Question

On December 31, 20Y3, Lopez company (lessee) signed a 3-year, noncancelable lease for the use of manufacturing equipment now owned by Zinger, Inc. (lessor). The

On December 31, 20Y3, Lopez company (lessee) signed a 3-year, noncancelable lease for the use of manufacturing equipment now owned by Zinger, Inc. (lessor). The lease expires December 31, 20Y6 and has the following terms:

- Annual contractual payments of $16,664 at the end of each year. The first payment is due December 31, 20Y3.

- No down payment; No purchase option.

- The asset's FMV at 12/31/Y3 is $60,000.

-Lopez does not guarantee any residual value at 12/31/Y6.

-Lopez can borrow at 10% per year for a 3-year loan; Lopez is unaware of Zinger's 8% desired return rate.

-The estimated useful life of the asset is 4 years.

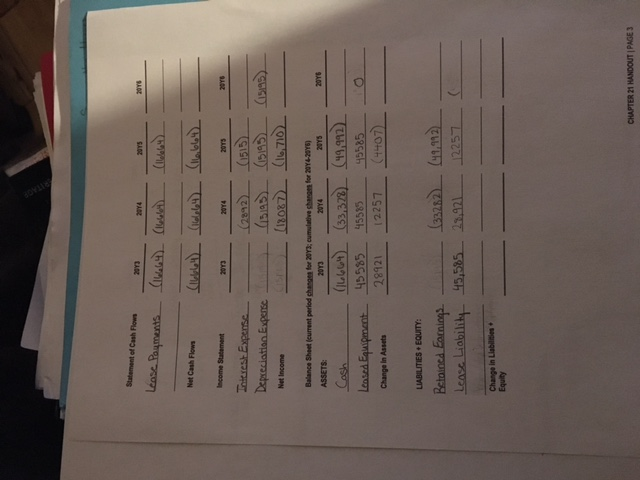

Use the following template to show how the above lease transactions impacted Lopez's Statement of Cash Flows, Income Statement, and Balance Sheet for the years 20Y3-20Y6. Round all amounts to the nearest whole dollar. The Balance Sheet should reflect CUMULATIVE changes to the statement. It should also separate debt into current a non-current amounts.

SEE ATTACHMENTS FOR THE WORK I HAVE DONE SO FAR. I JUST CANNOT GET IT TO BALANCE ON THE STATEMENTS.

Statement of Cash Flows Depreciation Balance Sheet (eument period changes for 20Y3: cumulative chMeast for 20Y 2 Cash 45585 5585 5525 28921 12 257 Change in Assets chained Earnings 225 Lease Liabi Change in Liabilities CHAPTER 21 HANDOUT IPAGE 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started