Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2019, Guimaras Corporation is experiencing extreme financial pressure and is in default in meeting interest payment on its long-term note of

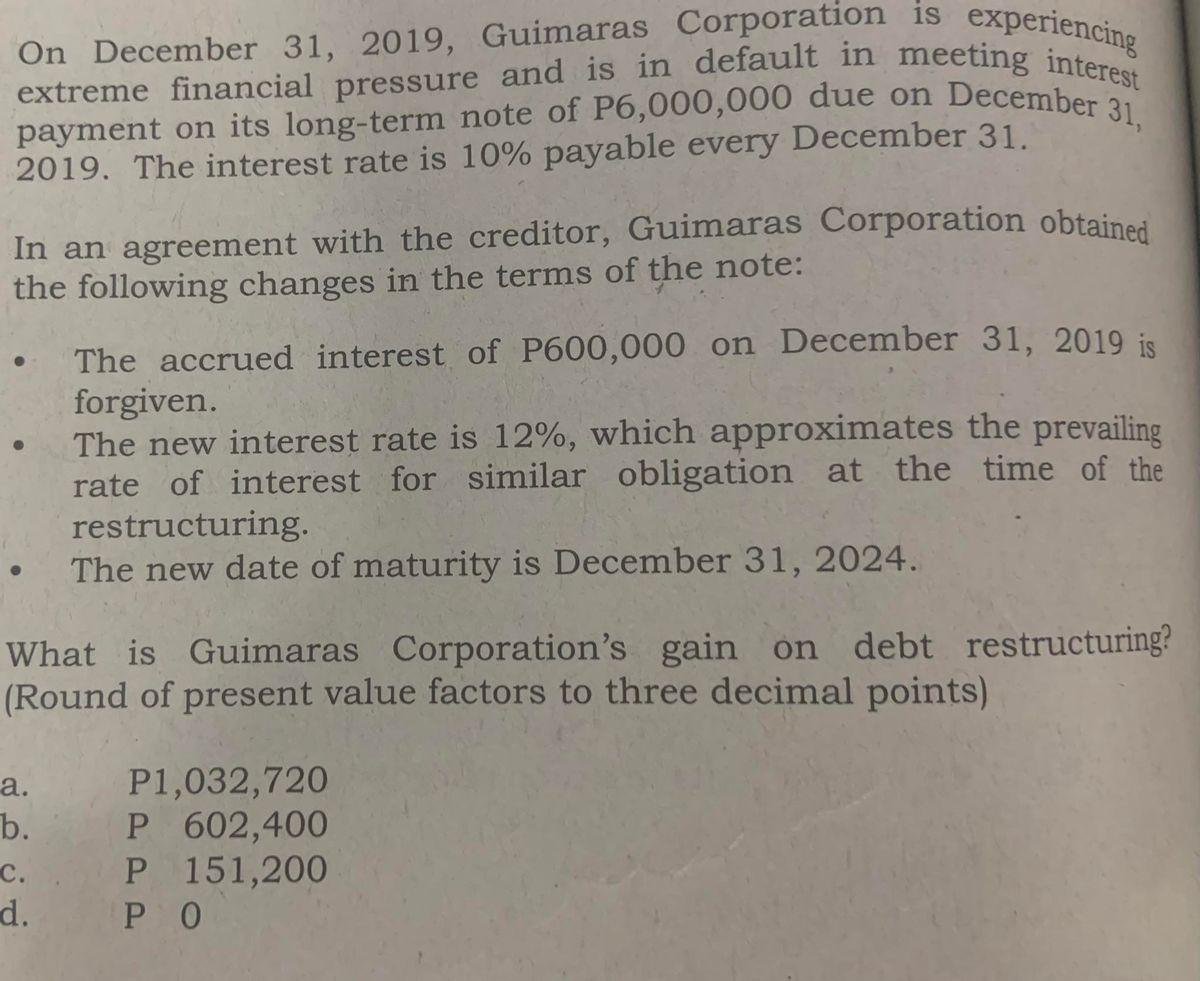

On December 31, 2019, Guimaras Corporation is experiencing extreme financial pressure and is in default in meeting interest payment on its long-term note of P6,000,000 due on December 31, 2019. The interest rate is 10% payable every December 31. In an agreement with the creditor, Guimaras Corporation obtained the following changes in the terms of the note: What is Guimaras Corporation's gain on debt restructuring? (Round of present value factors to three decimal points) a. b. The accrued interest of P600,000 on December 31, 2019 is forgiven. The new interest rate is 12%, which approximates the prevailing rate of interest for similar obligation at the time of the restructuring. The new date of maturity is December 31, 2024. C. d. P1,032,720 P 602,400 P 151,200 PO On December 31, 2019, Guimaras Corporation is experiencing extreme financial pressure and is in default in meeting interest payment on its long-term note of P6,000,000 due on December 31, 2019. The interest rate is 10% payable every December 31. In an agreement with the creditor, Guimaras Corporation obtained the following changes in the terms of the note: What is Guimaras Corporation's gain on debt restructuring? (Round of present value factors to three decimal points) a. b. The accrued interest of P600,000 on December 31, 2019 is forgiven. The new interest rate is 12%, which approximates the prevailing rate of interest for similar obligation at the time of the restructuring. The new date of maturity is December 31, 2024. C. d. P1,032,720 P 602,400 P 151,200 PO On December 31, 2019, Guimaras Corporation is experiencing extreme financial pressure and is in default in meeting interest payment on its long-term note of P6,000,000 due on December 31, 2019. The interest rate is 10% payable every December 31. In an agreement with the creditor, Guimaras Corporation obtained the following changes in the terms of the note: What is Guimaras Corporation's gain on debt restructuring? (Round of present value factors to three decimal points) a. b. The accrued interest of P600,000 on December 31, 2019 is forgiven. The new interest rate is 12%, which approximates the prevailing rate of interest for similar obligation at the time of the restructuring. The new date of maturity is December 31, 2024. C. d. P1,032,720 P 602,400 P 151,200 PO On December 31, 2019, Guimaras Corporation is experiencing extreme financial pressure and is in default in meeting interest payment on its long-term note of P6,000,000 due on December 31, 2019. The interest rate is 10% payable every December 31. In an agreement with the creditor, Guimaras Corporation obtained the following changes in the terms of the note: What is Guimaras Corporation's gain on debt restructuring? (Round of present value factors to three decimal points) a. b. The accrued interest of P600,000 on December 31, 2019 is forgiven. The new interest rate is 12%, which approximates the prevailing rate of interest for similar obligation at the time of the restructuring. The new date of maturity is December 31, 2024. C. d. P1,032,720 P 602,400 P 151,200 PO

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Guimaras Corporations gain on debt restructuring we need to compare the present value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started