Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2021, Danny purchased $23,000 of newly issued bonds of Howard Corporation for $19,045. The bonds are dated December 31, 2021. The

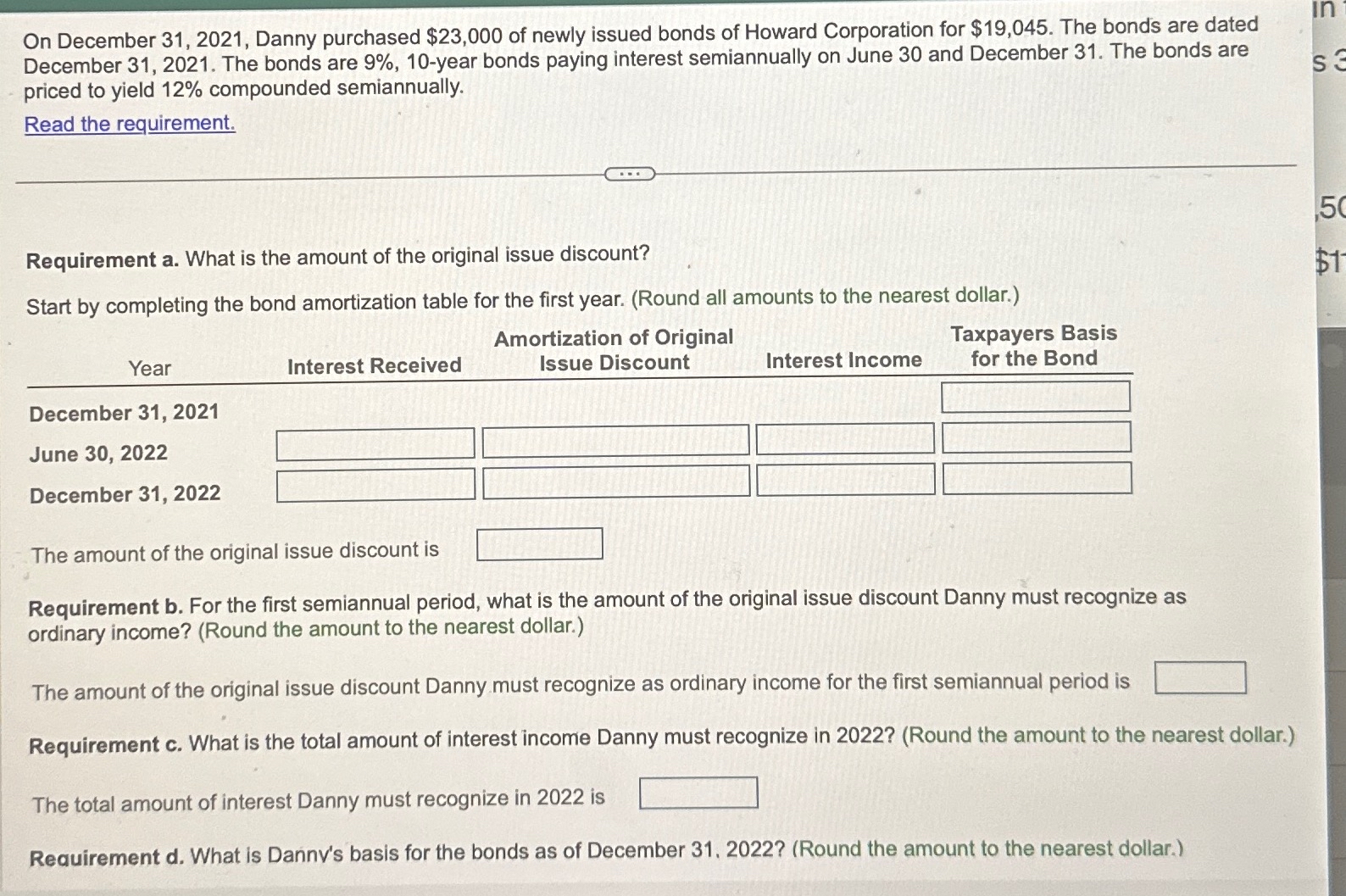

On December 31, 2021, Danny purchased $23,000 of newly issued bonds of Howard Corporation for $19,045. The bonds are dated December 31, 2021. The bonds are 9%, 10-year bonds paying interest semiannually on June 30 and December 31. The bonds are priced to yield 12% compounded semiannually. Read the requirement. Requirement a. What is the amount of the original issue discount? Start by completing the bond amortization table for the first year. (Round all amounts to the nearest dollar.) Year Interest Received December 31, 2021 June 30, 2022 December 31, 2022 Amortization of Original Issue Discount Taxpayers Basis Interest Income for the Bond s3 S 50 55 $11 The amount of the original issue discount is Requirement b. For the first semiannual period, what is the amount of the original issue discount Danny must recognize as ordinary income? (Round the amount to the nearest dollar.) The amount of the original issue discount Danny must recognize as ordinary income for the first semiannual period is Requirement c. What is the total amount of interest income Danny must recognize in 2022? (Round the amount to the nearest dollar.) The total amount of interest Danny must recognize in 2022 is Requirement d. What is Danny's basis for the bonds as of December 31, 2022? (Round the amount to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Dannys Bond Investment Analysis Bond Details Face value23000 Purchase price19045 Interest rate9 semi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started