Answered step by step

Verified Expert Solution

Question

1 Approved Answer

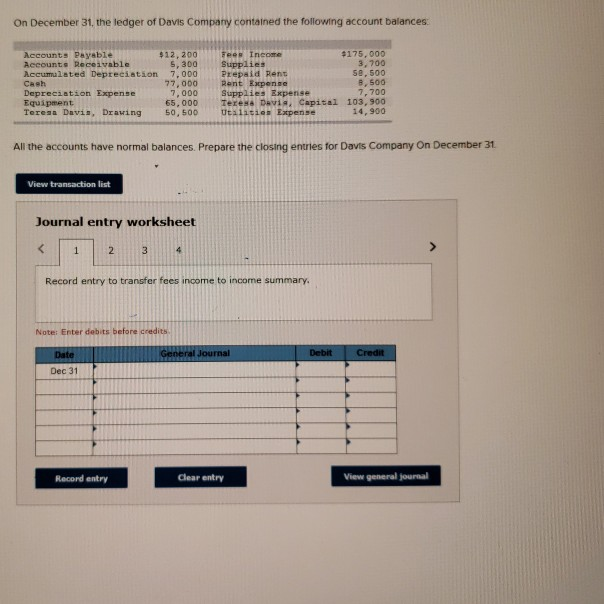

On December 31, the ledger of Davis Company contained the following account balances. Accounts Payable Account Receivable Accumulated Depreciation Cash Depreciation Expense Equipment Teresa Davis

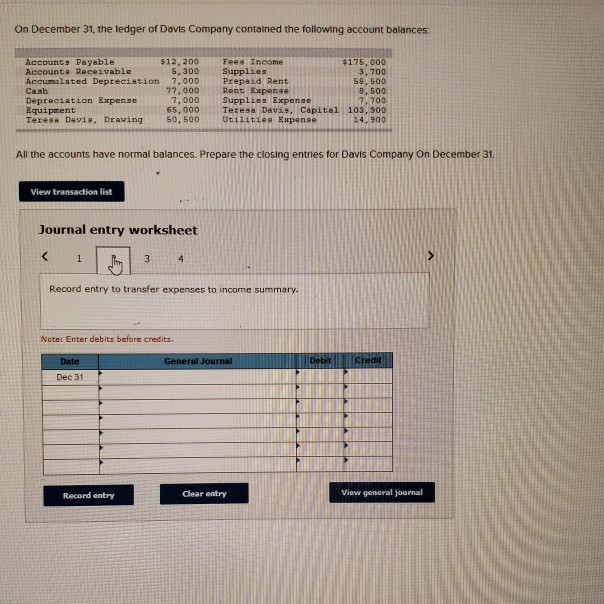

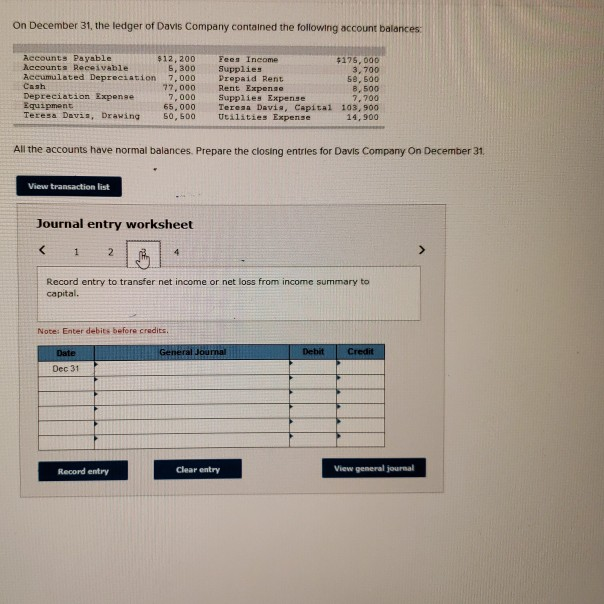

On December 31, the ledger of Davis Company contained the following account balances. Accounts Payable Account Receivable Accumulated Depreciation Cash Depreciation Expense Equipment Teresa Davis Deawing $12, 200 5.300 7.000 77,000 7.000 65,000 50.500 Teen Income $175.000 Supplies 3.700 Prepaid Rens 50.500 Rent Expense Supplies Expense S 7,700 Tereva DaVia Capital 103, 900 Utsisid Expense 14, 900 All the accounts have normal balances. Prepare the closing entries for Davis Company on December 31 View transaction list Journal entry worksheet 1 2 3 4 Record entry to transfer fees income to income summary Note Enter debits before credits Date General Journal Credit Dec 31 Record entry Clear entry View general journal On December 31, the ledger of Davis Company contained the following account balances Accounts Payable $12, 200 Account Receivable 5.300 Accumulated Depreciation 7.000 Cash 77.000 Depreciation Expense 7.000 Equipment 65,000 Teresa Davis, Drawing 50.500 Fees Income $175.000 Supplies 3, 700 Prepaid Rent 58,500 Rent Expense 9.500 Supplies Expense 17,700 Teresa Davis, Capital 103,900 Utilities Expense 14,900 All the accounts have normal balances. Prepare the closing entries for Davis Company on December 31. View transaction list Journal entry worksheet Record entry to transfer expenses to income summary Note: Enter debits before credits. General Journal Date Dec 31 Record entry clear entry View general journal On December 31, the ledger of Davis Company contained the following account balances Accounts Payable $12.200 Accounts Receivable 5,300 Accumulated Depreciation 7,000 Cash 77,000 Depreciation Expense 7.000 Equipment 65,000 Teresa Davis, Drawing 50, 500 Fees Income $175,000 Supplies 3.700 Prepaid Rent 50.500 Rent Expense 8.500 Supplies Expense 7.700 Teresa Davis, Capital 103, 900 cilities Expense 14,900 All the accounts have normal balances. Prepare the closing entries for Davis Company on December 31 View transaction list Journal entry worksheet 1 2 Record entry to transfer net income or net loss from income summary to capital. Note: Enter debits before credits Date Debit Credit Dec 31 Record entry Clear entry View general journal On December 31, the ledger or Davis Company contained the following account balances Accounts Payable $ 12. 200 Accounts Receivable 5,300 Accumulated Depreciation 7.000 Cash 77,000 Depreciation Expense 7,000 Equipment 65,000 Teresa Davis, Drawing 50, 500 Fees Income $175,000 Supplies 3,700 Prepaid Rent 58,500 Rent Expense 8,500 Supplieg Expense 7.700 Teresa Davis, Capital 103, 900 Utilities Expense 14,900 All the accounts have normal balances. Prepare the closing entries for Davis Company on December 31 View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started