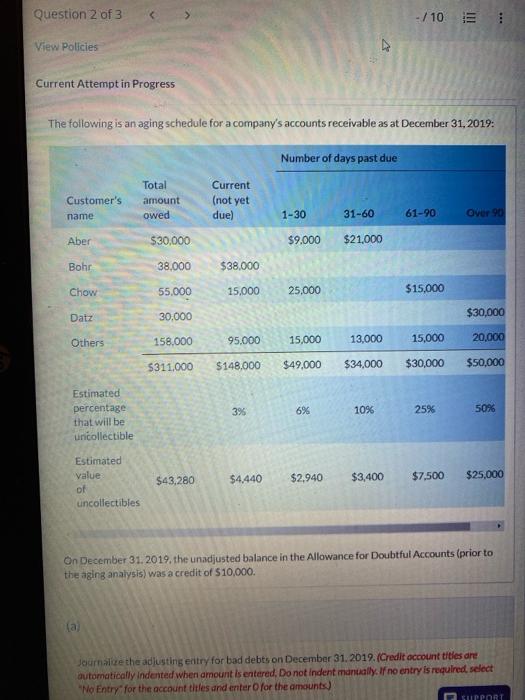

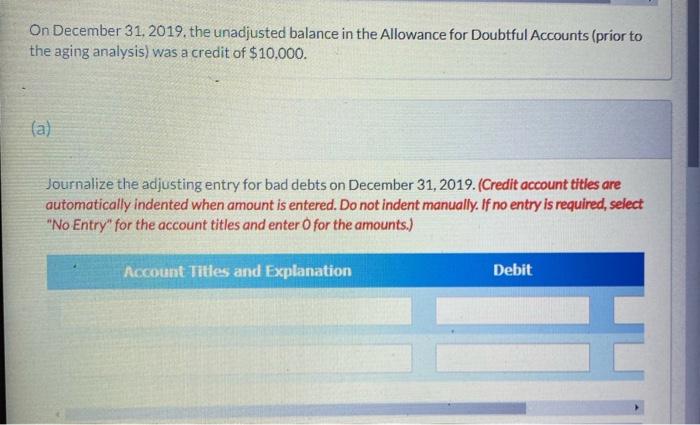

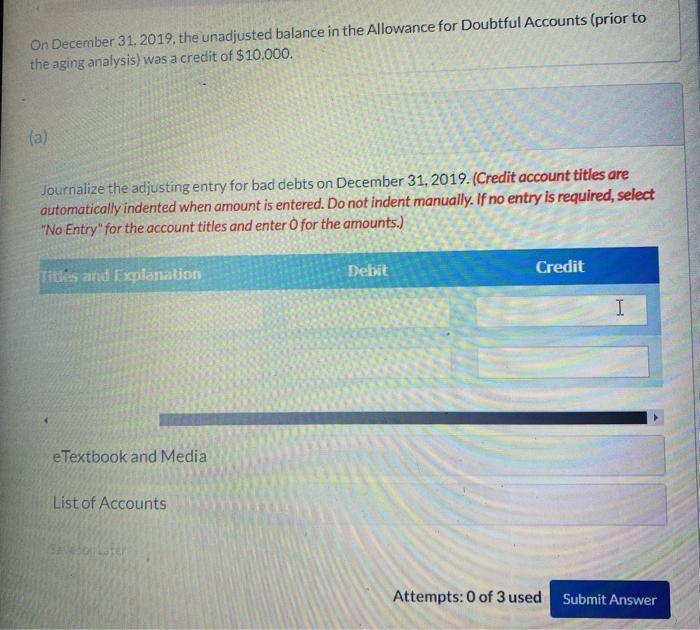

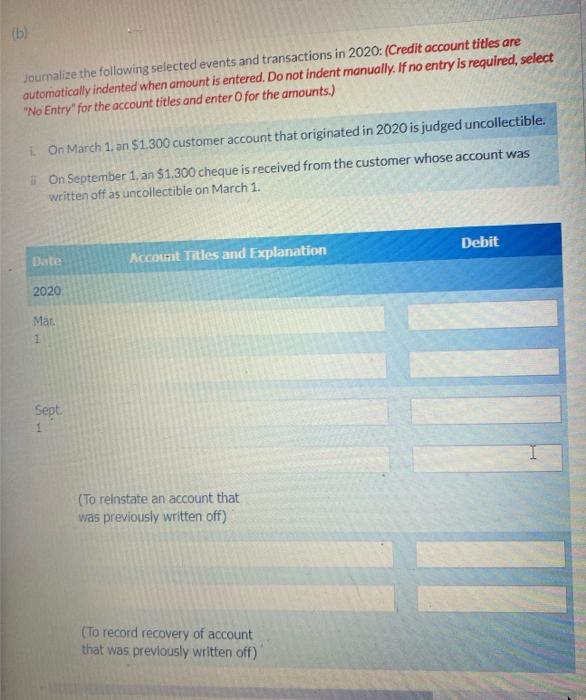

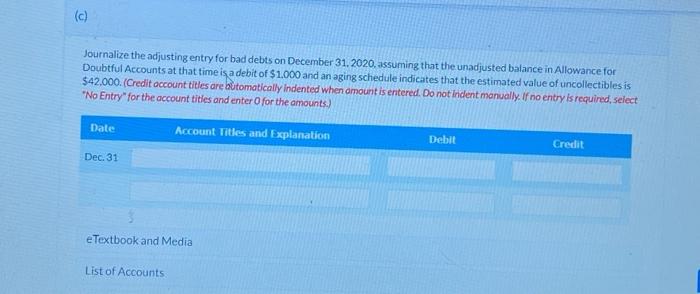

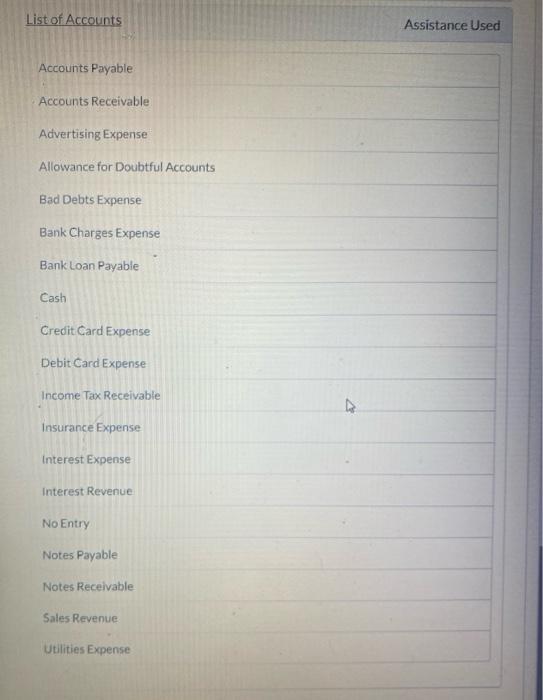

On December 31, 2019, the unadjusted balance in the Allowance for Doubtful Accounts (prior to the aging analysis) was a credit of $10,000. (a) Journalize the adjusting entry for bad debts on December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Journalize the following selected events and transactions in 2020: (Credit occount titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts.) 1. On March 1. an $1,300 customer account that originated in 2020 is judged uncollectible. iv On September 1 , an $1,300 cheque is received from the customer whose account was written off as uncollectible on March 1. Current Attempt in Progress The following is an aging schedule for a company's accounts receivable as at December 31, 2019: On December 31.2019, the unadjusted balance in the Allowance for Doubtful Accounts (prior to the aging analysis) was a credit of $10,000. (a) journalque the adjusting entry for bad debts on December 31, 2019. (Credit occount tities ore automatically indented when amount is entered, Do not indent mankally. If no entry is required select We Entry for the account tiffes and enter ofor the amounts) On December 31, 2019, the unadjusted balance in the Allowance for Doubtful Accounts (prior to the aging analysis) was a credit of $10,000. (a) Journalize the adjusting entry for bad debts on December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) List of Accounts Assistance Used Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Bad Debts Expense Bank Charges Expense BankLoan Payable Cash Credit Card Expense Debit Card Expense Income Tax Receivable Insurance Expense Interest Expense Interest Revenue No Entry Notes Payable Notes Receivable Sales Revenue Julities Expense Journalize the adjusting entry for bad debts on December 31,2020, assuming that the unadjusted balance in Allowance for Doubtful Accounts at that time is a debit of $1,000 and an aging schedule indicates that the estimated value of uncollectibles is \$42.000. (Credit occount titles are butomatically indented when amount is entered. Do not indent