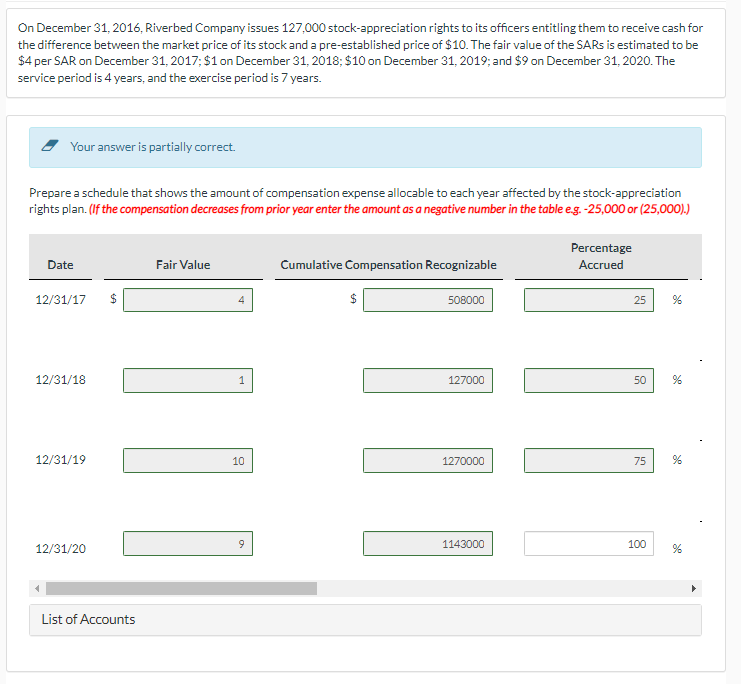

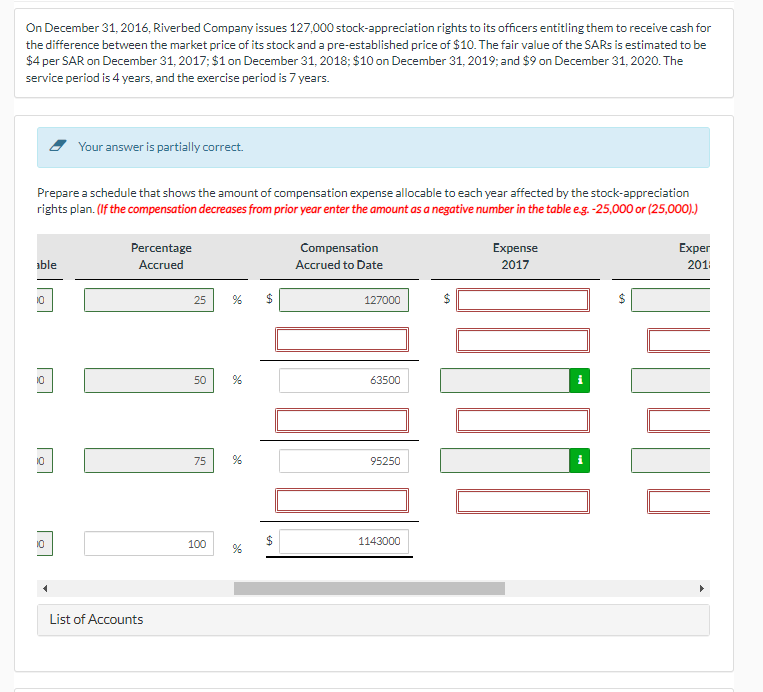

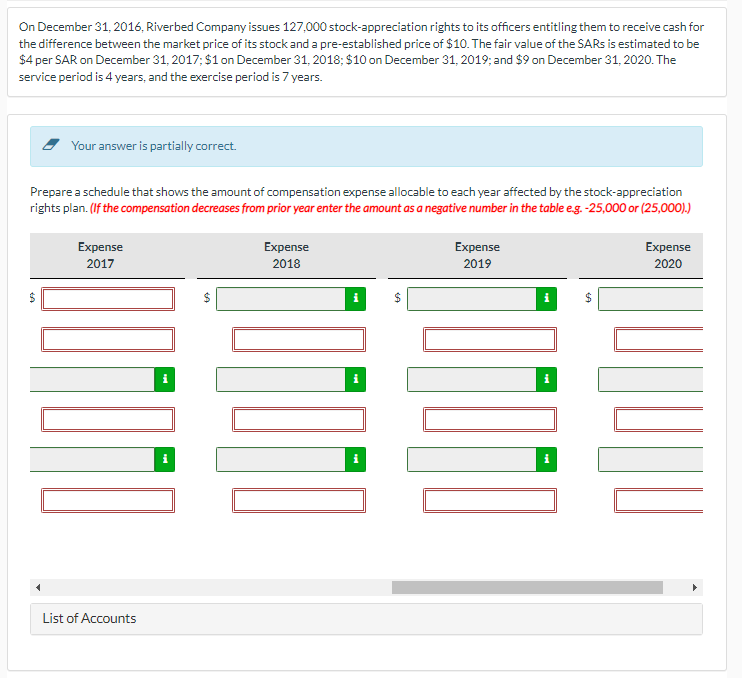

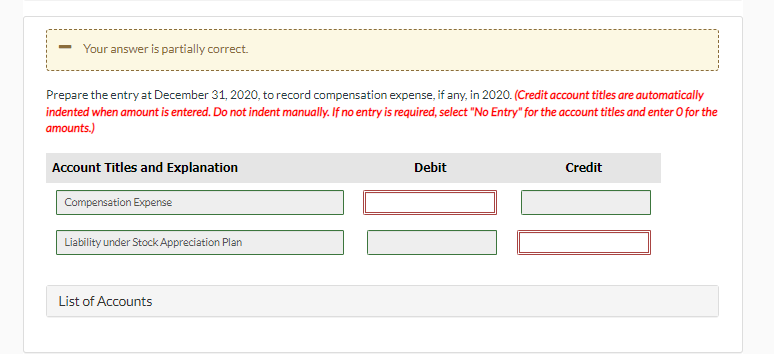

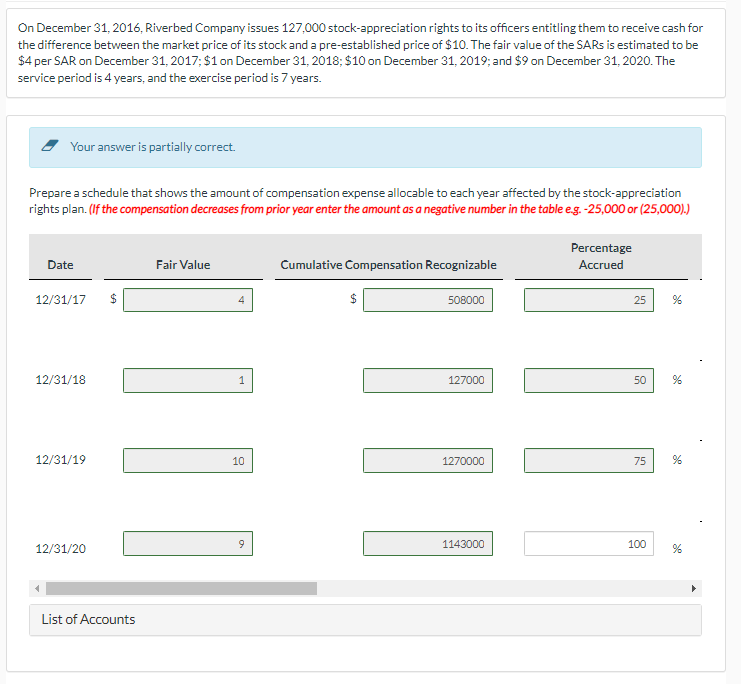

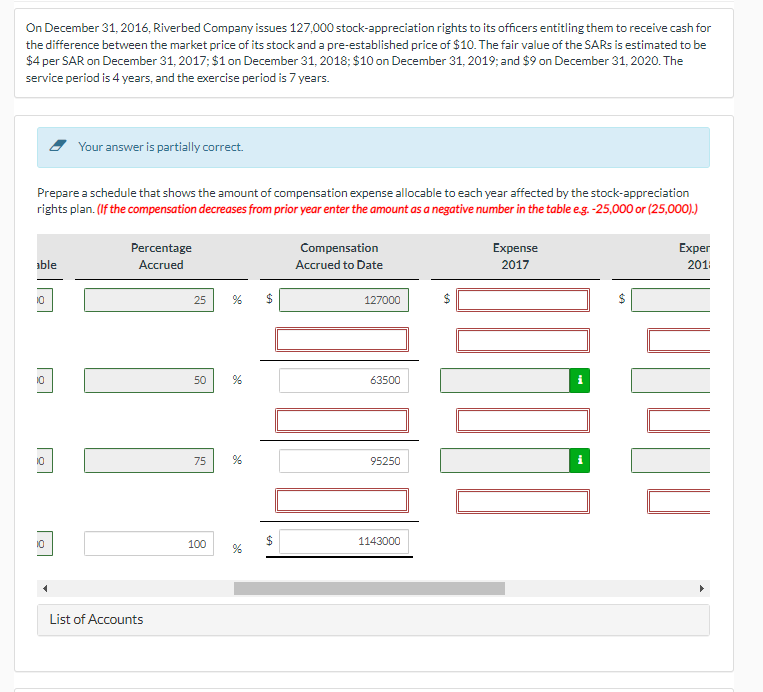

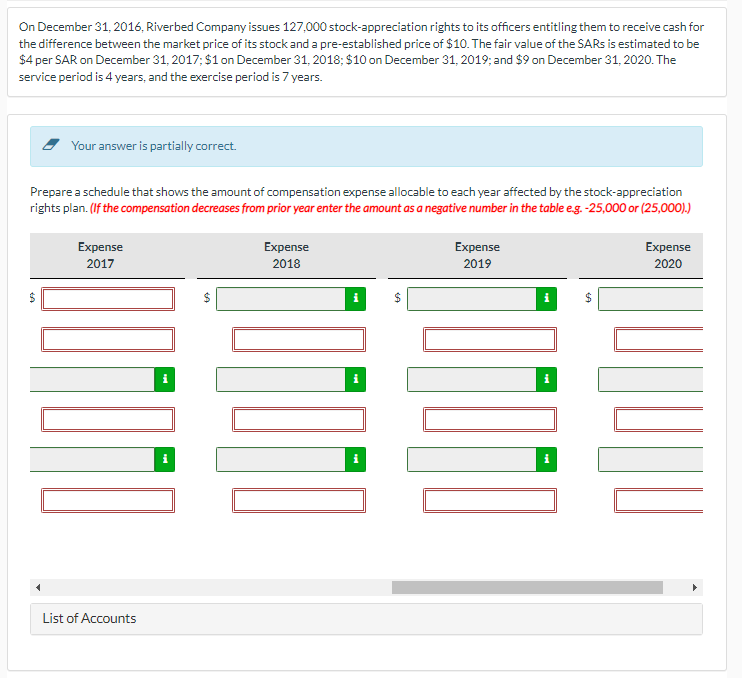

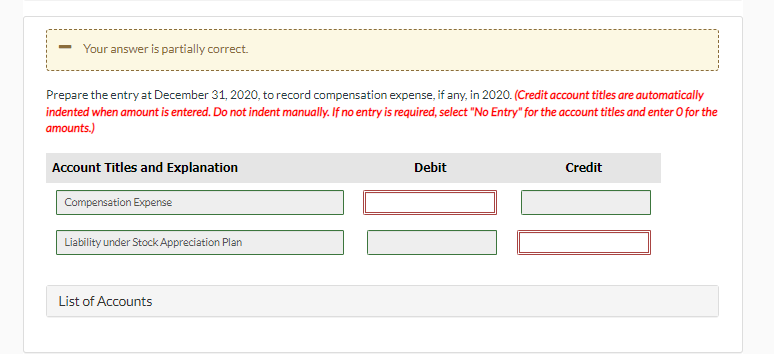

On December 31,2016 , Riverbed Company issues 127,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. The fair value of the SARs is estimated to be $4 per SAR on December 31,2017;$1 on December 31,2018 ; $10 on December 31,2019 ; and $9 on December 31,2020 . The service period is 4 years, and the exercise period is 7 years. Your answer is partially correct. Prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan. (If the compensation decreases from prior year enter the amount as a negative number in the table e.g. 25,000 or (25,000).) On December 31,2016 , Riverbed Company issues 127,000 stock-appreciation rights to its officers entitling them to receive cash for he difference between the market price of its stock and a pre-established price of $10. The fair value of the SARs is estimated to be $4 per SAR on December 31,2017;$1 on December 31,2018;$10 on December 31,2019 ; and $9 on December 31,2020 . The iervice period is 4 years, and the exercise period is 7 years. Your answer is partially