Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2019, Park Ltd. (lessor) leased a machine to Orange Farm Ltd. (lessee) under the following terms: Term of the lease: 3

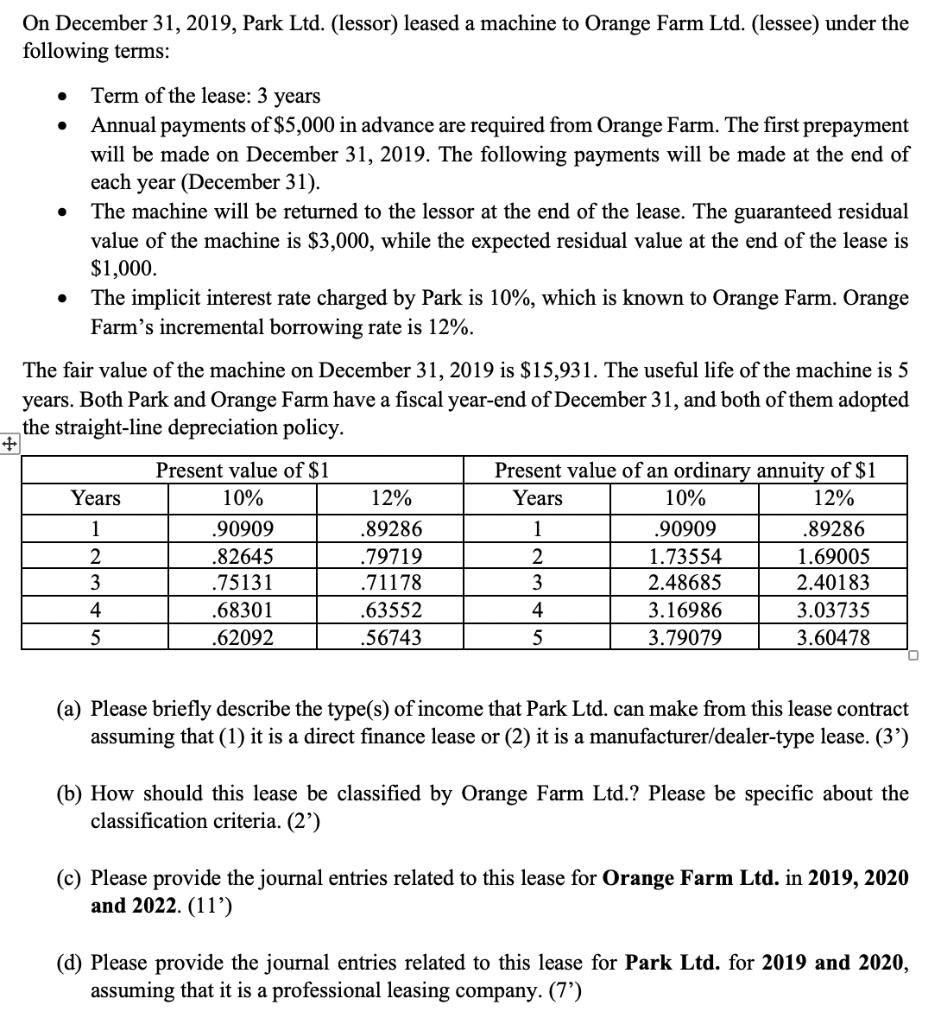

On December 31, 2019, Park Ltd. (lessor) leased a machine to Orange Farm Ltd. (lessee) under the following terms: Term of the lease: 3 years Annual payments of $5,000 in advance are required from Orange Farm. The first prepayment will be made on December 31, 2019. The following payments will be made at the end of each year (December 31). The machine will be returned to the lessor at the end of the lease. The guaranteed residual value of the machine is $3,000, while the expected residual value at the end of the lease is $1,000. The implicit interest rate charged by Park is 10%, which is known to Orange Farm. Orange Farm's incremental borrowing rate is 12%. The fair value of the machine on December 31, 2019 is $15,931. The useful life of the machine is 5 years. Both Park and Orange Farm have a fiscal year-end of December 31, and both of them adopted the straight-line depreciation policy. Years 1 2 3 4 5 Present value of $1 10% .90909 .82645 .75131 .68301 .62092 12% .89286 .79719 .71178 .63552 .56743 Present value of an ordinary annuity of $1 Years 10% 12% 1 2 3 4 5 .90909 1.73554 2.48685 3.16986 3.79079 .89286 1.69005 2.40183 3.03735 3.60478 (a) Please briefly describe the type(s) of income that Park Ltd. can make from this lease contract assuming that (1) it is a direct finance lease or (2) it is a manufacturer/dealer-type lease. (3') (b) How should this lease be classified by Orange Farm Ltd.? Please be specific about the classification criteria. (2') (c) Please provide the journal entries related to this lease for Orange Farm Ltd. in 2019, 2020 and 2022. (11') (d) Please provide the journal entries related to this lease for Park Ltd. for 2019 and 2020, assuming that it is a professional leasing company. (7')

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a If this is a direct finance lease then Park Lid will recognize income from the lease payments made ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started