Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, year 0, your company bought a delivery truck for $50,000. The expected useful life is 4 years, with an expected salvage

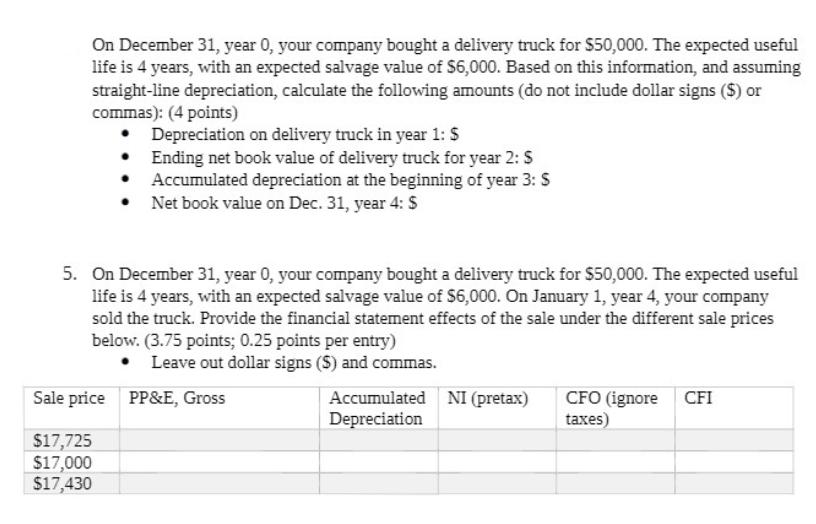

On December 31, year 0, your company bought a delivery truck for $50,000. The expected useful life is 4 years, with an expected salvage value of $6,000. Based on this information, and assuming straight-line depreciation, calculate the following amounts (do not include dollar signs ($) or commas): (4 points) Depreciation on delivery truck in year 1: $ Ending net book value of delivery truck for year 2: $ Accumulated depreciation at the beginning of year 3: S Net book value on Dec. 31, year 4: $ 5. On December 31, year 0, your company bought a delivery truck for $50,000. The expected useful life is 4 years, with an expected salvage value of $6,000. On January 1, year 4, your company sold the truck. Provide the financial statement effects of the sale under the different sale prices below. (3.75 points; 0.25 points per entry) Leave out dollar signs (S) and commas. Sale price PP&E, Gross $17,725 $17,000 $17,430 Accumulated NI (pretax) Depreciation CFO (ignore taxes) CFI

Step by Step Solution

★★★★★

3.29 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepwise calculations for the 17430 sale price Original cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started