Question

On December 31, 2019, Warren Company's Intangible Assets account reflects two assets: 1. Goodwill , $117,000. This amount was recorded in December 2018 as part

On December 31, 2019, Warren Company's Intangible Assets account reflects two assets:

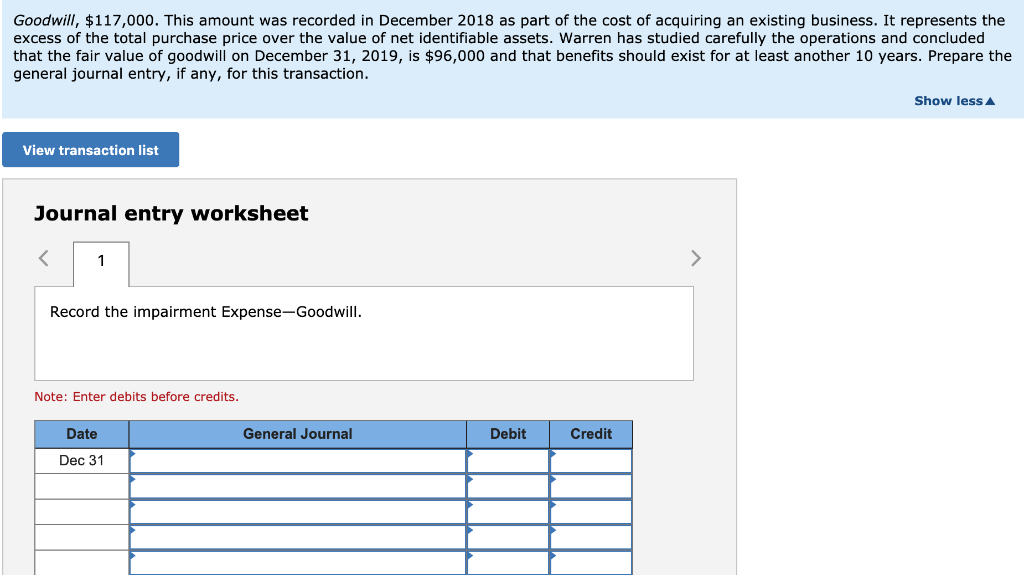

1. Goodwill, $117,000. This amount was recorded in December 2018 as part of the cost of acquiring an existing business. It represents the excess of the total purchase price over the value of net identifiable assets. Warren has studied carefully the operations and concluded that the fair value of goodwill on December 31, 2019, is $96,000 and that benefits should exist for at least another 10 years. Prepare the general journal entry, if any, for this transaction.

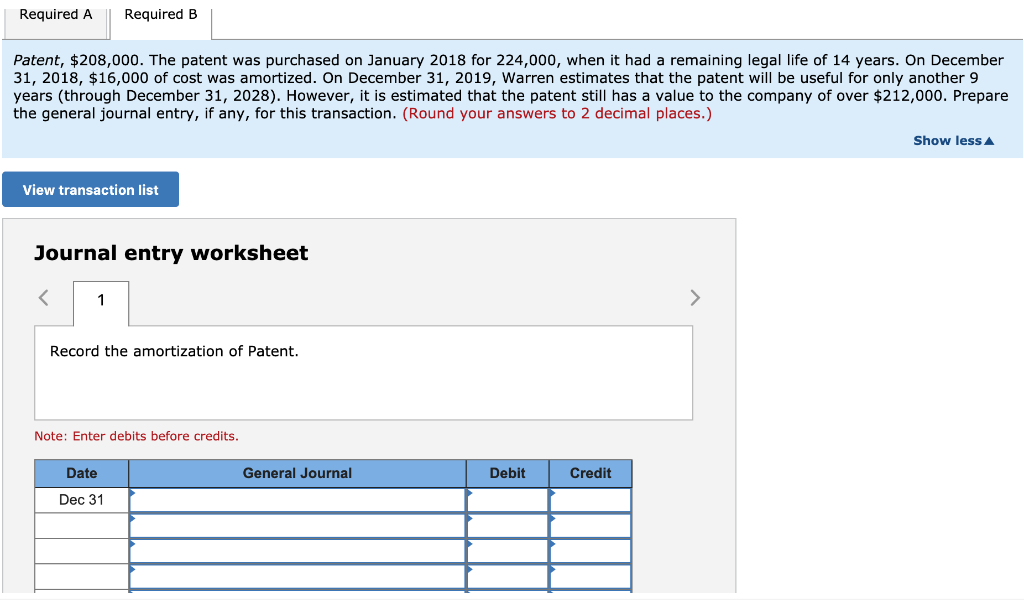

2. Patent, $208,000. The patent was purchased on January 2018 for 224,000, when it had a remaining legal life of 14 years. On December 31, 2018, $16,000 of cost was amortized. On December 31, 2019, Warren estimates that the patent will be useful for only another 9 years (through December 31, 2028). However, it is estimated that the patent still has a value to the company of over $212,000. Prepare the general journal entry, if any, for this transaction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started