Answered step by step

Verified Expert Solution

Question

1 Approved Answer

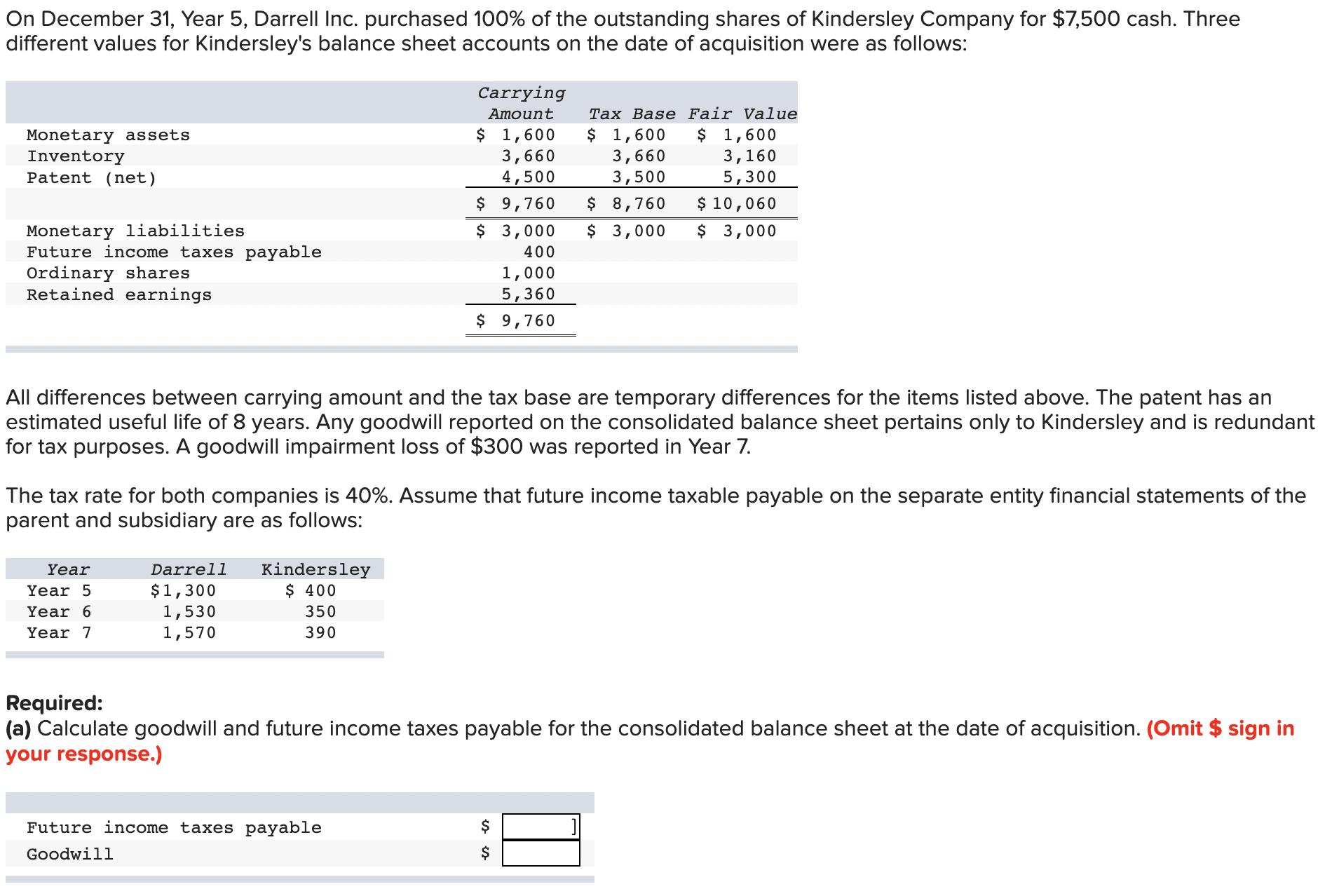

On December 31, Year 5, Darrell Inc. purchased 100% of the outstanding shares of Kindersley Company for $7,500 cash. Three different values for Kindersley's