correct. Prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan. (If the compensation decreases from prior year enter the amount as a negative number in the table e.g. 25,000 or ( 25,000 ).) On December 31,2016 , Riverbed Company issues 127,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. The fair value of the SARs is estimated to be $4 per SAR on December 31,2017;$1 on December 31,2018 ; $10 on December 31,2019 ; and $9 on December 31,2020 . The service period is 4 years, and the exercise period is 7 years. Your answer is partially correct. Prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan. (If the compensation decreases from prior year enter the amount as a negative number in the table e.g. 25,000 or ( 25,000 ).) Prepare the entry at December 31,2020 , to record compensation expense, if any, in 2020 . (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) On December 31,2016 , Riverbed Company issues 127,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. The fair value of the SARs is estimated to be $4 per SAR on December 31,2017;$1 on December 31,2018 ; $10 on December 31,2019 ; and $9 on December 31,2020 . The service period is 4 years, and the exercise period is 7 years. Your answer is partially correct. Prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan. (If the compensation decreases from prior year enter the amount as a negative number in the table e.g. 25,000 or (25,000).) On December 31,2016 , Riverbed Company issues 127,000 stock-appreciation rights to its officers entitling them to receive cash for he difference between the market price of its stock and a pre-established price of $10. The fair value of the SARs is estimated to be $4 per SAR on December 31,2017;$1 on December 31,2018;$10 on December 31,2019 ; and $9 on December 31,2020 . The iervice period is 4 years, and the exercise period is 7 years. Your answer is partially correct. Prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan. (If the compensation decreases from prior year enter the amount as a negative number in the table e.g. 25,000 or ( 25,000 ).) On December 31,2016 , Riverbed Company issues 127,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. The fair value of the SARs is estimated to be $4 per SAR on December 31,2017;$1 on December 31,2018 ; $10 on December 31,2019 ; and $9 on December 31,2020 . The service period is 4 years, and the exercise period is 7 years. Your answer is partially correct. Prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan. (If the compensation decreases from prior year enter the amount as a negative number in the table e.g. 25,000 or ( 25,000 ).) Prepare the entry at December 31,2020 , to record compensation expense, if any, in 2020 . (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)