Question

On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 40,000 shares issued

On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances:

| Common stock ($10 par, 100,000 shares authorized) 40,000 shares issued and outstanding | $400,000 |

| Retained earnings | $531,100 |

For the year 2022, the corporation had net income before income taxes of $223,400, income taxes of $44,680, and net income after taxes of $178,720. The corporations tax rate is 20 percent. An expansion of the existing plant at a cost of $519,700 is planned. The corporations president, who owns 60 percent of the corporations common stock, estimates that the expansion would result in an increased net income of approximately $223,400 before interest and taxes. The financial vice president forecasts that the increase would be only $111,700.

Management is considering two possibilities for financing:

Issuance of 40,000 additional shares of common stock for $14 per share.

Issuance of $519,700 face amount, 10-year, 6 percent bonds payable, secured by a mortgage lien on the plant.

Assume that profits from existing operations will remain the same. Required:

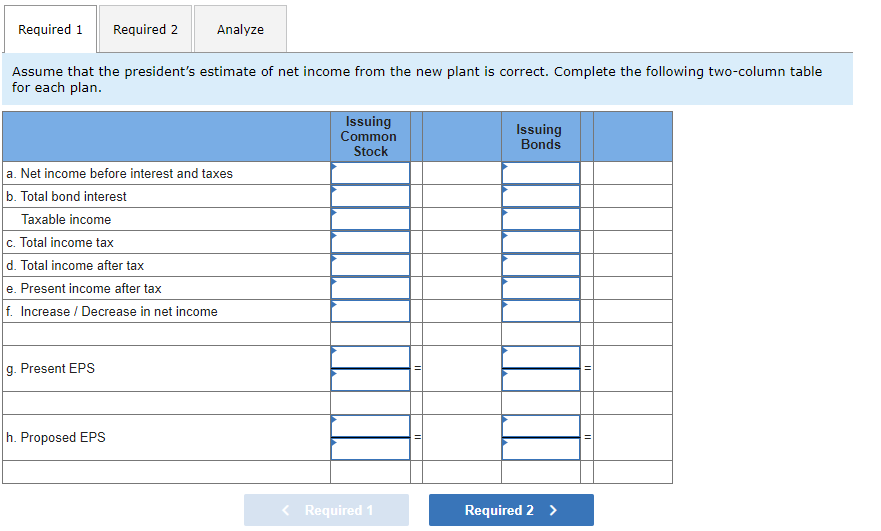

Assume that the presidents estimate of net income from the new plant is correct. Complete the following two-column table for each plan.

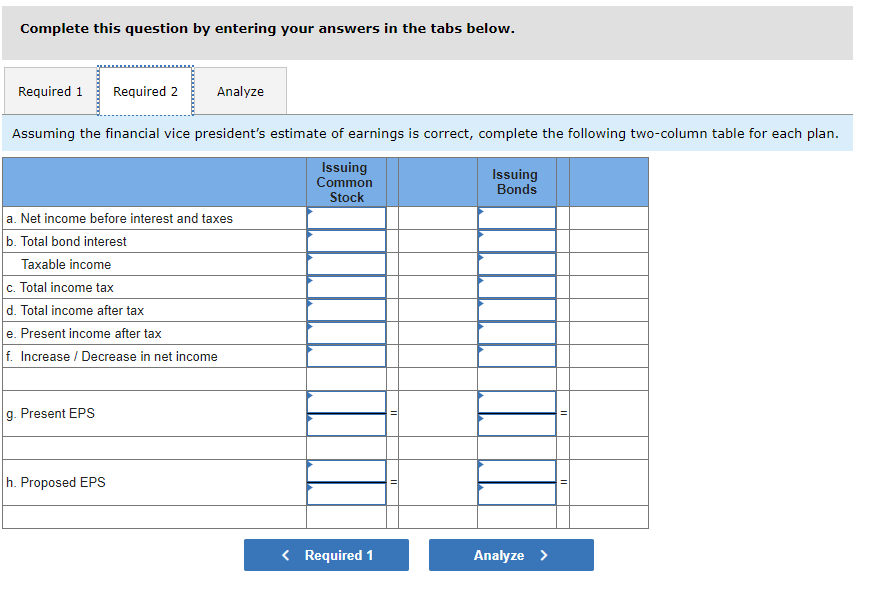

Assuming the financial vice presidents estimate of earnings is correct, complete the following two-column table for each plan.

(For all the requirements, round all calculations to the nearest dollar.)

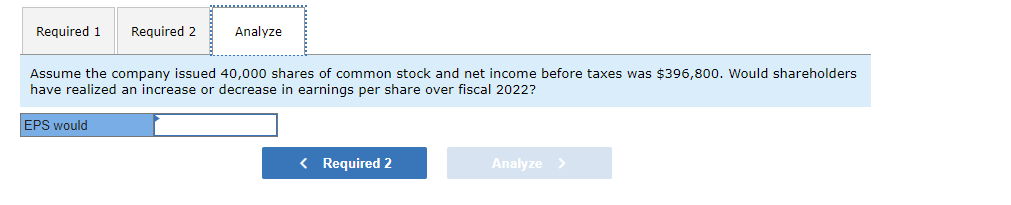

Analyze: Assume the company issued 40,000 shares of common stock and net income before taxes was $396,800. Would shareholders have realized an increase or decrease in earnings per share over fiscal 2022?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started