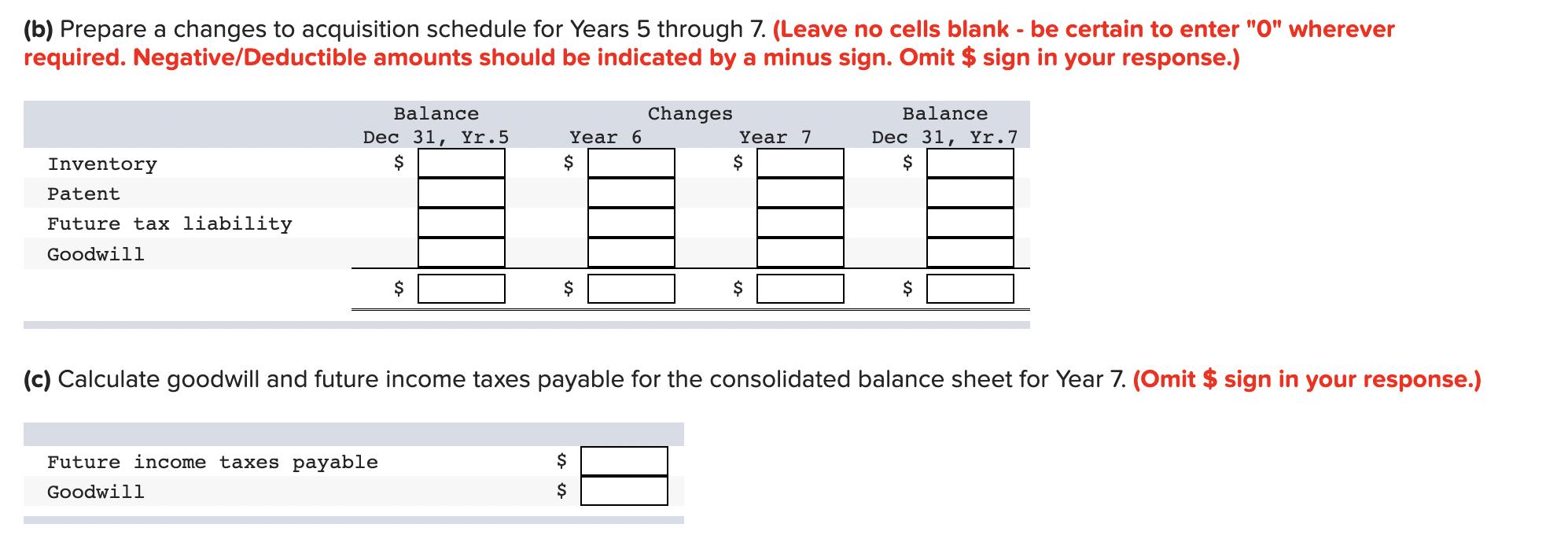

On December 31, Year 5, Darrell Inc. purchased 100% of the outstanding shares of Kindersley Company for $7,500 cash. Three different values for Kindersley's balance sheet accounts on the date of acquisition were as follows: Monetary assets Inventory Patent (net) Monetary liabilities Future income taxes payable Ordinary shares Retained earnings Year Year 5 Year 6 Year 7 All differences between carrying amount and the tax base are temporary differences for the items listed above. The patent has an estimated useful life of 8 years. Any goodwill reported on the consolidated balance sheet pertains only to Kindersley and is redundant for tax purposes. A goodwill impairment loss of $300 was reported in Year 7. Darrell $1,300 1,530 1,570 Carrying Amount Tax Base Fair Value $ 1,600 $ 1,600 $ 1,600 3,160 3,660 4,500 3,660 3,500 5,300 9,760 $ 8,760 $ 10,060 $ 3,000 3,000 $ 3,000 400 The tax rate for both companies is 40%. Assume that future income taxable payable on the separate entity financial statements of the parent and subsidiary are as follows: Kindersley $ 400 350 390 $ $ 1,000 5,360 $9,760 Future income taxes payable Goodwill Required: (a) Calculate goodwill and future income taxes payable for the consolidated balance sheet at the date of acquisition. (Omit $ sign in your response.) $ $ (b) Prepare a changes to acquisition schedule for Years 5 through 7. (Leave no cells blank - be certain to enter "0" wherever required. Negative/Deductible amounts should be indicated by a minus sign. Omit $ sign in your response.) Inventory Patent Future tax liability Goodwill Balance Dec 31, Yr.5 $ Year 6 $ Future income taxes payable Goodwill $ Changes $ $ Year 7 $ $ Balance Dec 31, Yr.7 $ (c) Calculate goodwill and future income taxes payable for the consolidated balance sheet for Year 7. (Omit $ sign in your response.) $

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Future Income Taxes Payable Year 5 Darrell 1300 given Kindersley 400 given Year 6 Darrell 1530 given Kindersley 350 given Year 7 Darrell 1570 given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started