Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2020, the accounts receivable control account of WHITE Company had a balance of 5,870,500, excluding accrued interest for notes, which agreed with

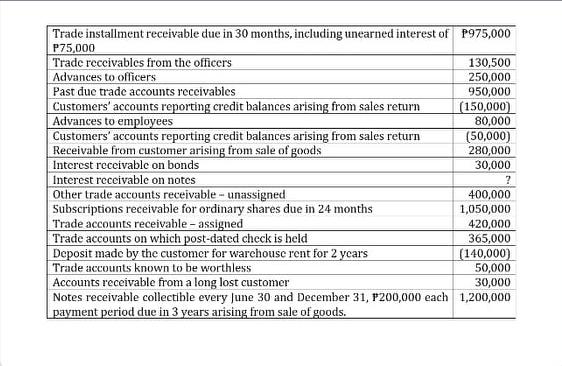

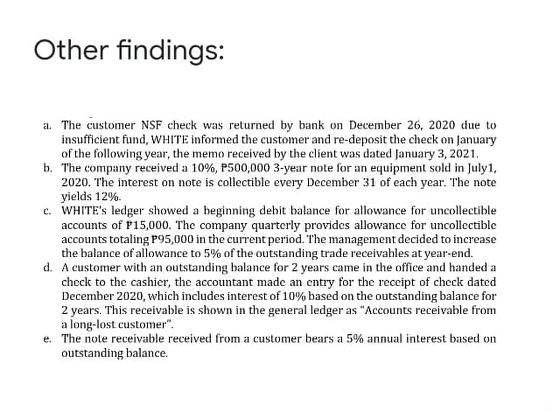

On December 31, 2020, the accounts receivable control account of WHITE Company had a balance of ₱5,870,500, excluding accrued interest for notes, which agreed with the total shown in its subsidiary ledger. As an auditor, you perform analytical procedures and inquiry with the audit client. The following were noted in your audit:

Trade installment receivable due in 30 months, including unearned interest of P975,000 P75,000 Trade receivables from the officers Advances to officers Past due trade accounts receivables Customers' accounts reporting credit balances arising from sales return Advances to employees 130,500 250,000 950,000 (150,000) 80,000 (50,000) 280,000 30,000 Customers' accounts reporting credit balances arising from sales return Receivable from customer arising from sale of goods Interest receivable on bonds Interest receivable on notes Other trade accounts receivable - unassigned Subscriptions receivable for ordinary shares due in 24 months Trade accounts receivable - assigned Trade accounts on which post-dated check is held Deposit made by the customer for warehouse rent for 2 years Trade accounts known to be worthless Accounts receivable from a long lost customer 30,000 Notes receivable collectible every June 30 and December 31, P200,000 each 1,200,000 payment period due in 3 years arising from sale of goods. 400,000 1,050,000 420,000 365,000 (140,000) 50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

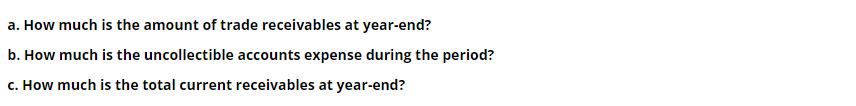

a Calculation of the amount of trade receivables at yearend Trade installment receivable due in 30 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started