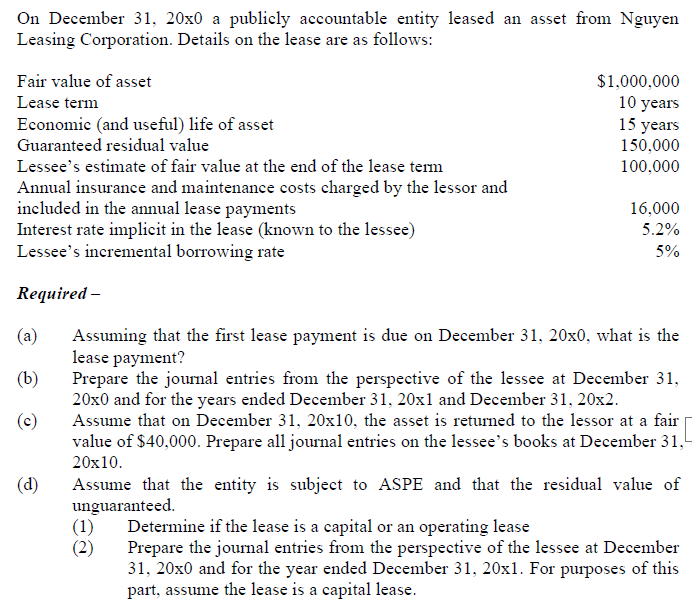

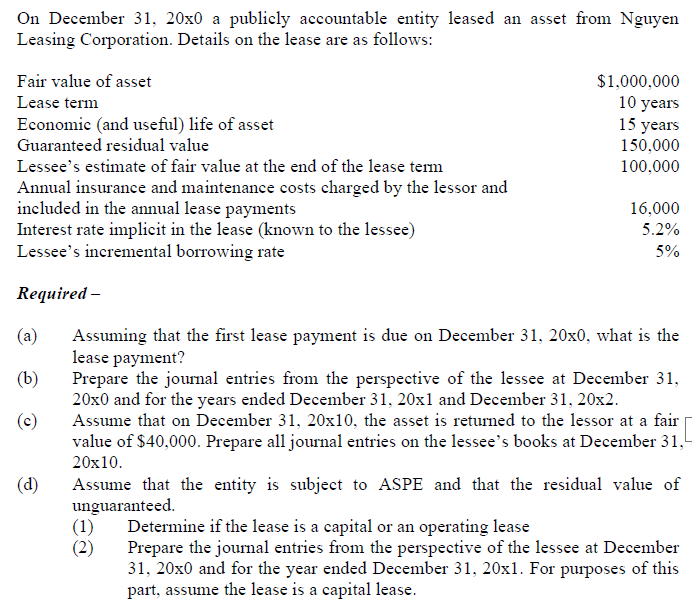

On December 31, 20x0 a publicly accountable entity leased an asset from Nguyen Leasing Corporation. Details on the lease are as follows: Fair value of asset Lease term Economic (and useful) life of asset Guaranteed residual value Lessee's estimate of fair value at the end of the lease term Annual insurance and maintenance costs charged by the lessor and included in the annual lease payments Interest rate implicit in the lease (known to the lessee) Lessee's incremental borrowing rate $1,000,000 10 years 15 years 150,000 100,000 16,000 5.2% 5% Required - (a) (b) Assuming that the first lease payment is due on December 31, 20x0, what is the lease payment? Prepare the journal entries from the perspective of the lessee at December 31, 20x0 and for the years ended December 31, 20x1 and December 31, 20x2. Assume that on December 31, 20x10, the asset is returned to the lessor at a fair value of $40,000. Prepare all journal entries on the lessee's books at December 31, 20x10. Assume that the entity is subject to ASPE and that the residual value of unguaranteed. (1) Determine if the lease is a capital or an operating lease (2) Prepare the journal entries from the perspective of the lessee at December 31, 20x0 and for the year ended December 31, 20xl. For purposes of this part, assume the lease is a capital lease. (d) On December 31, 20x0 a publicly accountable entity leased an asset from Nguyen Leasing Corporation. Details on the lease are as follows: Fair value of asset Lease term Economic (and useful) life of asset Guaranteed residual value Lessee's estimate of fair value at the end of the lease term Annual insurance and maintenance costs charged by the lessor and included in the annual lease payments Interest rate implicit in the lease (known to the lessee) Lessee's incremental borrowing rate $1,000,000 10 years 15 years 150,000 100,000 16,000 5.2% 5% Required - (a) (b) Assuming that the first lease payment is due on December 31, 20x0, what is the lease payment? Prepare the journal entries from the perspective of the lessee at December 31, 20x0 and for the years ended December 31, 20x1 and December 31, 20x2. Assume that on December 31, 20x10, the asset is returned to the lessor at a fair value of $40,000. Prepare all journal entries on the lessee's books at December 31, 20x10. Assume that the entity is subject to ASPE and that the residual value of unguaranteed. (1) Determine if the lease is a capital or an operating lease (2) Prepare the journal entries from the perspective of the lessee at December 31, 20x0 and for the year ended December 31, 20xl. For purposes of this part, assume the lease is a capital lease. (d)