On December 31, 2020, Horsebarn Co. had the following defined benefit pension plan balances (in thousands of $s): Projected benefit obligation Plan assets AOCI

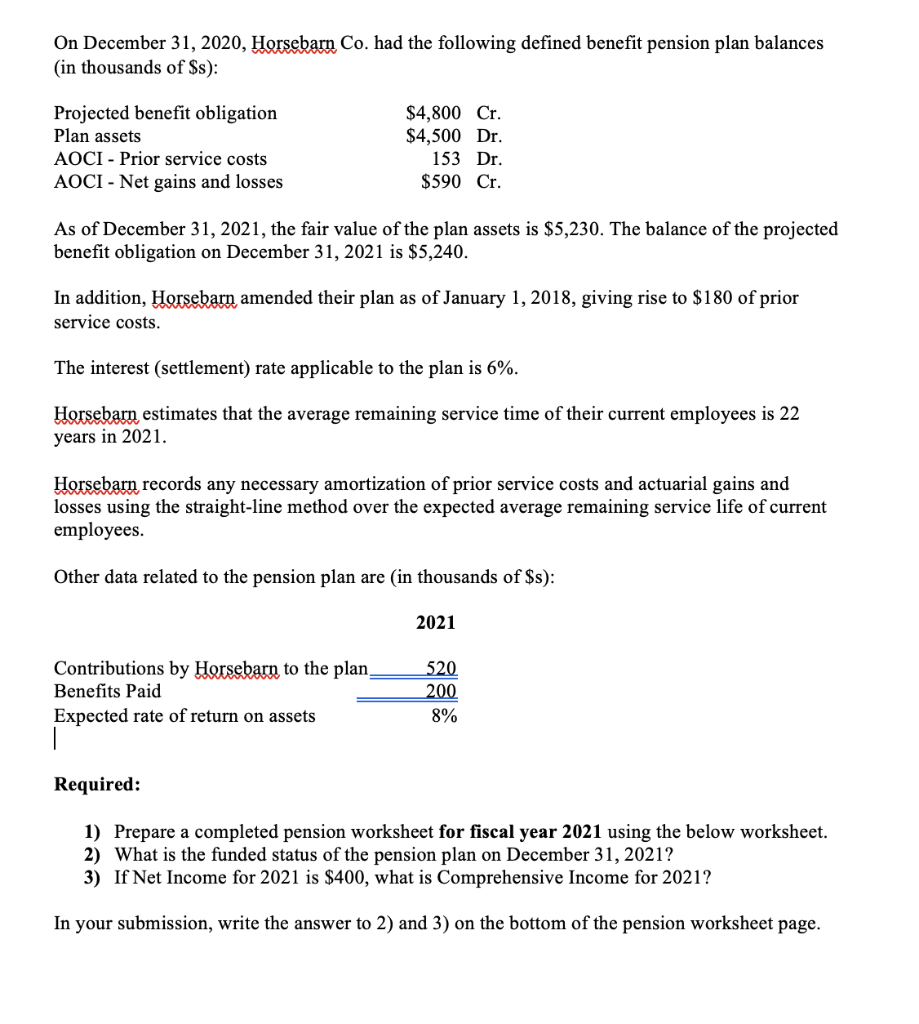

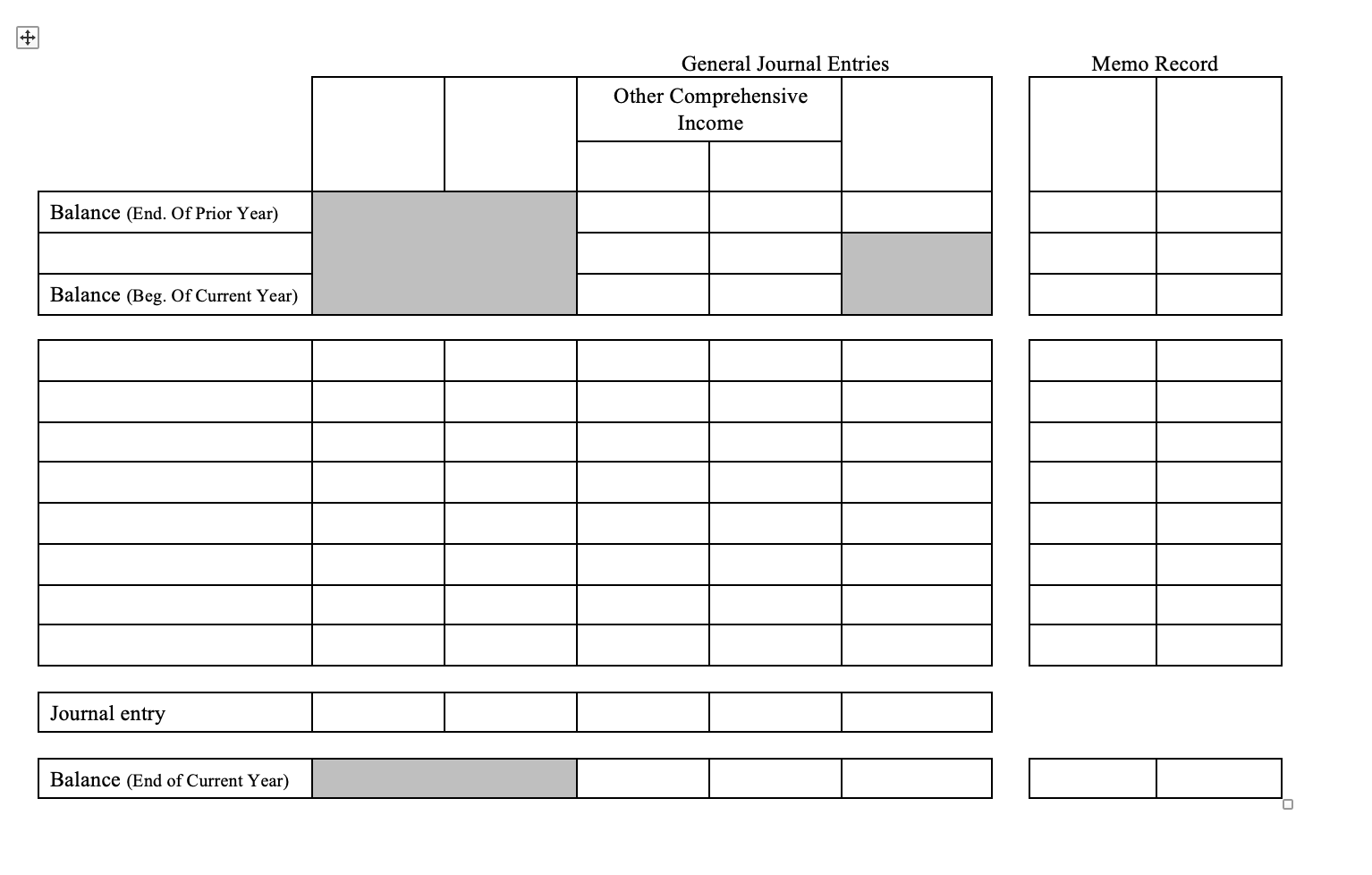

On December 31, 2020, Horsebarn Co. had the following defined benefit pension plan balances (in thousands of $s): Projected benefit obligation Plan assets AOCI - Prior service costs AOCI - Net gains and losses $4,800 Cr. $4,500 Dr. 153 Dr. $590 Cr. As of December 31, 2021, the fair value of the plan assets is $5,230. The balance of the projected benefit obligation on December 31, 2021 is $5,240. In addition, Horsebarn amended their plan as of January 1, 2018, giving rise to $180 of prior service costs. The interest (settlement) rate applicable to the plan is 6%. Horsebarn estimates that the average remaining service time of their current employees is 22 years in 2021. Horsebarn records any necessary amortization of prior service costs and actuarial gains and losses using the straight-line method over the expected average remaining service life of current employees. Other data related to the pension plan are (in thousands of $s): Contributions by Horsebarn to the plan Benefits Paid Expected rate of return on assets 2021 520 200 8% Required: 1) Prepare a completed pension worksheet for fiscal year 2021 using the below worksheet. 2) What is the funded status of the pension plan on December 31, 2021? 3) If Net Income for 2021 is $400, what is Comprehensive Income for 2021? In your submission, write the answer to 2) and 3) on the bottom of the pension worksheet page. + Balance (End. Of Prior Year) Balance (Beg. Of Current Year) Journal entry Balance (End of Current Year) General Journal Entries Other Comprehensive Income Memo Record

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Horsebarn Co Pension Plan For the Year Ended December 31 2021 Projected benefit obligation Beg...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started