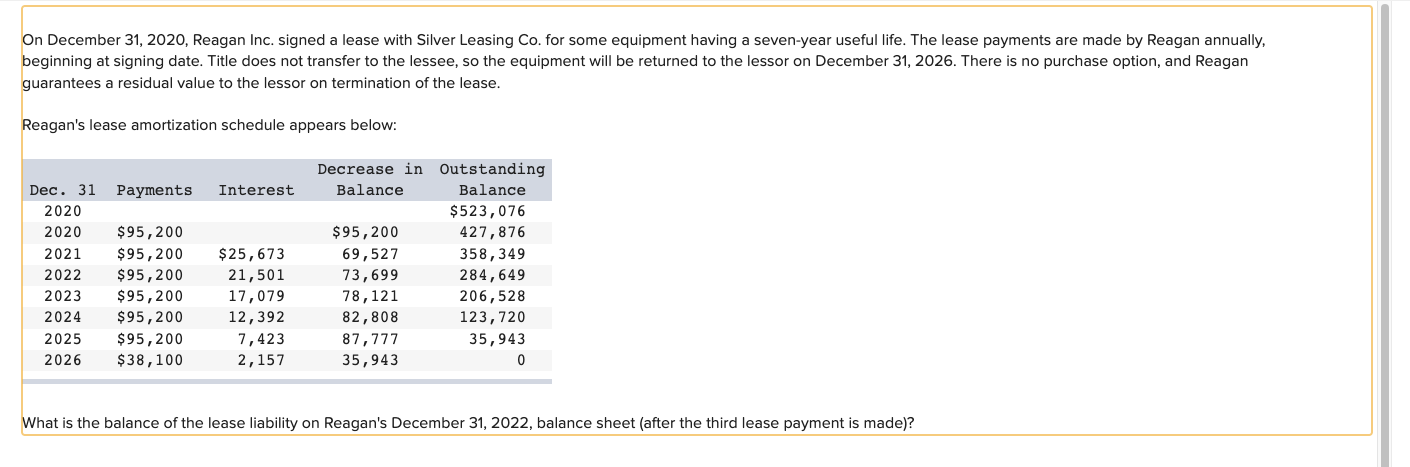

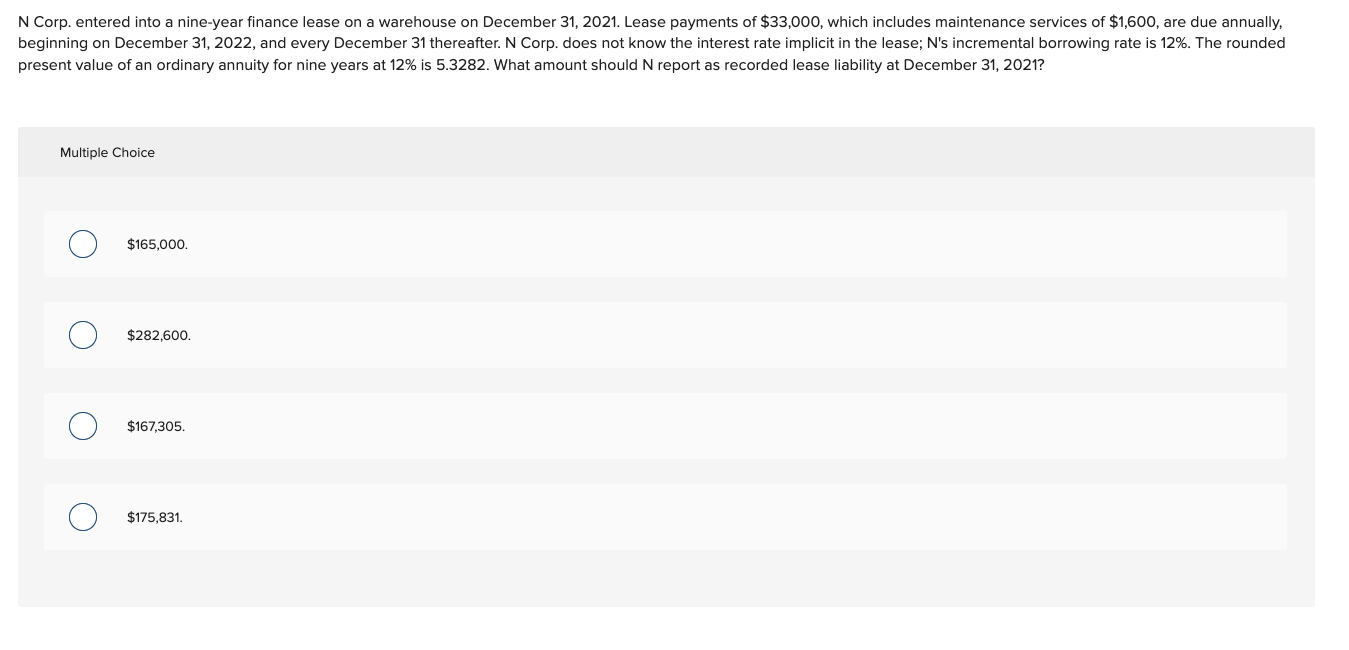

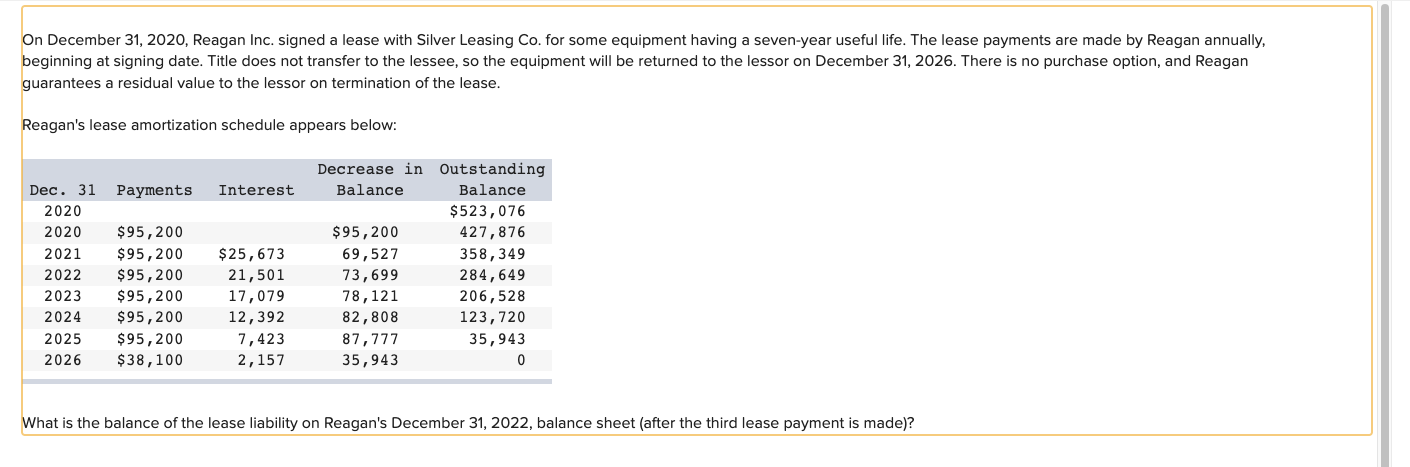

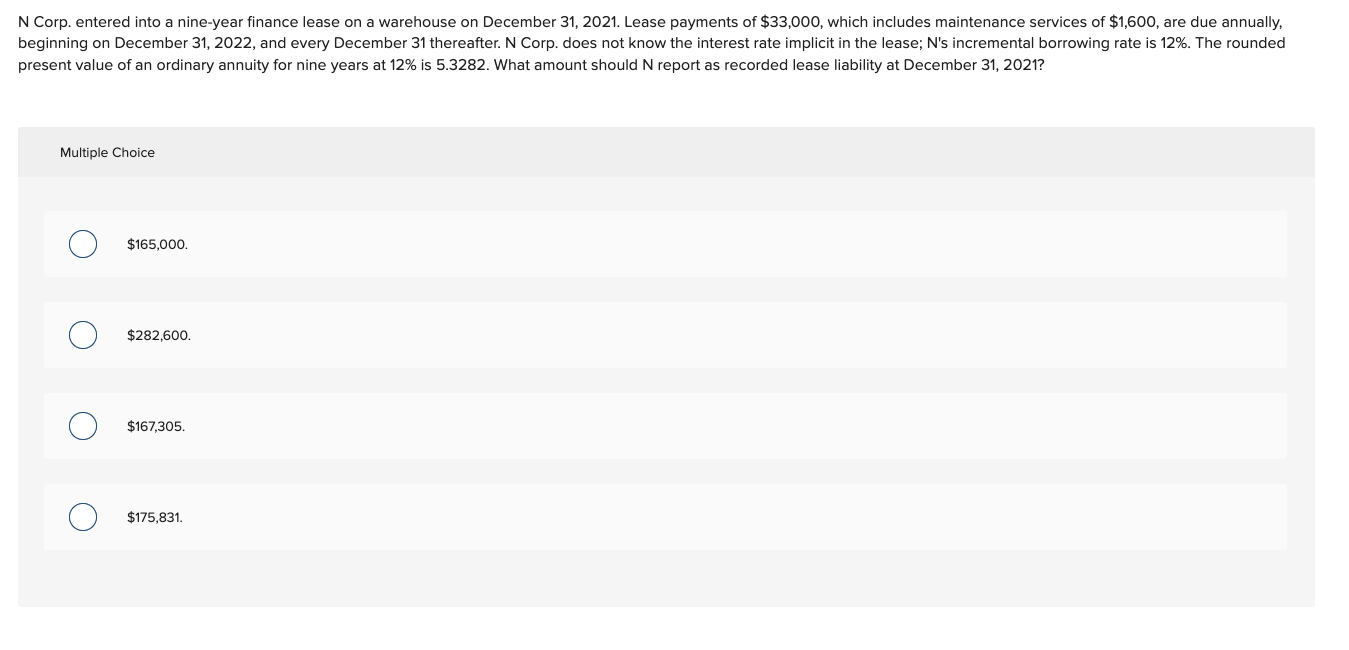

On December 31, 2020, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31 , 2026 . There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease. Reagan's lease amortization schedule appears below: What is the balance of the lease liability on Reagan's December 31,2022 , balance sheet (after the third lease payment is made)? N Corp. entered into a nine-year finance lease on a warehouse on December 31,2021 . Lease payments of $33,000, which includes maintenance services of $1,600, are due annually, beginning on December 31,2022 , and every December 31 thereafter. N Corp. does not know the interest rate implicit in the lease; N's incremental borrowing rate is 12%. The rounded present value of an ordinary annuity for nine years at 12% is 5.3282 . What amount should N report as recorded lease liability at December 31,2021 ? Multiple Choice $165,000. $282,600. $167,305. $175,831. On December 31, 2020, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31 , 2026 . There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease. Reagan's lease amortization schedule appears below: What is the balance of the lease liability on Reagan's December 31,2022 , balance sheet (after the third lease payment is made)? N Corp. entered into a nine-year finance lease on a warehouse on December 31,2021 . Lease payments of $33,000, which includes maintenance services of $1,600, are due annually, beginning on December 31,2022 , and every December 31 thereafter. N Corp. does not know the interest rate implicit in the lease; N's incremental borrowing rate is 12%. The rounded present value of an ordinary annuity for nine years at 12% is 5.3282 . What amount should N report as recorded lease liability at December 31,2021 ? Multiple Choice $165,000. $282,600. $167,305. $175,831