Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2022, Ditka Incorporated had Retained Earnings of $271,800 before its closing entries were prepared and posted. During 2022, the company had service

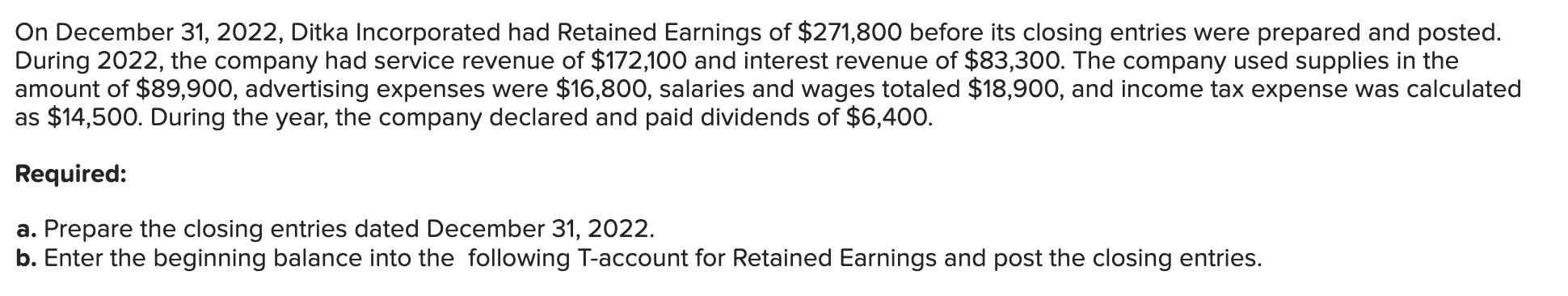

On December 31, 2022, Ditka Incorporated had Retained Earnings of $271,800 before its closing entries were prepared and posted. During 2022, the company had service revenue of $172,100 and interest revenue of $83,300. The company used supplies in the amount of $89,900, advertising expenses were $16,800, salaries and wages totaled $18,900, and income tax expense was calculated as $14,500. During the year, the company declared and paid dividends of $6,400. Required:

- Prepare the closing entries dated December 31, 2022.

