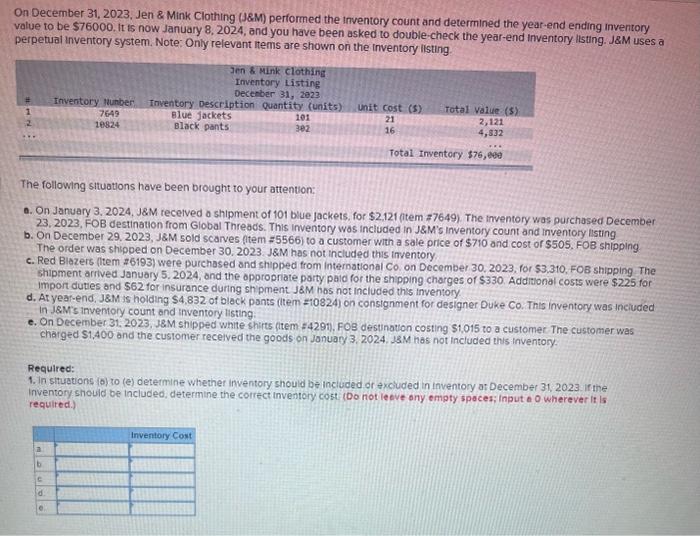

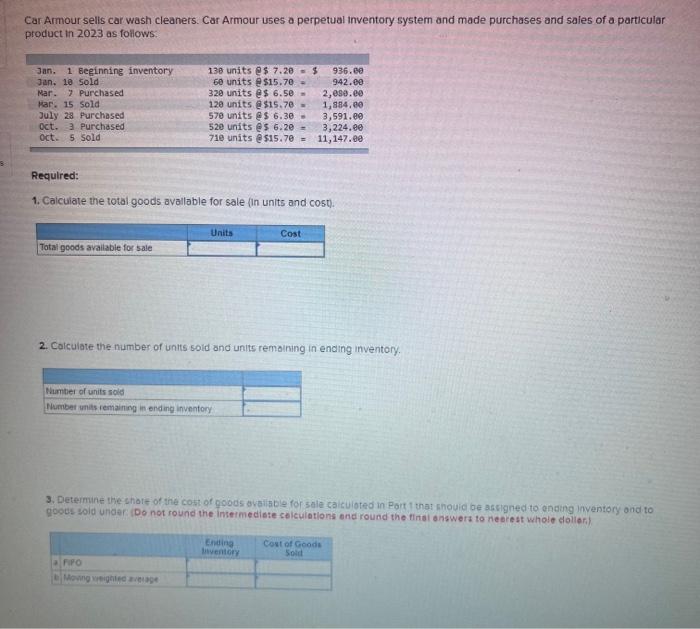

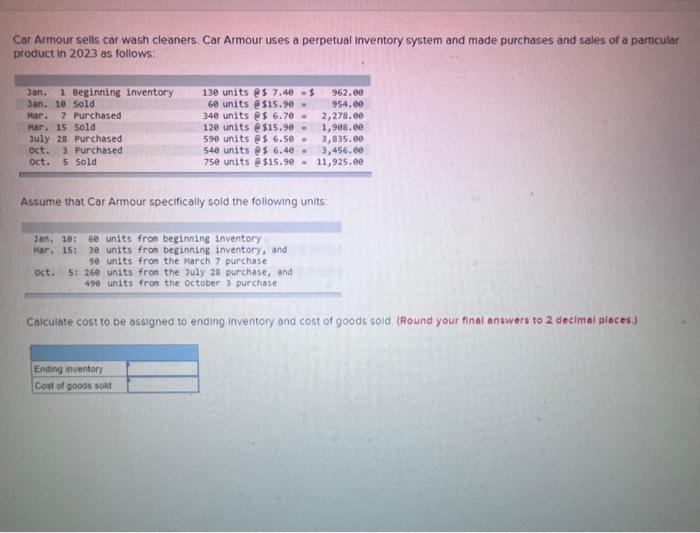

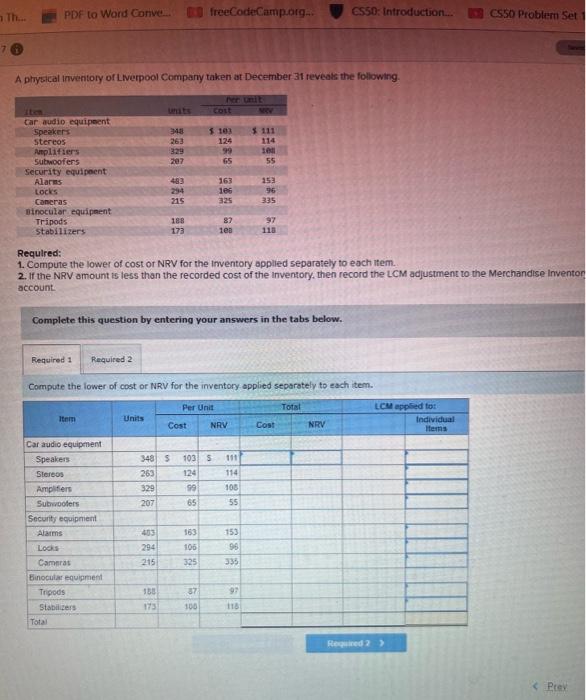

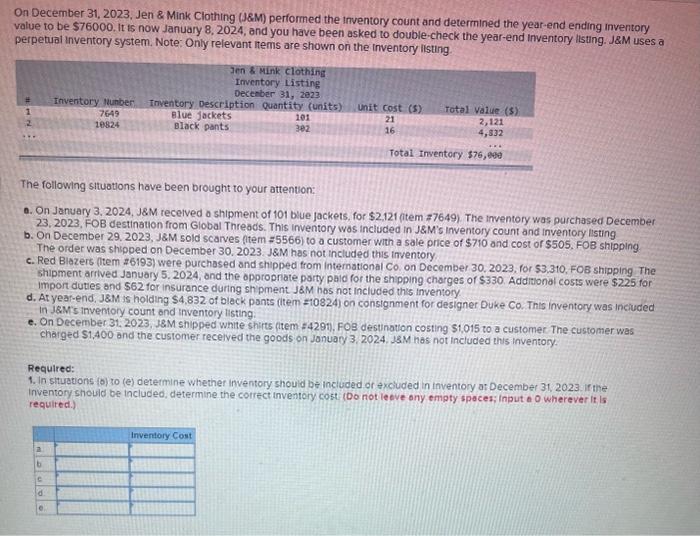

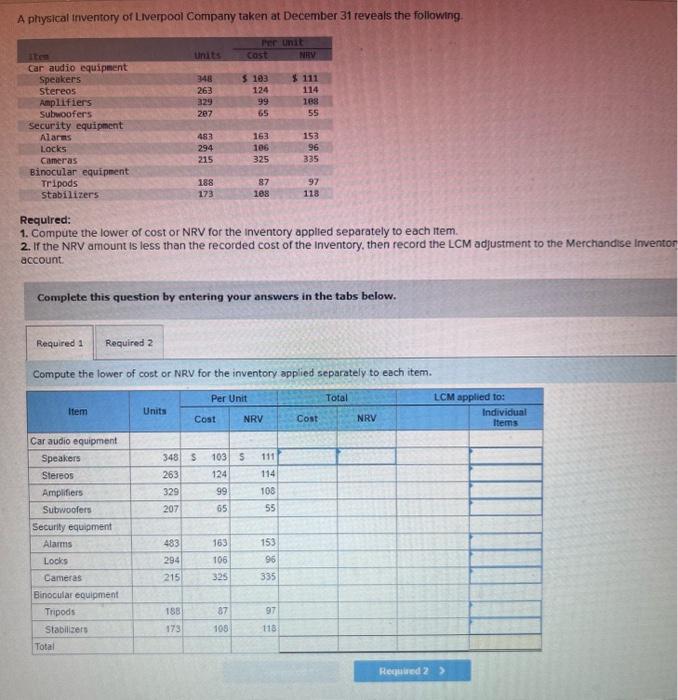

On December 31, 2023, Jen \& Mink Clothing (J\&M) performed the inventory count and determined the year-end ending inventory value to be $76000. It is now January 8, 2024, and you have been asked to double-check the year-end inventory ilsting. J\&M uses a perpetual inventory system. Note: Only relevant items are shown on the inventory listing The following situations have been brought to your attention: a. On January 3, 2024, J\&M recetved o shipment of 101 blue jackets, for $2.121 (item 77649 ). The inventory was purchased December 23, 2023. FOB destination from Global Threods. This inventory wos included in J\&M's inventory count and inventory isting b. On December 29,2023 , J\&M sold scarves (tem =5566 ) to a customer with a sale price of $710 and cost or $505. FOB shipping The order was shipped on December 30, 2023. J\&M has not included this inventory. c. Red Biazers (ltem 76193) were purchased and shipped from international Co. on December 30, 2023, for $3,310,FOB shipping The shipment arived January 5.2024 , and the oppropriate party paid for the shipping charges of $330. Additional costs were $225 for impor dutes and $62 for insurance during sh pment J $M hos not included this inventory d. At year-end, 18M is holding $4,832 of black ponts (item =10824 ) on consignment for designer Duke Co. This inventory was inciuded in 18Mrs invemory count and inventory listing: e. On December 31, 2023, J8M shipped white shirts (item 44291). FOB destinotion costing $1,015 to a customer. The customer was charged $1,400 and the customer recelved the goods on Jonuary 3, 2024, J3M has not included this inventory. Required: 1. In sltuations (o) zo (e) determine whether inventory should be inciuded