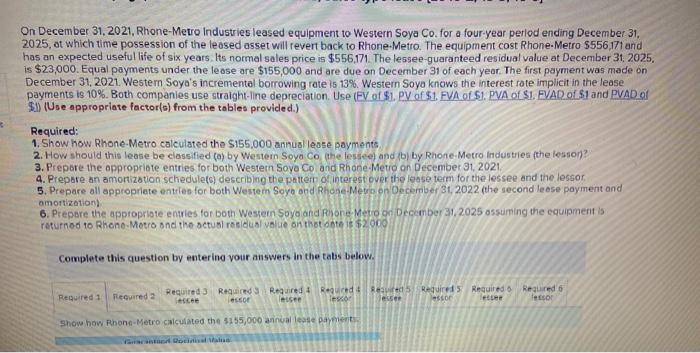

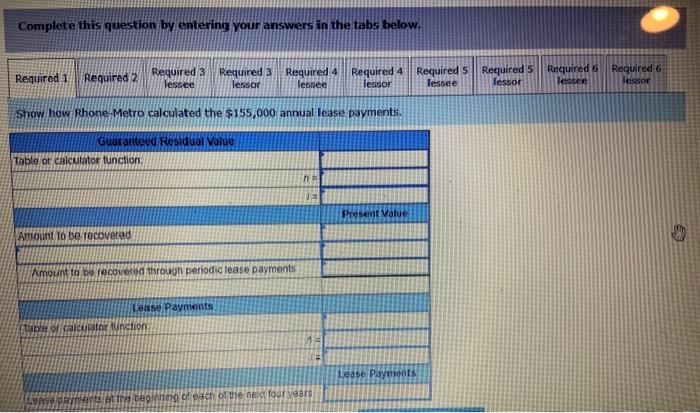

On December 31, 2021, Rhone-Metro Industries leased equipment to Western Soya Co. for a four-year period ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost Rhone-Metro $556171 and has an expected useful life of six years Its normal sales price is $556.171. The lessee-guaranteed residual value at December 31, 2025. is $23,000. Equal payments under the lease are $155,000 and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Saya's incremental borrowing rate is 13% Western Soyo knows the interest rate implicit in the lease payments is 10%. Both companies use straight-line depreciation. Use (FV of $1. PV of $1. FVA of $1. PVA of S1. FVAD OLSI and PVAD $) (Une appropriate factor(a) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $155,000 annual leate payments 2. How should this lease be classified (e) by Western Soyo Co the lessee) and (b) by Rhone Metro Industries the lesson? 3. Prepare the appropriate entries for both Western Soya Co and Rhone Metro on December 31, 2021 4. Prepare an amortization schedulete) describing the pattern of interest over the lasoterm for the lessee and the lessor 5. Prepare all appropriate entries for both Western Soyo and Rhone-Merib on December 31, 2022 (the second lease payment and amortization) 6. Prepare the appropriate entries for both Western Spa and Rore Metro on December 31, 2025 assuming the equipment is returned to Rhone Motro and the actual residual value on that one $200 Complete this question by entering your answers in the tabs below. Required 1 Rewired 2 Required 3 Required Required 4 Red Raw Requires Required Required 6 esce esco essee cor essee fesor Show how Rhone-Metro chiulated the 5155,000 annual lease payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 lessee Required 3 lessor Required 4 Required 4 lessee lessor Required 5 lessee Required 5 lessor Required 6 lessee Required 6 lessor Show how Rhone-Metro calculated the $155,000 annual lease payments. Guaranteed Residual Value Table or calculator function RE Present Value Altion to be recovered Amount to be recovered through periodic lease payments Lease Payments e or calculator function Lease Payments Lenge payments at the beginning of each of the next four years