On December 31, 2018, the following are the available market values per share:

- EA Corporation - Php 50

- DJA Company - Php 15

- RVE - Php 45

- AR Company - Php 100

- LC Company - Php 60

Required: Based on the above, answer the following:

- The correct cost of investment acquired on January 5.

- The total dividend income during the year

- The total net loss on sale of fair value through other comprehensive income securities

- The total net gain or loss on exchange to be recognized in 2018

- The total adjusted balance of the investment

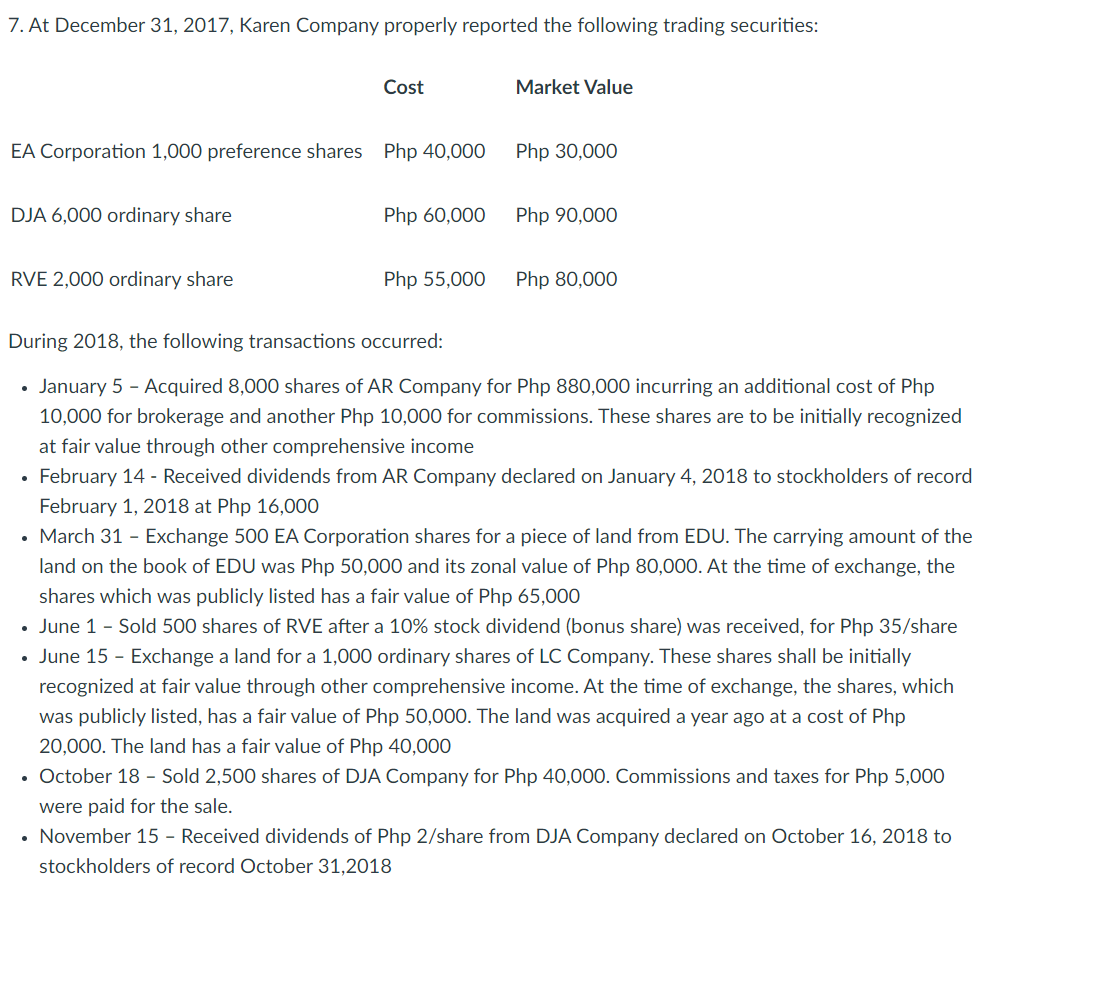

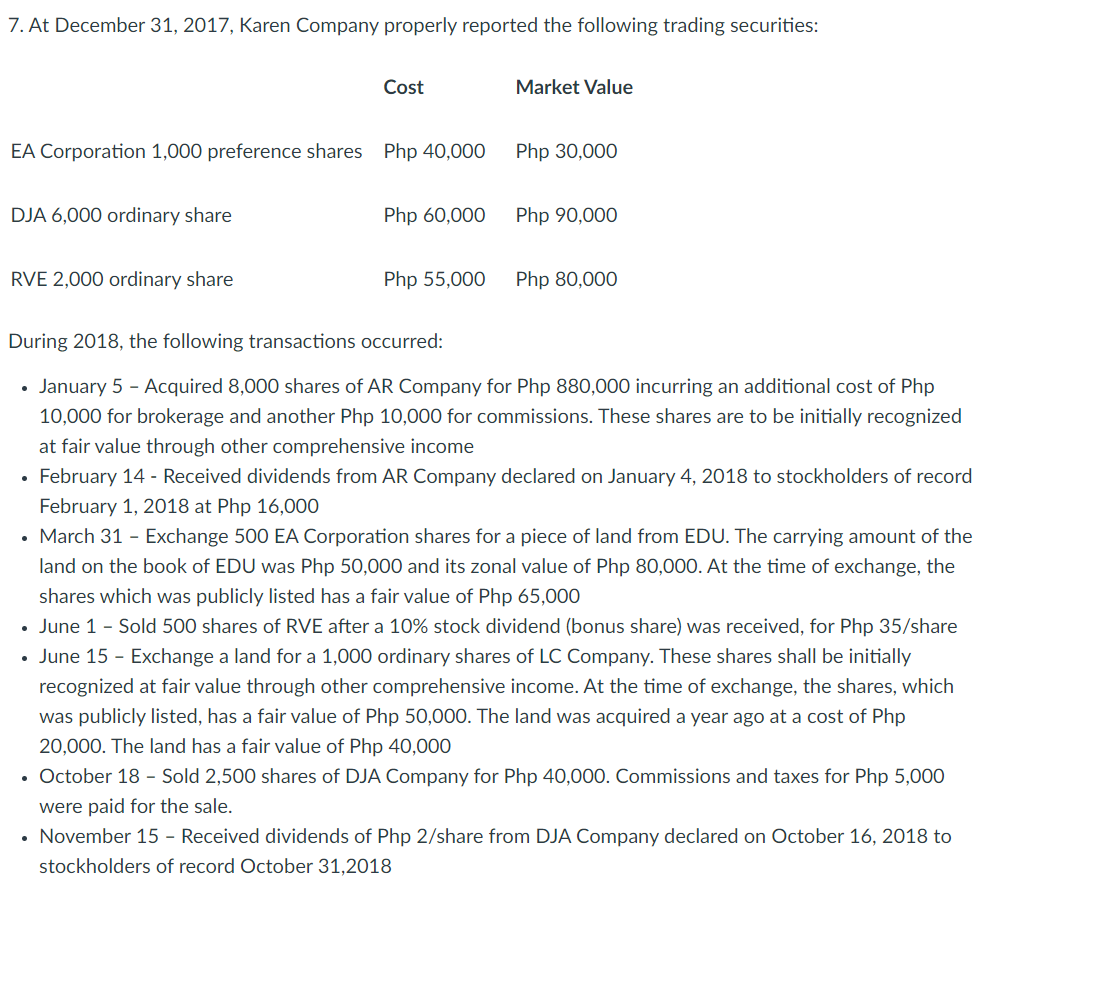

7. At December 31, 2017, Karen Company properly reported the following trading securities: Cost Market Value EA Corporation 1,000 preference shares Php 40,000 Php 30,000 DJA 6,000 ordinary share Php 60,000 Php 90,000 RVE 2,000 ordinary share Php 55,000 Php 80,000 During 2018, the following transactions occurred: January 5 - Acquired 8,000 shares of AR Company for Php 880,000 incurring an additional cost of Php 10,000 for brokerage and another Php 10,000 for commissions. These shares are to be initially recognized at fair value through other comprehensive income February 14 - Received dividends from AR Company declared on January 4, 2018 to stockholders of record February 1, 2018 at Php 16,000 March 31 - Exchange 500 EA Corporation shares for a piece of land from EDU. The carrying amount of the land on the book of EDU was Php 50,000 and its zonal value of Php 80,000. At the time of exchange, the shares which was publicly listed has a fair value of Php 65,000 June 1 - Sold 500 shares of RVE after a 10% stock dividend (bonus share) was received, for Php 35/share June 15 - Exchange a land for a 1,000 ordinary shares of LC Company. These shares shall be initially recognized at fair value through other comprehensive income. At the time of exchange, the shares, which was publicly listed, has a fair value of Php 50,000. The land was acquired a year ago at a