or fxcluded in ioventory ar December 31,2023 if the Inventory should be included, determine the colrect inventory cost (Do not leeve ony empty spoces; input o o wherever it is requilred.) Car Armour selis car wash cleaners. Car Armour uses a perpetual inventory system and made purchases and sales of a particular product in 2023 as follows. Required: 1. Calculate the total goods avallable for sale (in units and cost ). 2. Calculate the number of untts sold and units remolning in ending inventory. 3. Determine the shore of the cont of goods bvailsble for sale calkuloted in Port t that hnouid be askigned to ending inventory and to goots sold under (Do not round the insermediete selculotlons ond round the finde onswera to neerest whole dolleri) Car Armour sells car wash cleaners. Car Armour uses a perpetual inventory system and made purchases and sales of a partucular product in 2023 as follows: Assume that Car Armour specifically sold the following units: Caicuiate cost to be assigned to ending inventory and cost of goods sold (Round your final answers to 2 decimal places.) A physical inventory of Liverpool Company taken at December 31 reveak the following. Requlred: 1. Compune the lower of cost or NRV for the inventory applied separately to each item. 2. If the NRV amount is less than the recorded cost of the inventory, then record the LCM adjustment to the Merchandise Invento account: Complete this question by entering your answers in the tabs below. Compute the lower of cost or NRV for the inventory applied separately to each item. On December 31,2023, Jen & Mink Clothing ( 18M ) performed the inventory count and determined the year-end ending inventory value to be $76000. It is now January 8, 2024, and you have been asked to double-check the year-end Inventory ilsting. J\&M uses a perpetual inventory system. Note: Only relevant items are shown on the inventory ilsting The following situations have been brought to your attention: 