Question

On December 31, 2022, Apostles Partnership's Statement of Financial Positions shows that Peter, James, and John have capital balances of P500,000, P300,000, and P200,000,

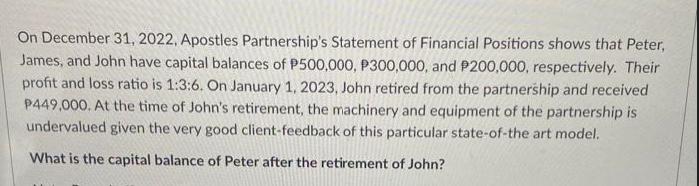

On December 31, 2022, Apostles Partnership's Statement of Financial Positions shows that Peter, James, and John have capital balances of P500,000, P300,000, and P200,000, respectively. Their profit and loss ratio is 1:3:6. On January 1, 2023, John retired from the partnership and received P449,000. At the time of John's retirement, the machinery and equipment of the partnership is undervalued given the very good client-feedback of this particular state-of-the art model. What is the capital balance of Peter after the retirement of John?

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

We can start by calculating the total capital balance of the partnership before Johns retirement Tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

4th Edition

1119607515, 978-1119607519

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App