Question

On December 31, 2020, the partnership of Abe, Bravo, Chartie and Delfin decided to liquidate with the following account balances. Cash NCA Liab. Bravo

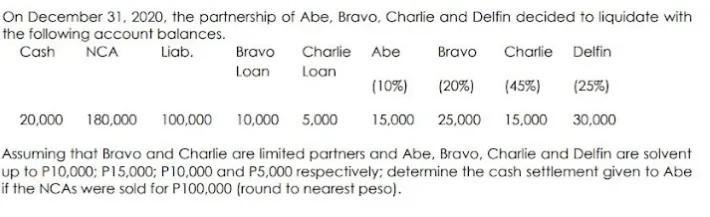

On December 31, 2020, the partnership of Abe, Bravo, Chartie and Delfin decided to liquidate with the following account balances. Cash NCA Liab. Bravo Charlie Abe Bravo Charlie Delfin Loan Loan (10%) (20%) (45%) (25% ) 20,000 180,000 100,000 10,000 5,000 15,000 25,000 15,000 30,000 Assuming that Bravo and Charlie are limited partners and Abe, Bravo, Charlie and Delfin are solvent up to P10,000; P15,000; P10,000 and P5,000 respectively; determine the cash settlement given to Abe if the NCAS were sold for P100,000 (round to nearest peso).

Step by Step Solution

3.34 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Workings Cash NCA Liability Bravo Loan Charlie Loan Abe Capital Bravo Capital Charlie Capital Delfin ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

13th Edition

978-0073379616, 73379611, 978-0697789938

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App