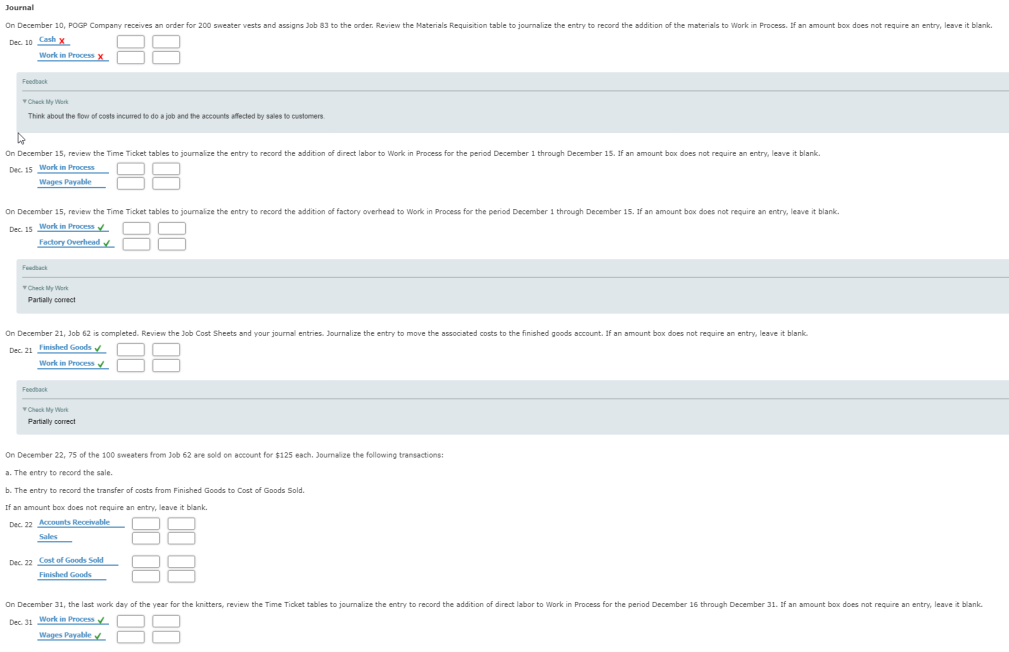

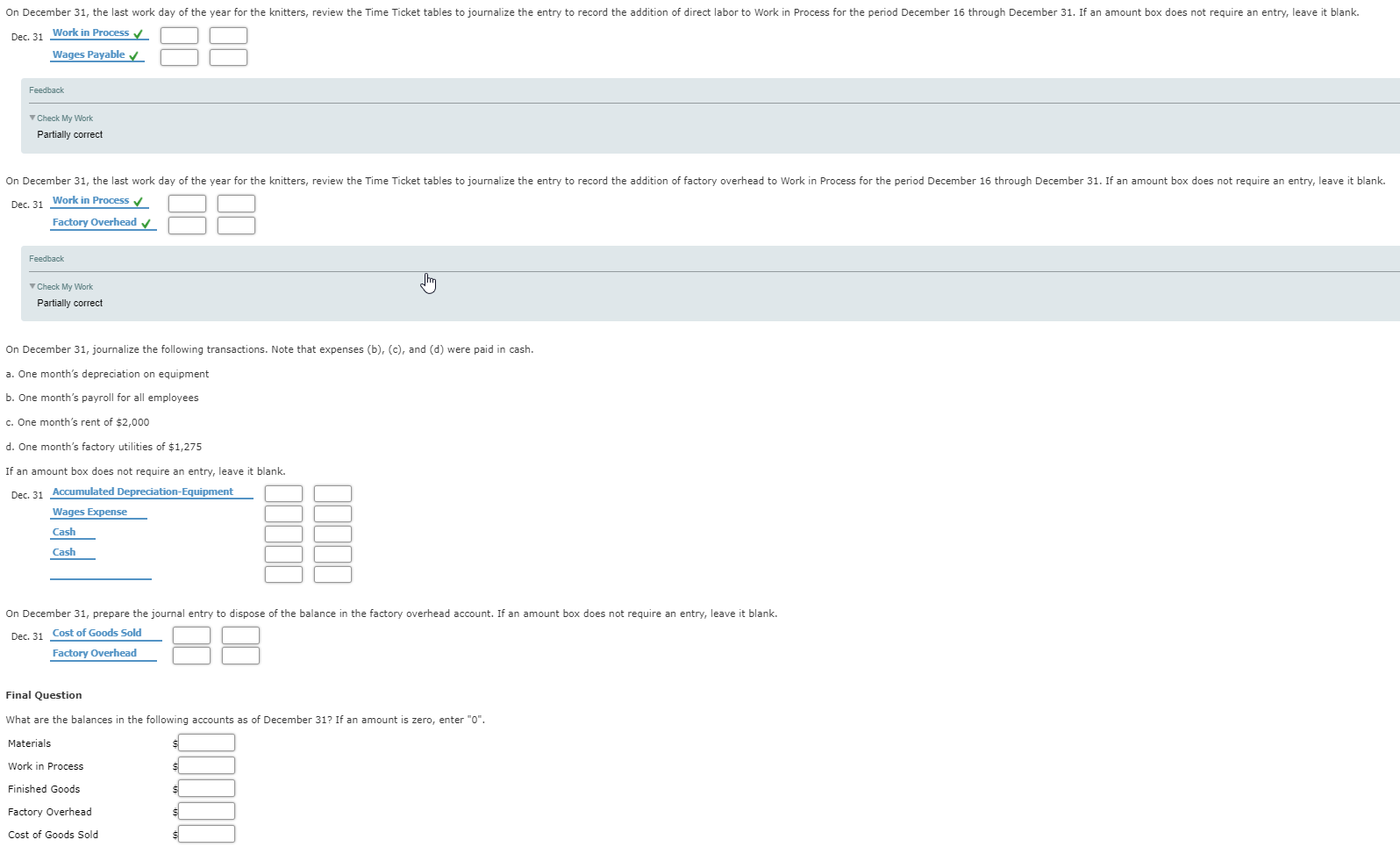

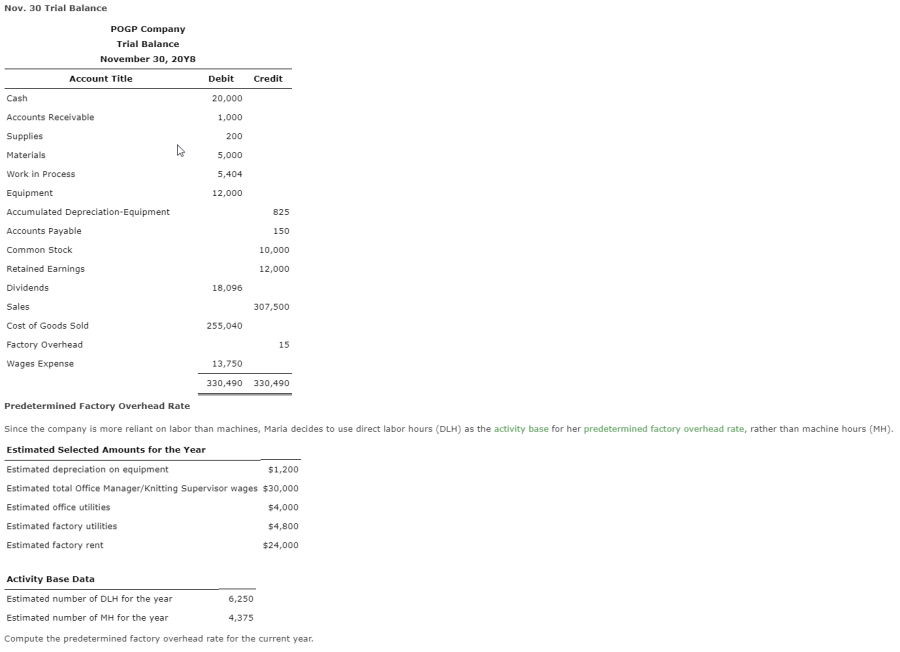

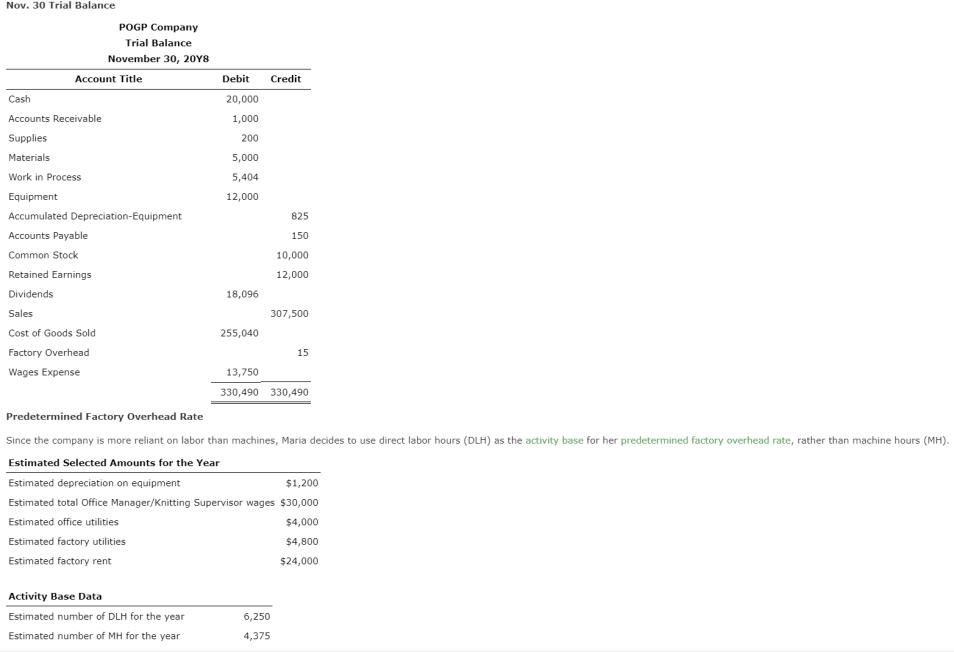

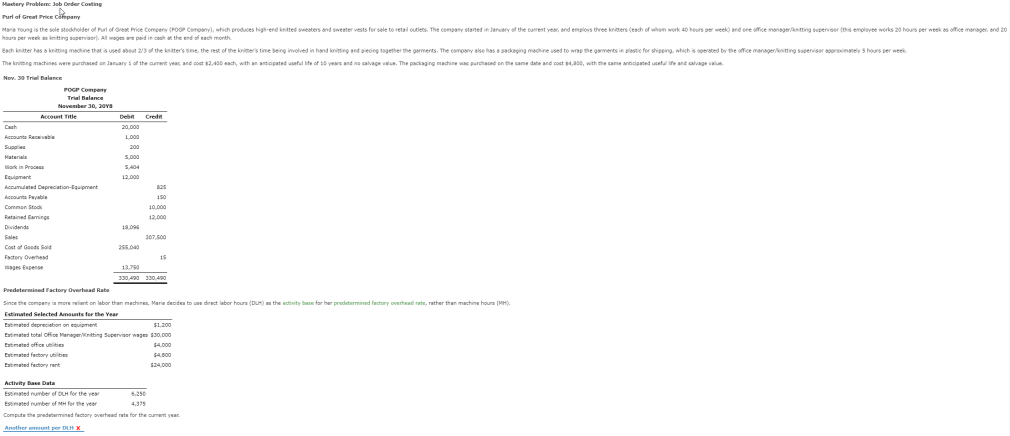

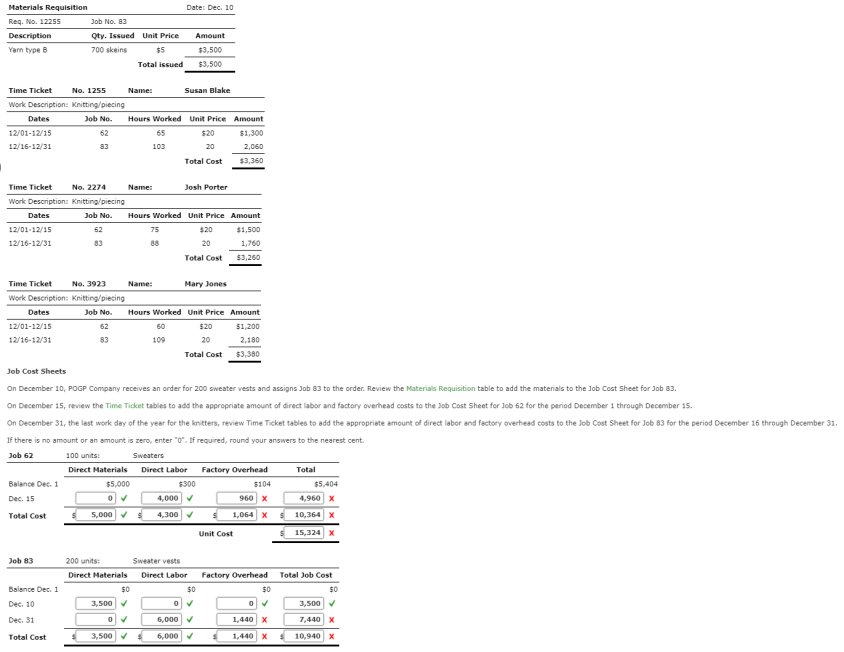

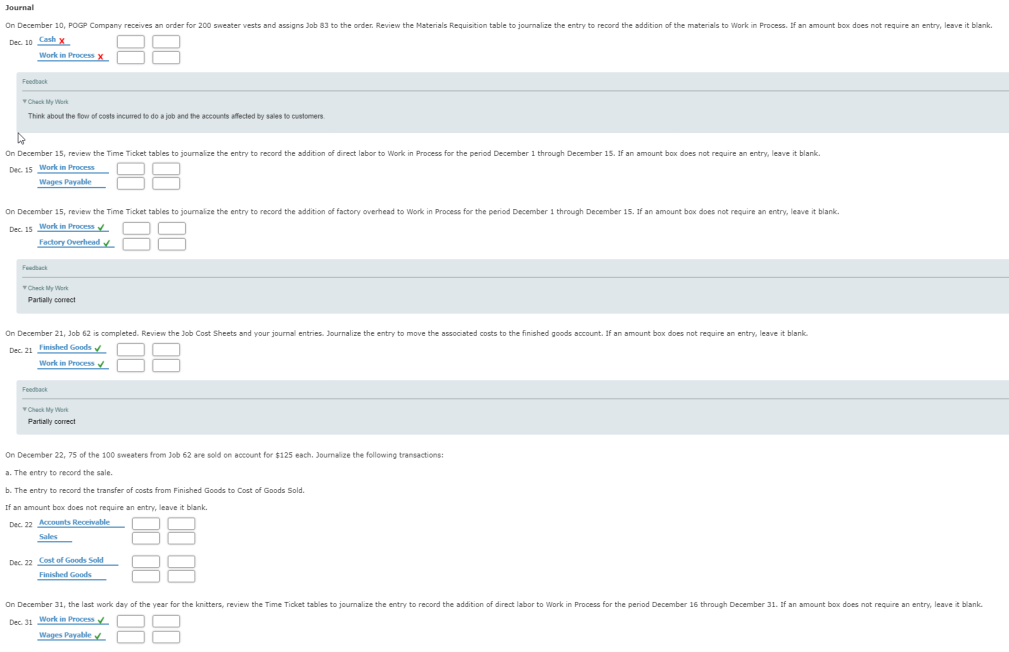

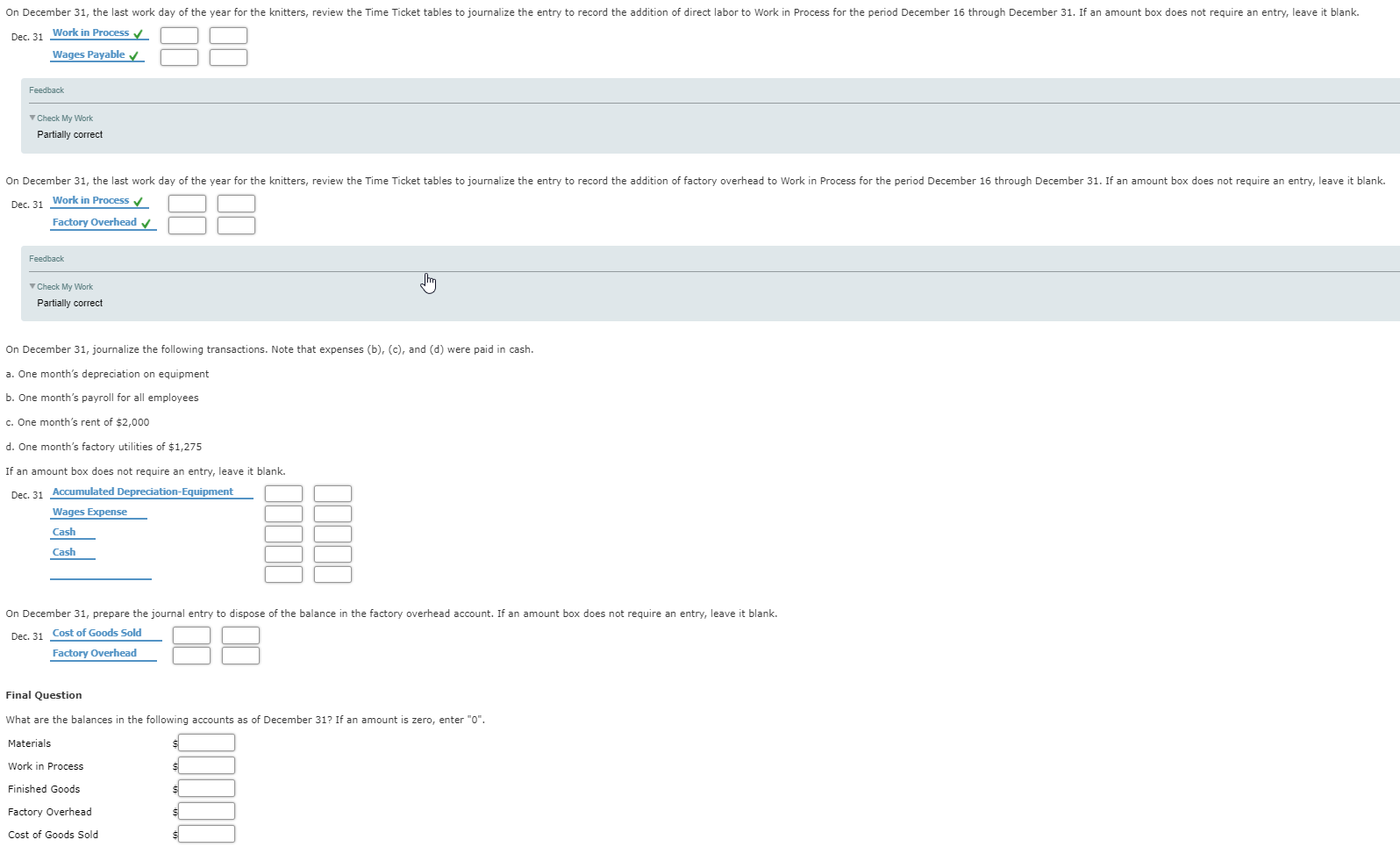

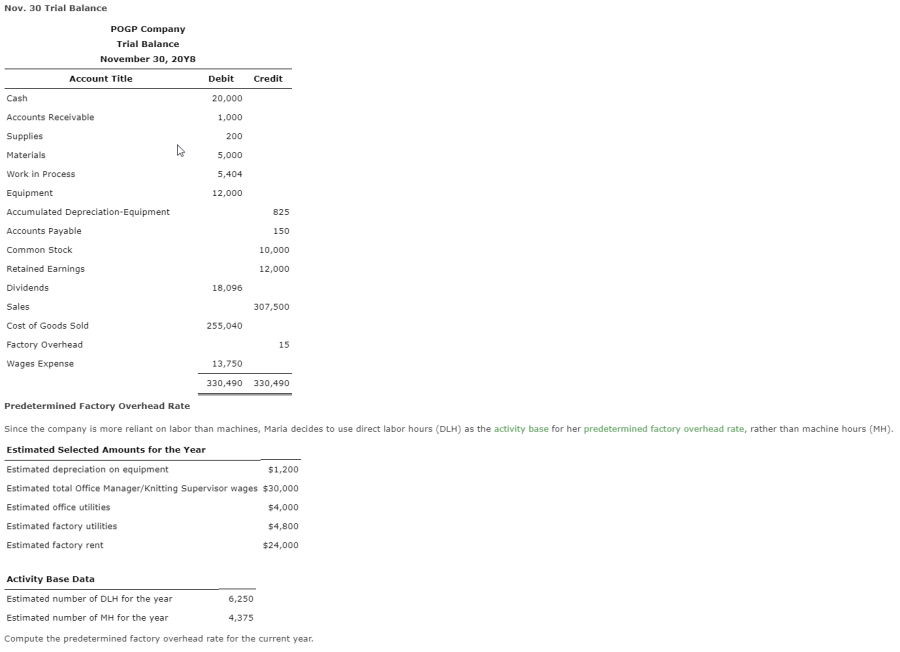

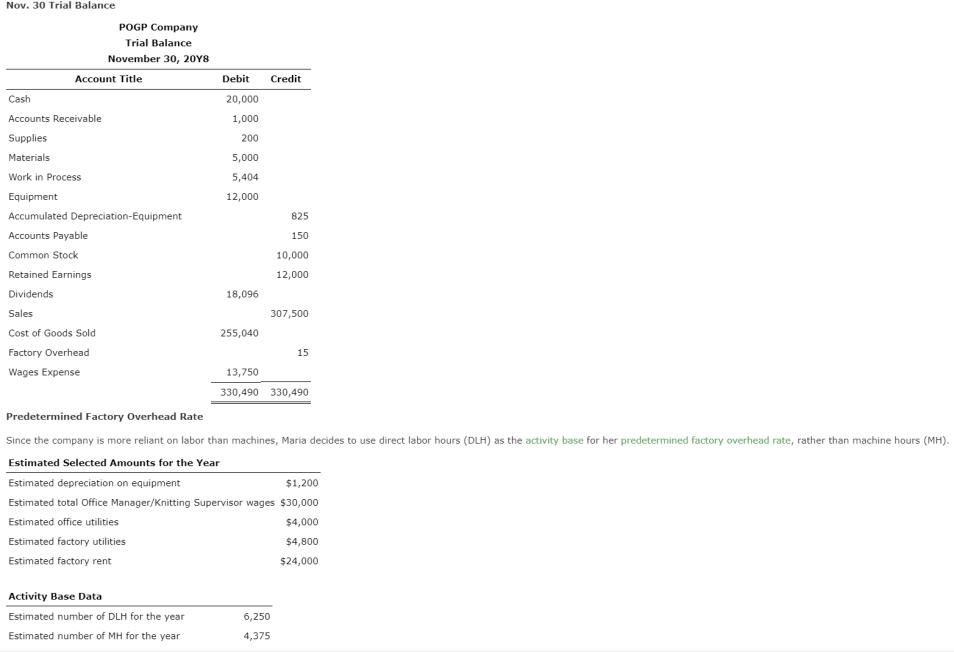

