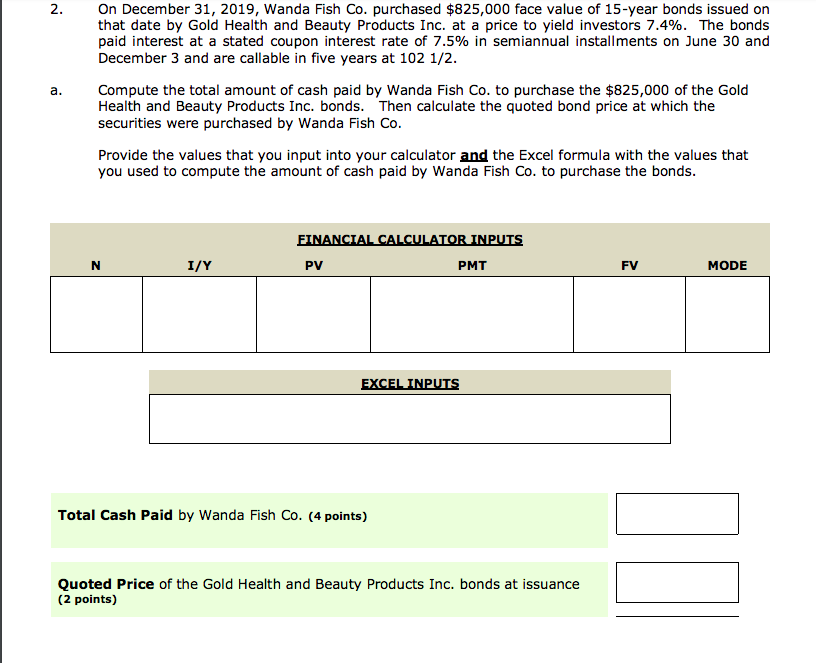

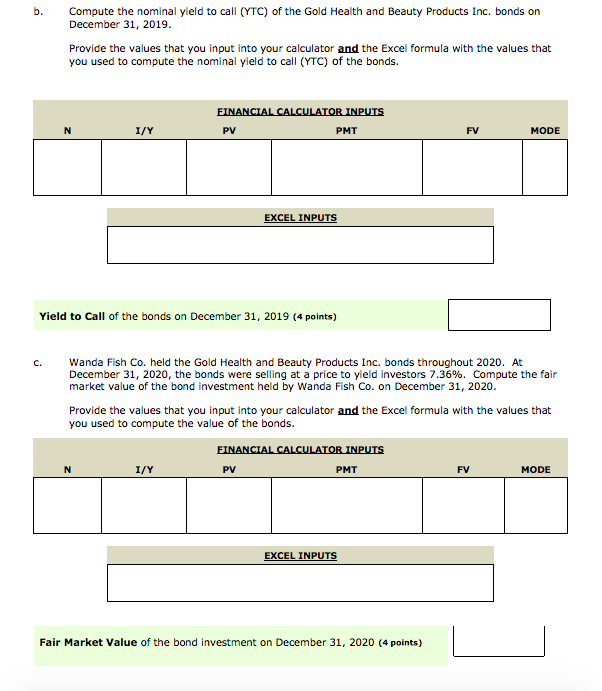

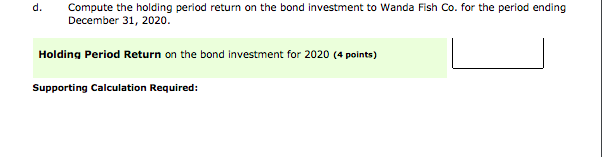

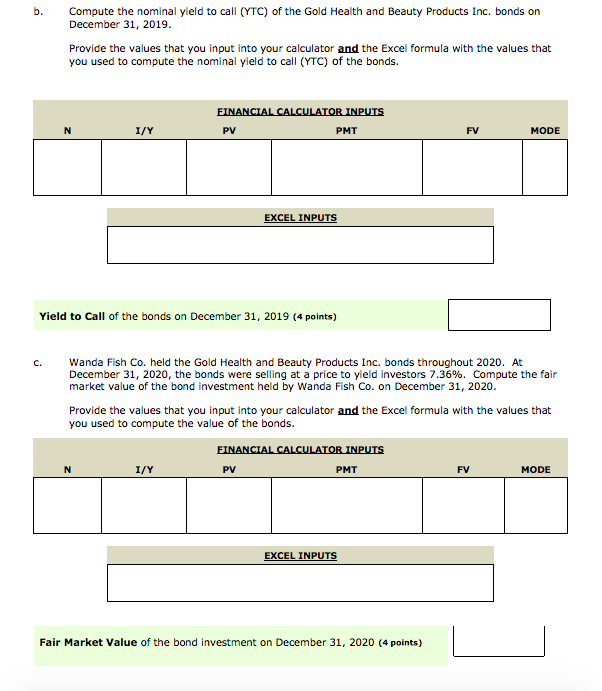

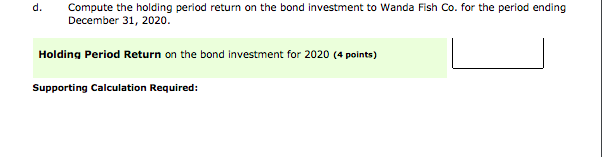

On December 31, 2019, Wanda Fish Co. purchased $825,000 face value of 15-year bonds issued on that date by Gold Health and Beauty Products Inc. at a price to yield investors 7.4%. The bonds paid interest at a stated coupon interest rate of 7.5% in semiannual installments on June 30 and December 3 and are callable in five years at 102 1/2. 2. Compute the total amount of cash paid by Wanda Fish Co. to purchase the $825,000 of the Gold Health and Beauty Products Inc. bonds. securities were purchased by Wanda Fish Co a. Then calculate the quoted bond price at which the Provide the values that you input into your calculator and the Excel formula with the values that you used to compute the amount of cash paid by Wanda Fish Co. to purchase the bonds. FINANCIAL CALCULATOR INPUTS PV PMT FV MODE A/I EXCEL INPUTS Total Cash Paid by Wanda Fish Co. (4 points) Quoted Price of the Gold Health and Beauty Products Inc. bonds at issuance (2 points) Compute the nominal yield to call (YTC) of the Gold Health and Beauty Products Inc. bonds on December 31, 2019 Provide the values that you input into your calculator and the Excel formula with the values that you used to compute the nominal yield to call (YTC) of the bonds. FINANCIAL CALCULATOR INPUTS N I/Y PV MT FV MODE EXCEL INPUTS Yield to Call of the bonds on December 31, 2019 (4 points) Wanda Fish Co. held the Gold Health and Beauty Products Inc. bonds throughout 2020. At December 31, 2020, the bonds were selling at a price to yield investors 7.36 %. Compute the fair market value of the bond investment held by Wanda Fish Co. on December 31, 2020. Provide the values that you input into your calculator and the Excel formula with the values that you used to compute the value of the bonds. FINANCIAL CALCULATOR INPUTS N MODE I/Y PV PMT FV EXCEL INPUTS Fair Market Value of the bond investment on December 31, 2020 (4 points) d. Compute the holding period return on the bond investment to Wanda Fish Co. for the period ending December 31, 2020. Holding Period Return on the bond investment for 2020 (4 points) Supporting Calculation Required