Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2025, Blue Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Blue Co. agreed to accept a

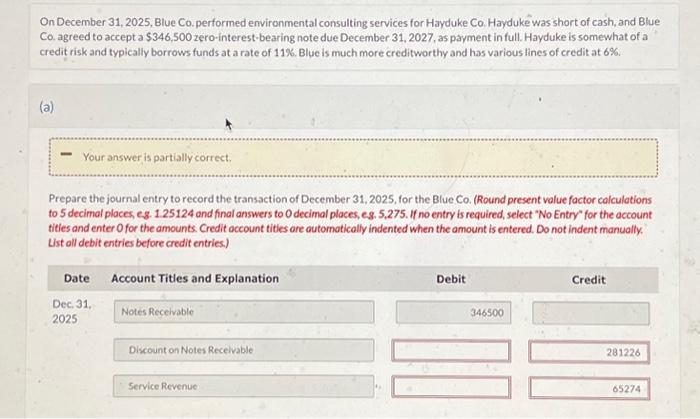

On December 31, 2025, Blue Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Blue Co. agreed to accept a $346,500 zero-interest-bearing note due December 31, 2027, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 11%. Blue is much more creditworthy and has various lines of credit at 6%. (a) - Your answer is partially correct. Prepare the journal entry to record the transaction of December 31, 2025, for the Blue Co. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Dec. 31, 2025 Account Titles and Explanation Notes Receivable Discount on Notes Receivable Service Revenue Debit 346500 Credit 281226 65274

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started