Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2020, Sage Corp. had a $5,340,000,6% fixed-rate note outstanding, payable in 2 years. It decides to enter into a 2 year swap

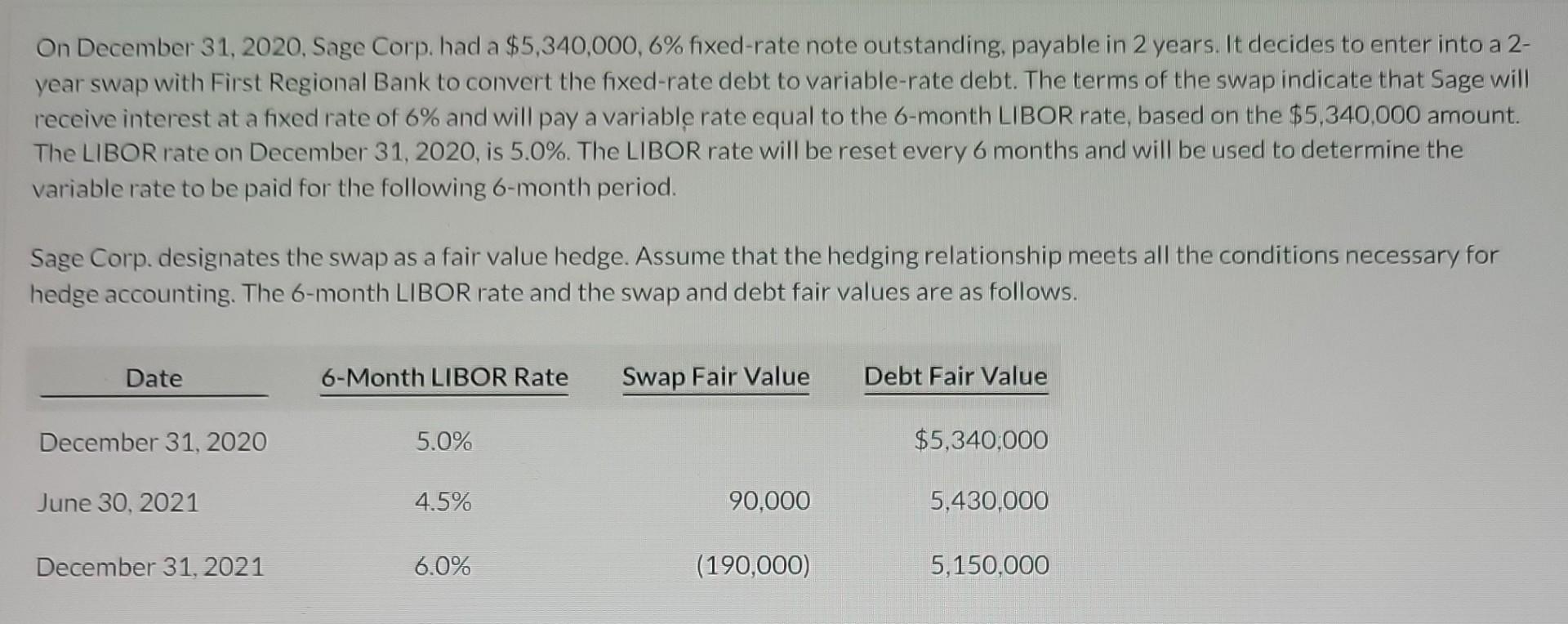

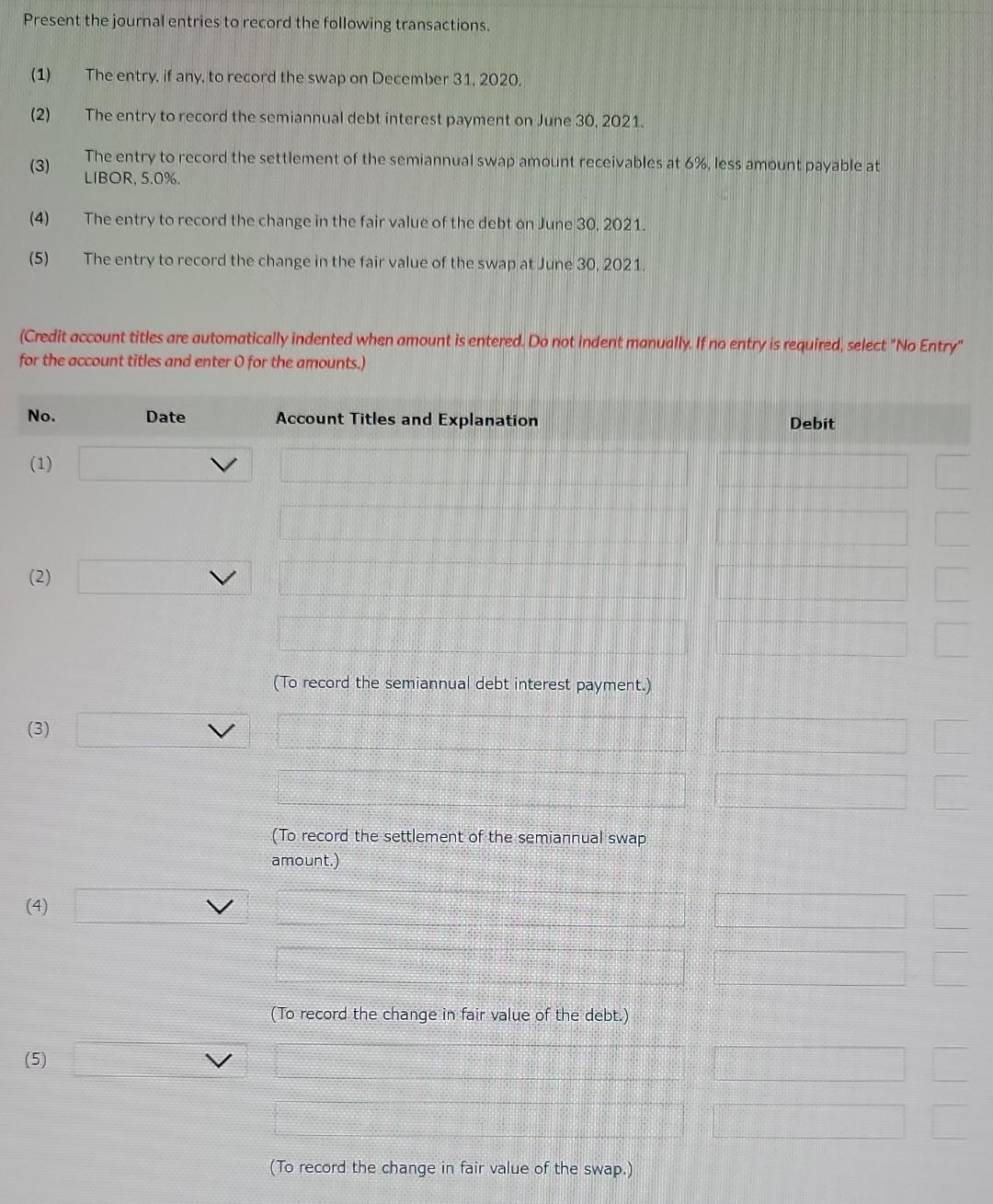

On December 31, 2020, Sage Corp. had a $5,340,000,6% fixed-rate note outstanding, payable in 2 years. It decides to enter into a 2 year swap with First Regional Bank to convert the fixed-rate debt to variable-rate debt. The terms of the swap indicate that Sage will receive interest at a fixed rate of 6% and will pay a variable rate equal to the 6 -month LIBOR rate, based on the $5,340,000 amount. The LIBOR rate on December 31,2020, is 5.0\%. The LIBOR rate will be reset every 6 months and will be used to determine the variable rate to be paid for the following 6-month period. Sage Corp. designates the swap as a fair value hedge. Assume that the hedging relationship meets all the conditions necessary for hedge accounting. The 6-month LIBOR rate and the swap and debt fair values are as follows. Present the journal entries to record the following transactions. (1) The entry, if any, to record the swap on December 31,2020. (2) The entry to record the semiannual debt interest payment on June 30,2021. (3) The entry to record the settlement of the semiannual swap amount receivables at 6%, less ambunt payable at LIBOR, 5.0%. (4) The entry to record the change in the fair value of the debt on June 30,2021 . (5) The entry to record the change in the fair value of the swap at June 30,2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started