to a third party. During 2020, Seahawk sold $90,000 worth of inventory to Packer, 50% of which was sold to outsiders during the year (the rest was sold in 2021). There were no other intercompany inventory transactions in 2019 or 2020 Seahawk and Packer both have an effective tax rate of 25%. All intercompany inventory sales as well as sales to outsiders are priced to generate a gross profit of 20% of sales. The trial balances of the two companies are shown below as at December 31, 2020 Trial balances: Dr. (Cr.) 31-Dec-20 Cash Accounts and other receivables Inventories PPE Land Investment in Seahawk Other investments Intangibles Accounts and other payables Bonds payable Common shares Retained earnings Dividends paid Sales Investment income Other income Cost of sales Depreciation & amortization expense Other expenses Income tax expense Packer Seahawk $27,000 $35,000 160,000 202,500 240,000 75,000 1,045,000 405,000 200,000 0 750,000 0 50,000 50,000 0 40,000 (659,300) (131,000) 0 (200,000) (1,350,000) (150,000) (335,500) (245,000) 100,000 70,000 (1,752,500) (1,200,000) (80,000) (100,000) 0 (92,500) 1,120,000 720,000 85,000 350,500 49,800 90,000 245,000 86,000 For parts D-H, calculate the balances as they would appear on the consolidated income statement for the year ended December 31, 2020: D) Sales (2 Point) E) Investment Income (2 Points) 3 F) Cost of sales (3 Points) G) Depreciation and amortization expense (2 Points) H) Net income attributable to the equity holders of the parent for the year ended December 31, 2020 (6 Points)