Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31 2019, Sunshine Corporation sold some of its product to Moon Company, accepting a 3%, four-year promissory note having a maturity value

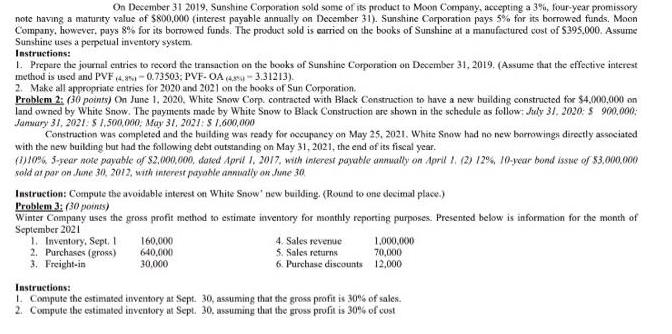

On December 31 2019, Sunshine Corporation sold some of its product to Moon Company, accepting a 3%, four-year promissory note having a maturity value of $800,000 (interest payable annually on December 31). Sunshine Corporation pays 5% for its borrowed funds. Moon Company, however, pays 8% for its borrowed funds. The product sold is carried on the books of Sunshine at a manufactured cost of $395,000. Assume Sunshine uses a perpetual inventory system. Instructions: 1. Prepare the journal entries to record the transaction on the books of Sunshine Corporation on December 31, 2019. (Assume that the effective interest method is used and PVF4.5-0.73503; PVF-OA (4-3.31213). 2. Make all appropriate entries for 2020 and 2021 on the books of Sun Corporation. Problem 2: (30 points) On June 1, 2020, White Snow Corp. contracted with Black Construction to have a new building constructed for $4,000,000 on land owned by White Snow. The payments made by White Snow to Black Construction are shown in the schedule as follow: July 31, 2020: $ 900.000: January 31, 2021: $1,500,000, May 31, 2021: $ 1.600,000 Construction was completed and the building was ready for occupancy on May 25, 2021. White Snow had no new borrowings directly associated with the new building but had the following debt outstanding on May 31, 2021, the end of its fiscal year. (1)10%, 5-year note payable of $2,000,000, dated April 1, 2017, with interest payable annually on April 1. (2) 12%, 10-year bond issue of $3,000,000 sold at par on June 30, 2012, with interest payable annually on June 30 Instruction: Compute the avoidable interest on White Snow' new building. (Round to one decimal place.) Problem 3: (30 points) Winter Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of September 2021 1. Inventory, Sept. 1 160,000 4. Sales revenue 5. Sales returns 2. Purchases (gross) 3. Freight-in 640,000 30,000 1,000,000 70,000 12,000 6. Purchase discounts Instructions: 1. Compute the estimated inventory at Sept. 30, assuming that the gross profit is 30% of sales. 2. Compute the estimated inventory at Sept. 30, assuming that the gross profit is 30% of cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Problem1 Problem 2 Problem 3 a Inventory Sep 1 at cost 160000 Purchases ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started