cost of Php 20,000. The land has a fair value of Php 40,000 October 18 - Sold 2,500 shares of DJA Company for Php 40,000. Commissions and taxes for Php 5,000 were paid for the sale. November 15 - Received dividends of Php 2/share from DJA Company declared on October 16, 2018 to stockholders of record October 31, 2018 7. At December 31, 2017, Karen Company properly reported the following trading securities: Cost Market Value EA Corporation 1,000 preference shares Php 40,000 Php 30,000 DJA 6,000 ordinary share Php 60,000 Php 90,000 RVE 2,000 ordinary share Php 55,000 Php 80,000 During 2018, the following transactions occurred: January 5 - Acquired 8,000 shares of AR Company for Php 880,000 incurring an additional cost of Php 10,000 for brokerage and another Php 10,000 for commissions. These shares are to be initially recognized at fair value through other comprehensive income February 14 - Received dividends from AR Company declared on January 4, 2018 to stockholders of record February 1, 2018 at Php 16,000 March 31 - Exchange 500 EA Corporation shares for a piece of land from EDU. The carrying amount of the land on the book of EDU was Php 50,000 and its zonal value of Php 80,000. At the time of exchange, the shares which was publicly listed has a fair value of Php 65,000 June 1 - Sold 500 shares of RVE after a 10% stock dividend (bonus share) was received, for Php 35/share June 15 - Exchange a land for a 1,000 ordinary shares of LC Company. These shares shall be initially recognized at fair value through other comprehensive income. At the time of exchange, the shares, which was publicly listed, has a fair value of Php 50,000. The land was acquired a year ago at a cost of Php 20,000. The land has a fair value of Php 40,000 October 18 - Sold 2,500 shares of DJA Company for Php 40,000. Commissions and taxes for Php 5,000 were paid for the sale. November 15 - Received dividends of Php 2/share from DJA Company declared on October 16, 2018 to stockholders of record October 31, 2018