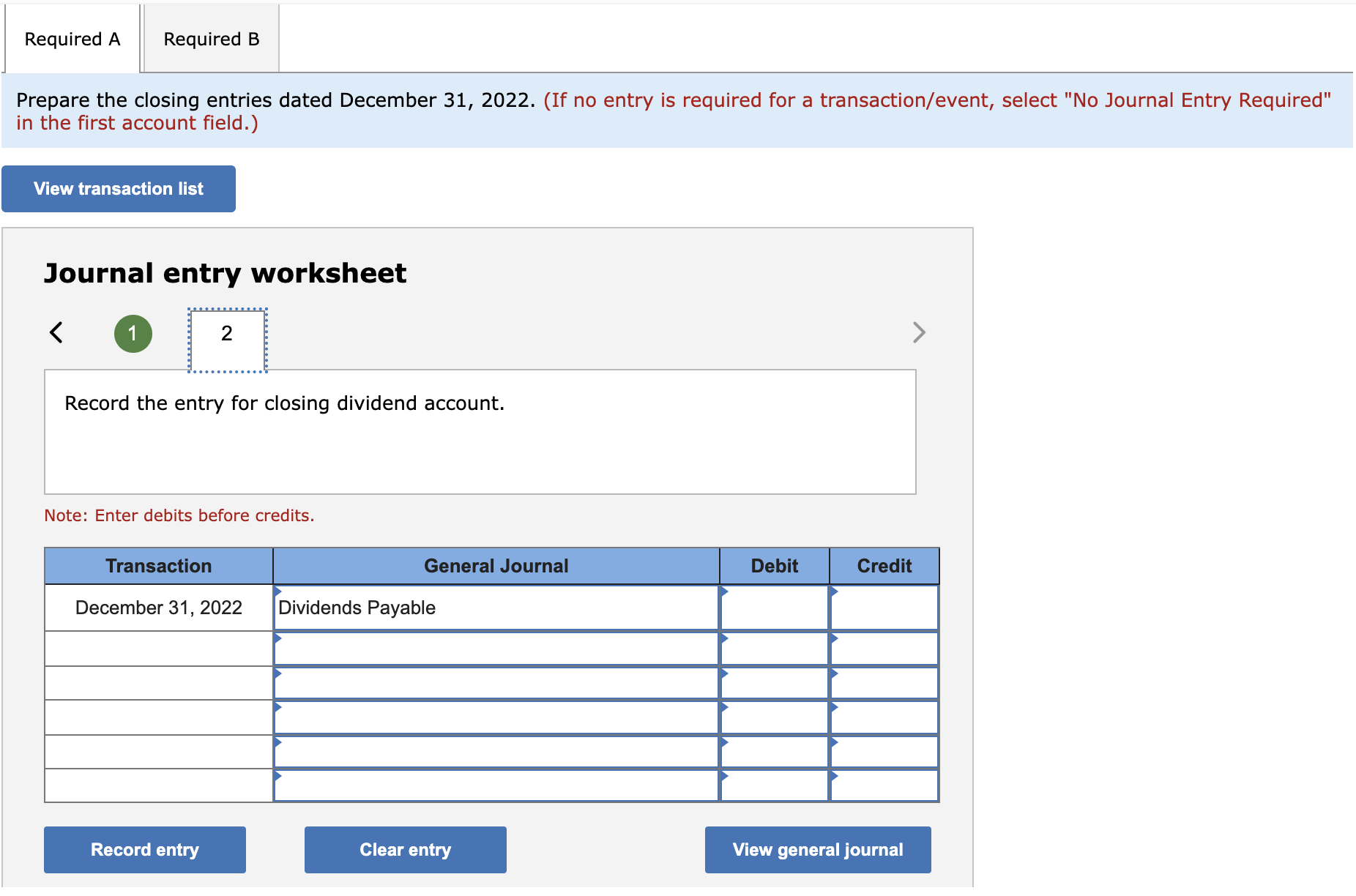

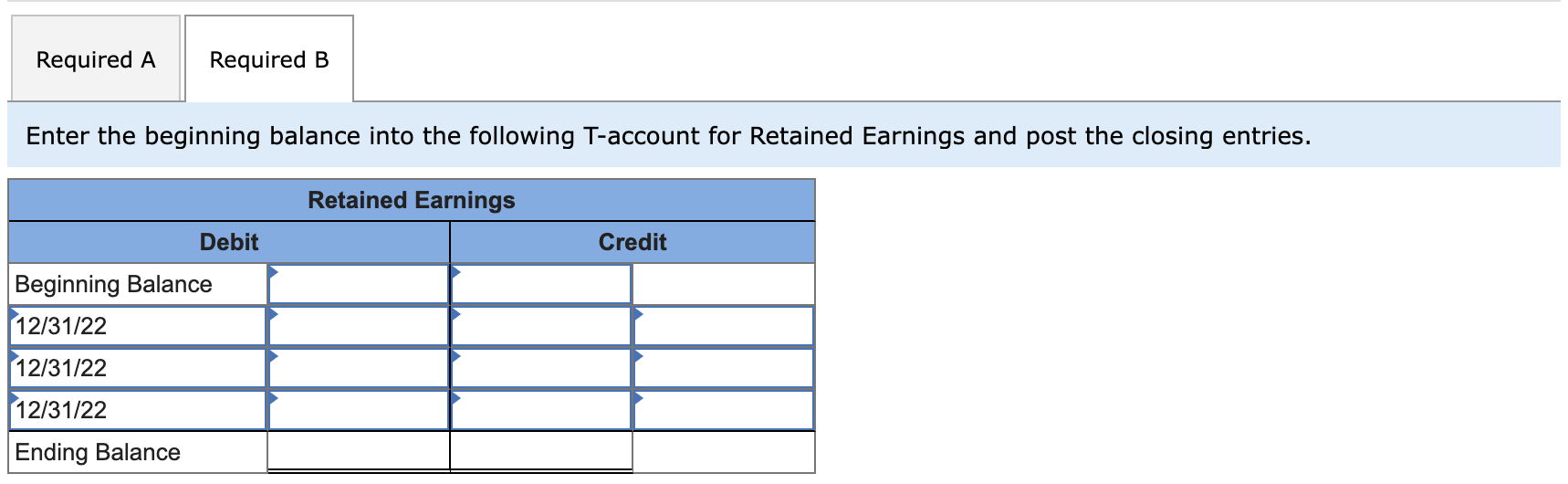

- Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries.

