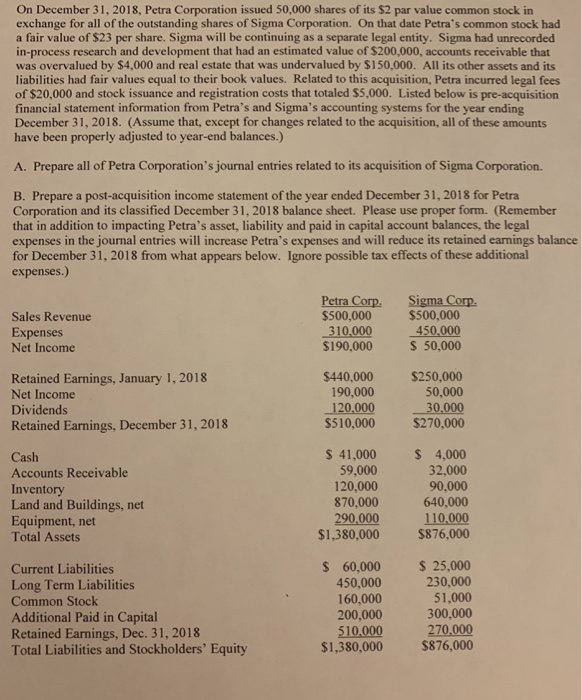

On December 31, 2018, Petra Corporation issued 50,000 shares of its $2 par value common stock in exchange for all of the outstanding shares of Sigma Corporation. On that date Petra's common stock had a fair value of $23 per share. Sigma will be continuing as a separate legal entity. Sigma had unrecorded in-process research and development that had an estimated value of $200,000, accounts receivable that was overvalued by $4,000 and real estate that was undervalued by $150,000. All its other assets and its liabilities had fair values equal to their book values. Related to this acquisition, Petra incurred legal fees of $20,000 and stock issuance and registration costs that totaled $5,000. Listed below is pre-acquisition financial statement information from Petra's and Sigma's accounting systems for the year ending December 31, 2018. (Assume that, except for changes related to the acquisition, all of these amounts have been properly adjusted to year-end balances.) A. Prepare all of Petra Corporation's journal entries related to its acquisition of Sigma Corporation. B. Prepare a post-acquisition income statement of the year ended December 31, 2018 for Petra Corporation and its classified December 31, 2018 balance sheet. Please use proper form. (Remember that in addition to impacting Petra's asset, liability and paid in capital account balances, the legal expenses in the journal entries will increase Petra's expenses and will reduce its retained earnings balance for December 31, 2018 from what appears below. Ignore possible tax effects of these additional expenses Petra Corp. Sigma Corp $500,000 Sales Revenue Expenses Net Income $500,000 310,000 450,000 $190,000 50,000 Retained Earnings, January 1, 2018 Net Income Dividends Retained Earnings, December 31, 2018 $440,000 $250,000 50,000 120,000 30,000 $510,000 $270,000 190,000 Cash Accounts Receivable Inventory Land and Buildings, net Equipment, net Total Assets S 41,000 4,000 32,000 90,000 640,000 290,000 110,000 $1,380,000 876,000 59,000 120,000 870,000 S 60,000 450,000 160,000 200,000 25,000 Current Liabilities Long Term Liabilities Common Stock Additional Paid in Capital Retained Earnings, Dec. 31, 2018 Total Liabilities and Stockholders' Equity 230,000 51,000 300,000 510,000 270,000 $1,380,000 $876,000