Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, Year 1, Main Corporation of Toronto paid 15.00 million Bahamian dollars (B$) for 100% of the outstanding common shares of Sub Company

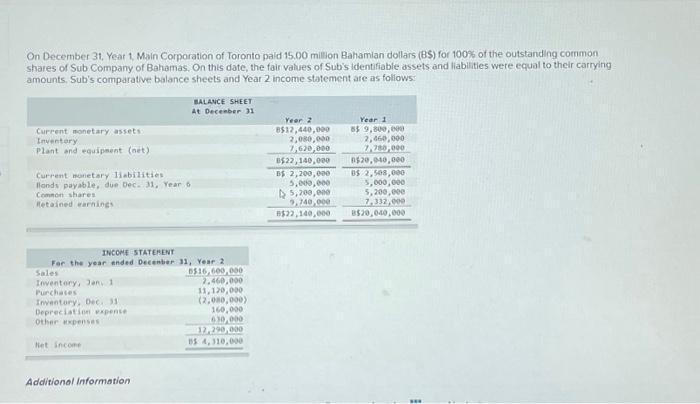

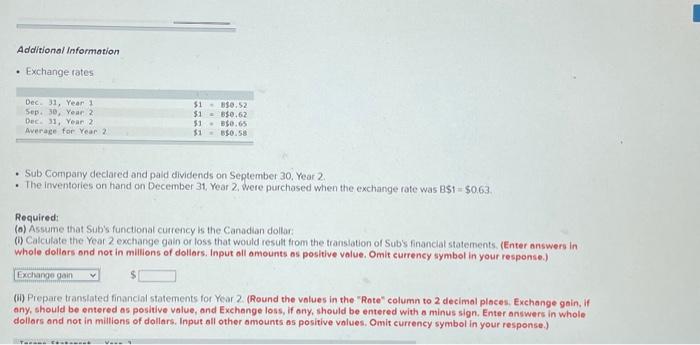

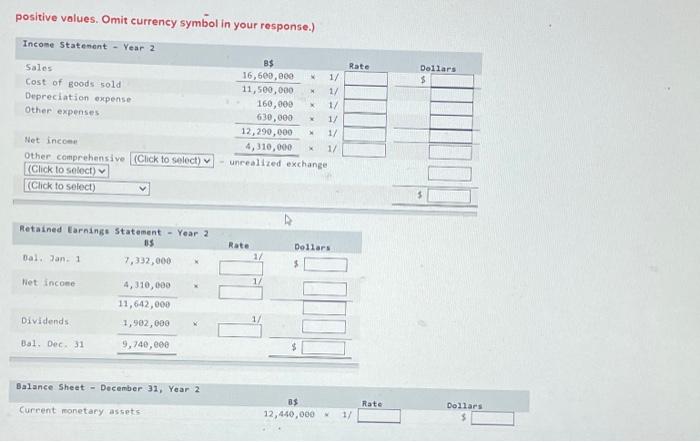

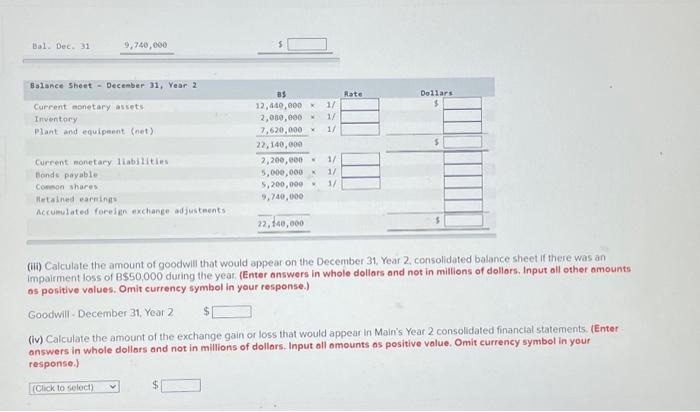

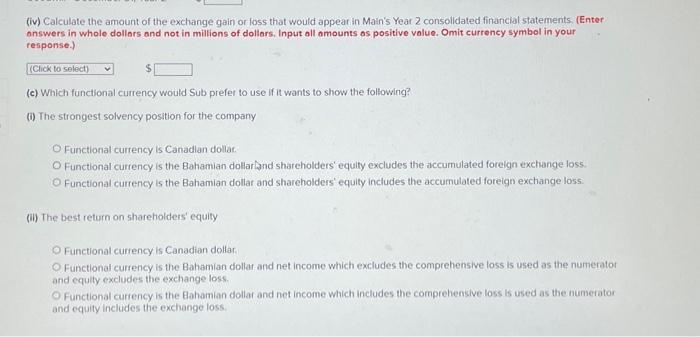

On December 31, Year 1, Main Corporation of Toronto paid 15.00 million Bahamian dollars (B$) for 100% of the outstanding common shares of Sub Company of Bahamas. On this date, the fair values of Sub's identifiable assets and liabilities were equal to their carrying amounts. Sub's comparative balance sheets and Year 2 income statement are as follows: Current monetary assets Inventory Plant and equipment (net) Current monetary liabilities Bonds payable, due Dec. 31, Year 6 Common shares Retained earnings INCOME STATEMENT For the year ended December 31, Year 2 Sales Inventory, Jan. 1 Purchases Inventory, Dec. 31 Depreciation expense Other expenses Net income BALANCE SHEET At December 31 Additional Information B$16,600,000 2,460,000 11,120,000 (2,080,000) 160,000 630,000 12,290,000 B$ 4,310,000 Year 2 B$12,440,000 2,080,000 7,620,000 B$22,140,000 B$ 2,200,000 5,000,000 5,200,000 9,740,000 B$22,140,000 Year 1 B$ 9,800,000 2,460,000 7,780,000 B$20,040,000 B$ 2,508,000 5,000,000 5,200,000 7,332,000 B$20,040,000 www

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started