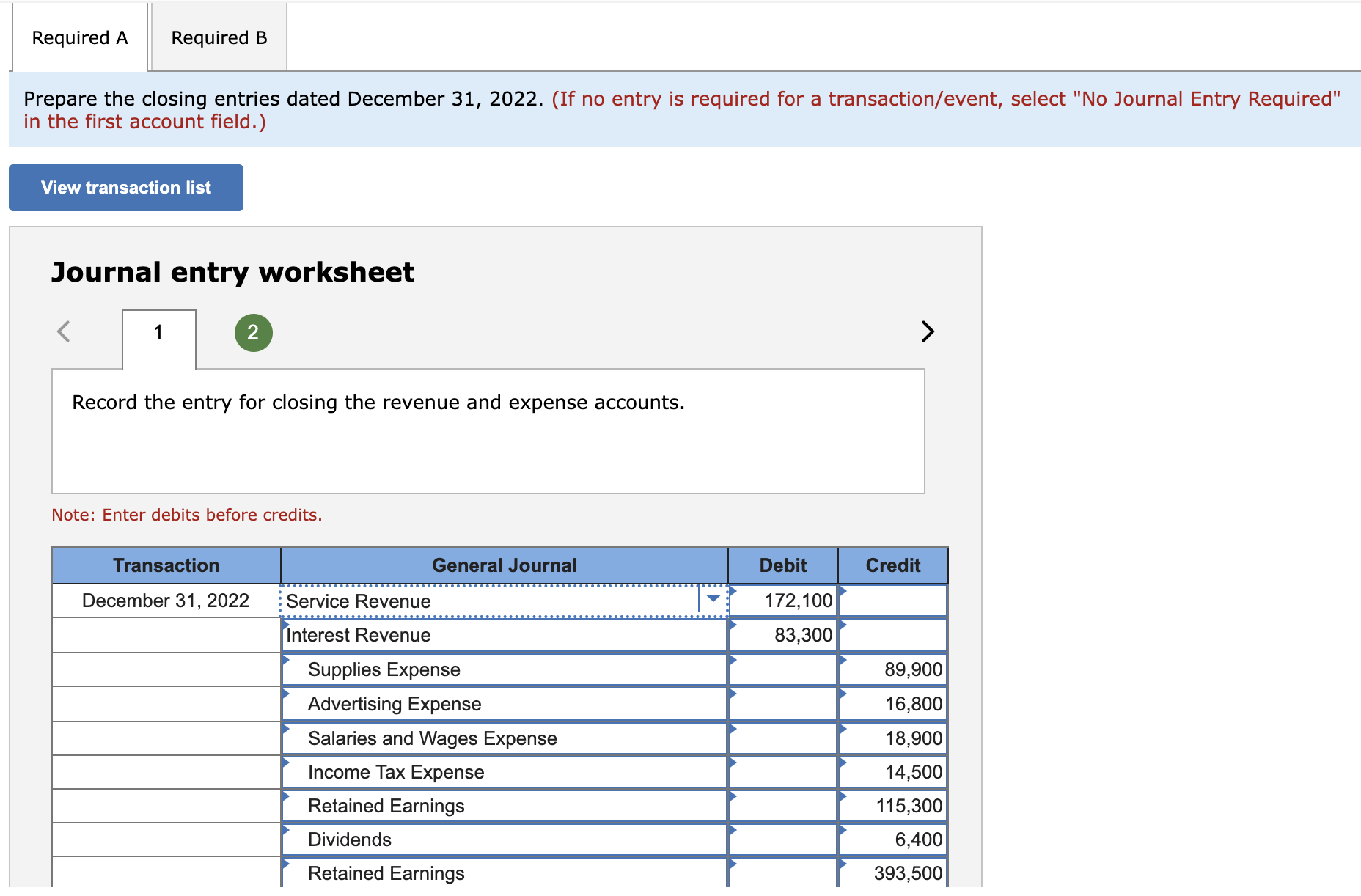

On December 31, 2022, Ditka Incorporated had Retained Earnings of $271,800 before its closing entries were prepared and posted. During 2022 , the company had service revenue of $172,100 and interest revenue of $83,300. The company used supplies in the amount of $89,900, advertising expenses were $16,800, salaries and wages totaled $18,900, and income tax expense was calculated as $14,500. During the year, the company declared and paid dividends of $6,400. Required: a. Prepare the closing entries dated December 31, 2022. b. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. Prepare the closing entries dated December 31,2022 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry for closing the revenue and expense accounts. Note: Enter debits before credits. Prepare the closing entries dated December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. On December 31, 2022, Ditka Incorporated had Retained Earnings of $271,800 before its closing entries were prepared and posted. During 2022 , the company had service revenue of $172,100 and interest revenue of $83,300. The company used supplies in the amount of $89,900, advertising expenses were $16,800, salaries and wages totaled $18,900, and income tax expense was calculated as $14,500. During the year, the company declared and paid dividends of $6,400. Required: a. Prepare the closing entries dated December 31, 2022. b. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. Prepare the closing entries dated December 31,2022 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry for closing the revenue and expense accounts. Note: Enter debits before credits. Prepare the closing entries dated December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries

On December 31, 2022, Ditka Incorporated had Retained Earnings of $271,800 before its closing entries were prepared and posted. During 2022 , the company had service revenue of $172,100 and interest revenue of $83,300. The company used supplies in the amount of $89,900, advertising expenses were $16,800, salaries and wages totaled $18,900, and income tax expense was calculated as $14,500. During the year, the company declared and paid dividends of $6,400. Required: a. Prepare the closing entries dated December 31, 2022. b. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. Prepare the closing entries dated December 31,2022 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry for closing the revenue and expense accounts. Note: Enter debits before credits. Prepare the closing entries dated December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. On December 31, 2022, Ditka Incorporated had Retained Earnings of $271,800 before its closing entries were prepared and posted. During 2022 , the company had service revenue of $172,100 and interest revenue of $83,300. The company used supplies in the amount of $89,900, advertising expenses were $16,800, salaries and wages totaled $18,900, and income tax expense was calculated as $14,500. During the year, the company declared and paid dividends of $6,400. Required: a. Prepare the closing entries dated December 31, 2022. b. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. Prepare the closing entries dated December 31,2022 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry for closing the revenue and expense accounts. Note: Enter debits before credits. Prepare the closing entries dated December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started