On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Work in Process y Dec. 31 Wages Payable v Feedback V Check My Work Partially correct On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 Work in Process v Factory Overhead v Feedback V Check My Work Partially correct On December 31, journalize the following transactions. Note that expenses (b), (c), and (d) were paid in cash. a. One month's depreciation on equipment b. One month's payroll for all employees c. One month's rent of $2,000 d. One month's factory utilities of $1,275 If an amount box does not require an entry, leave it blank. Dec. 31 Accumulated Depreciation-Equipment Wages Expense Cash Cash On December 31, prepare the journal entry to dispose of the balance in the factory overhead account. If an amount box does not require an entry, leave it blank. Cost of Goods Sold Dec. 31 Factory Overhead Final Question What are the balances in the following accounts as of December 31? If an amount is zero, enter "0". Materials Work in Process Finished Goods Factory Overhead Cost of Goods Sold On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of direct labor to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Work in Process y Dec. 31 Wages Payable v Feedback V Check My Work Partially correct On December 31, the last work day of the year for the knitters, review the Time Ticket tables to journalize the entry to record the addition of factory overhead to Work in Process for the period December 16 through December 31. If an amount box does not require an entry, leave it blank. Dec. 31 Work in Process v Factory Overhead v Feedback V Check My Work Partially correct On December 31, journalize the following transactions. Note that expenses (b), (c), and (d) were paid in cash. a. One month's depreciation on equipment b. One month's payroll for all employees c. One month's rent of $2,000 d. One month's factory utilities of $1,275 If an amount box does not require an entry, leave it blank. Dec. 31 Accumulated Depreciation-Equipment Wages Expense Cash Cash On December 31, prepare the journal entry to dispose of the balance in the factory overhead account. If an amount box does not require an entry, leave it blank. Cost of Goods Sold Dec. 31 Factory Overhead Final Question What are the balances in the following accounts as of December 31? If an amount is zero, enter "0". Materials Work in Process Finished Goods Factory Overhead Cost of Goods Sold