manually. If no entry is requind, select "No Entry" for the account tities and enter O for the amounts.) On December 31, 2019, the unadjusted balance in the Allowance for Doubtful Accounts (prior to the aging analysis) was a credit of $10,000. (a) Journalize the adjusting entry for bad debts on December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Journalize the following selected events and transactions in 2020: (Credit occount titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts.) 1. On March 1. an $1,300 customer account that originated in 2020 is judged uncollectible. iv On September 1 , an $1,300 cheque is received from the customer whose account was written off as uncollectible on March 1. Current Attempt in Progress The following is an aging schedule for a company's accounts receivable as at December 31, 2019: On December 31.2019, the unadjusted balance in the Allowance for Doubtful Accounts (prior to the aging analysis) was a credit of $10,000. (a) journalque the adjusting entry for bad debts on December 31, 2019. (Credit occount tities ore automatically indented when amount is entered, Do not indent mankally. If no entry is required select We Entry for the account tiffes and enter ofor the amounts) On December 31, 2019, the unadjusted balance in the Allowance for Doubtful Accounts (prior to the aging analysis) was a credit of $10,000. (a) Journalize the adjusting entry for bad debts on December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) List of Accounts Assistance Used Accounts Payable Accounts Receivable Advertising Expense Allowance for Doubtful Accounts Bad Debts Expense Bank Charges Expense BankLoan Payable Cash Credit Card Expense Debit Card Expense Income Tax Receivable Insurance Expense Interest Expense Interest Revenue No Entry Notes Payable Notes Receivable Sales Revenue Julities Expense Journalize the adjusting entry for bad debts on December 31,2020, assuming that the unadjusted balance in Allowance for Doubtful Accounts at that time is a debit of $1,000 and an aging schedule indicates that the estimated value of uncollectibles is \$42.000. (Credit occount titles are butomatically indented when amount is entered. Do not indent manually. If no entry is requind, select "No Entry" for the account tities and enter O for the amounts.)