Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On excel please, I'll leave thumbs up, thanks. Question 3 For each of the following statements indicate True or False and briefly explain A) An

On excel please, I'll leave thumbs up, thanks.

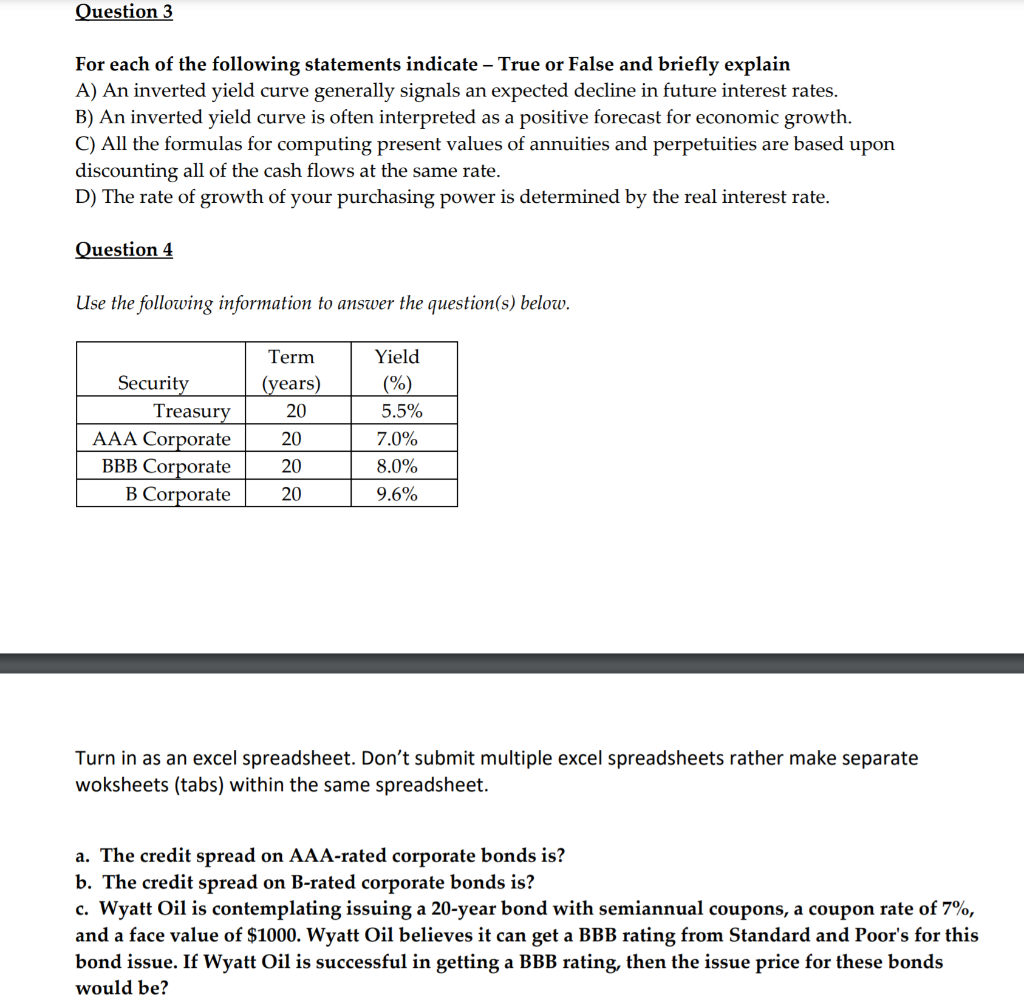

Question 3 For each of the following statements indicate True or False and briefly explain A) An inverted yield curve generally signals an expected decline in future interest rates. B) An inverted yield curve is often interpreted as a positive forecast for economic growth. C) All the formulas for computing present values of annuities and perpetuities are based upon discounting all of the cash flows at the same rate. D) The rate of growth of your purchasing power is determined by the real interest rate. Question 4 Use the following information to answer the question(s) below. Security Treasury AAA Corporate BBB Corporate B Corporate Term (years) 20 20 20 20 Yield (%) 5.5% 7.0% 8.0% 9.6% Turn in as an excel spreadsheet. Don't submit multiple excel spreadsheets rather make separate woksheets (tabs) within the same spreadsheet. a. The credit spread on AAA-rated corporate bonds is? b. The credit spread on B-rated corporate bonds is? c. Wyatt Oil is contemplating issuing a 20-year bond with semiannual coupons, a coupon rate of 7%, and a face value of $1000. Wyatt Oil believes it can get a BBB rating from Standard and Poor's for this bond issue. If Wyatt Oil is successful in getting a BBB rating, then the issue price for these bonds would beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started