On December 31, Year 1, the West Corporation estimated that $6,000 of its receivables might not be collected. At the end of Year 1,

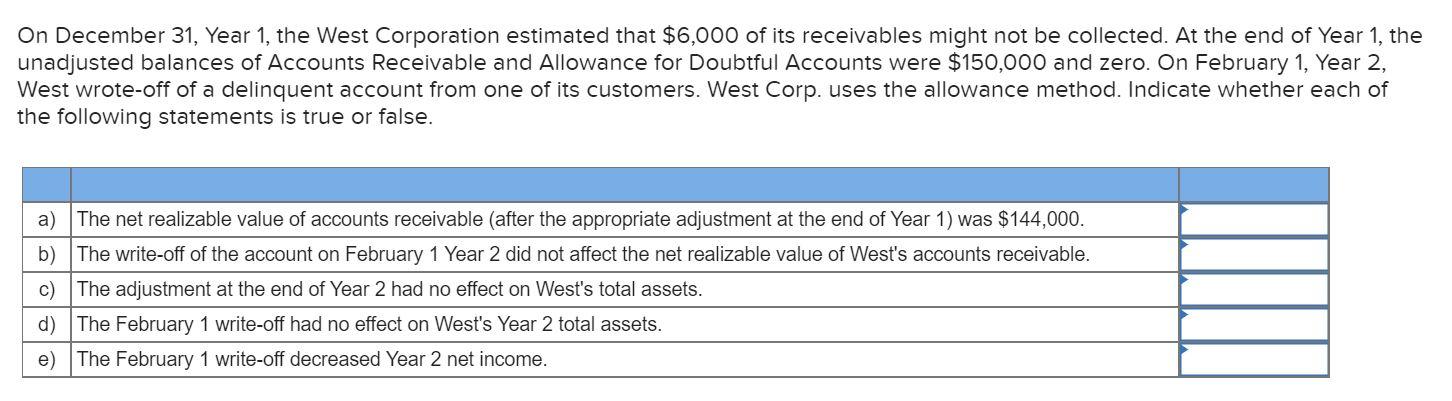

On December 31, Year 1, the West Corporation estimated that $6,000 of its receivables might not be collected. At the end of Year 1, the unadjusted balances of Accounts Receivable and Allowance for Doubtful Accounts were $150,000 and zero. On February 1, Year 2, West wrote-off of a delinquent account from one of its customers. West Corp. uses the allowance method. Indicate whether each of the following statements is true or false. a) The net realizable value of accounts receivable (after the appropriate adjustment at the end of Year 1) was $144,000. b) The write-off of the account on February 1 Year 2 did not affect the net realizable value of West's accounts receivable. c) The adjustment at the end of Year 2 had no effect on West's total assets. d) The February 1 write-off had no effect on West's Year 2 total assets. e) The February 1 write-off decreased Year 2 net income.

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution a TRUE Net realizable value 1500006000 144000 b TRUE The write off decreases both accoun...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started