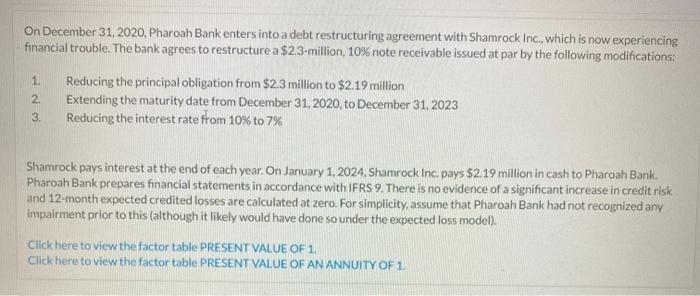

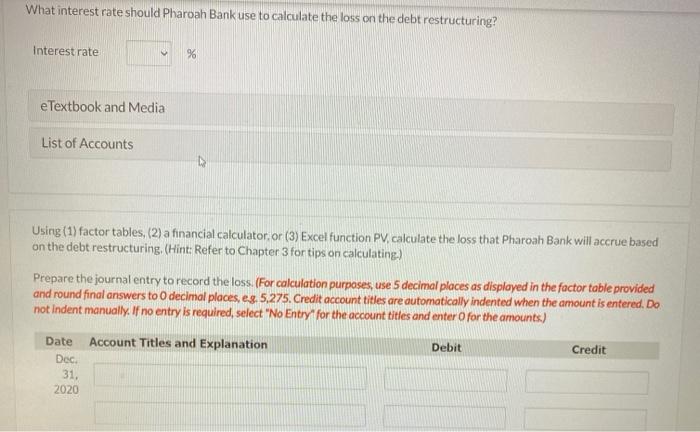

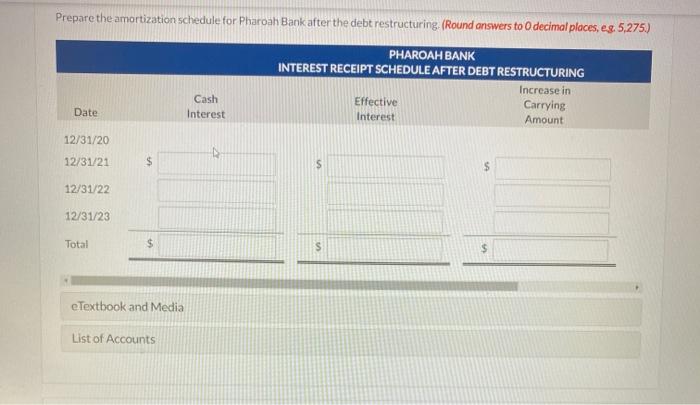

On December 31, 2020, Pharoah Bank enters into a debt restructuring agreement with Shamrock Inc., which is now experiencing financial trouble. The bank agrees to restructure a $2.3-million, 10% note receivable issued at par by the following modifications: 1. 2 3. Reducing the principal obligation from $2.3 million to $2.19 million Extending the maturity date from December 31, 2020, to December 31, 2023 Reducing the interest rate from 10% to 7% Shamrock pays interest at the end of each year. On January 1, 2024, Shamrock Inc. pays $2.19 million in cash to Pharoah Bank. Pharoah Bank prepares financial statements in accordance with IFRS 9. There is no evidence of a significant increase in credit risk and 12-month expected credited losses are calculated at zero. For simplicity, assume that Pharoah Bank had not recognized any impairment prior to this (although it likely would have done so under the expected loss model) Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1 What interest rate should Pharoah Bank use to calculate the loss on the debt restructuring? Interest rate %6 e Textbook and Media List of Accounts Using (1) factor tables, (2) a financial calculator, or (3) Excel function PV, calculate the loss that Pharoah Bank will accrue based on the debt restructuring. (Hint: Refer to Chapter 3 for tips on calculating) Prepare the journal entry to record the loss. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to decimal places, eg 5.275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts) Account Titles and Explanation Date Dec Debit Credit 31, 2020 Prepare the amortization schedule for Pharoah Bank after the debt restructuring (Round answers to decimal places, eg. 5,275) PHAROAH BANK INTEREST RECEIPT SCHEDULE AFTER DEBT RESTRUCTURING Increase in Effective Carrying Interest Amount Date Cash Interest 12/31/20 12/31/21 $ S 12/31/22 12/31/23 Total $ eTextbook and Media List of Accounts