0. On Jansary 3, 2024, J8M recelved o shipment of 101 blue jackets, for $2.121 (item 77649 ). The inventory was purchased December 23, 2023. FOB destinauon from Global Threods. This inventory wos included in J\&M's inventory count and inventory isting b. On December 29,2023 , J8M sold scarves (ntem =5566 ) to a customer with a sale price of $710 and cost or $505. FOB shipping The order was shipped on December 30,2023 . J\&M has not included this inventory. c. Red Biazers (item 76193) were purchosed and shipped from international Co. on December 30, 2023, for $3,310,FOB shipping The shipment arrived January 5,2024 , and the opproprate party paid for the shipping charges or $330. Additional costs were $225 for import dutles and 562 for insurance during shpment J MM hos not included this inventory d. At year-end. J\&M is holding $4,832 of black ponts (item =10824) on consignment for designer Duke Co. This inventory was inciuded in 18M s invemory count and inventory listing: e. On December 31, 2023, J8M shipped white shirts (item 442911 . FOB destinotion costing $1,015 to a customer The customer was charged $1,400 and the customer recelved the goods on Jonuary 3, 2024. JSM has not included this inventory. Required: 1. In shusutions (o) zo (e) determine whether inventory should be included or fxcluded in inventory ar December 31, 2023, if the Inventory should be included, determine the correct inventory cost (Do not leeve ony empty spoces; input a wherever it is requited.) A physical tiventory of Liverpool Company taken at December 31 reveals the following. Requlred: 1. Compute the lower of cost or NRV for the inventory applied separately to each item. 2. If the NRV amount is less than the recorded cost of the Inventory, then record the LCM adjustment to the Merchandise Invento account. Complete this question by entering your answers in the tabs below. Compute the lower of cost or NRV for the inventory applied separately to each item