Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Feb. 1st, you observe the following: * The spot S&P 500 price is $3,875. * There exists a March S&P 500 futures contract with

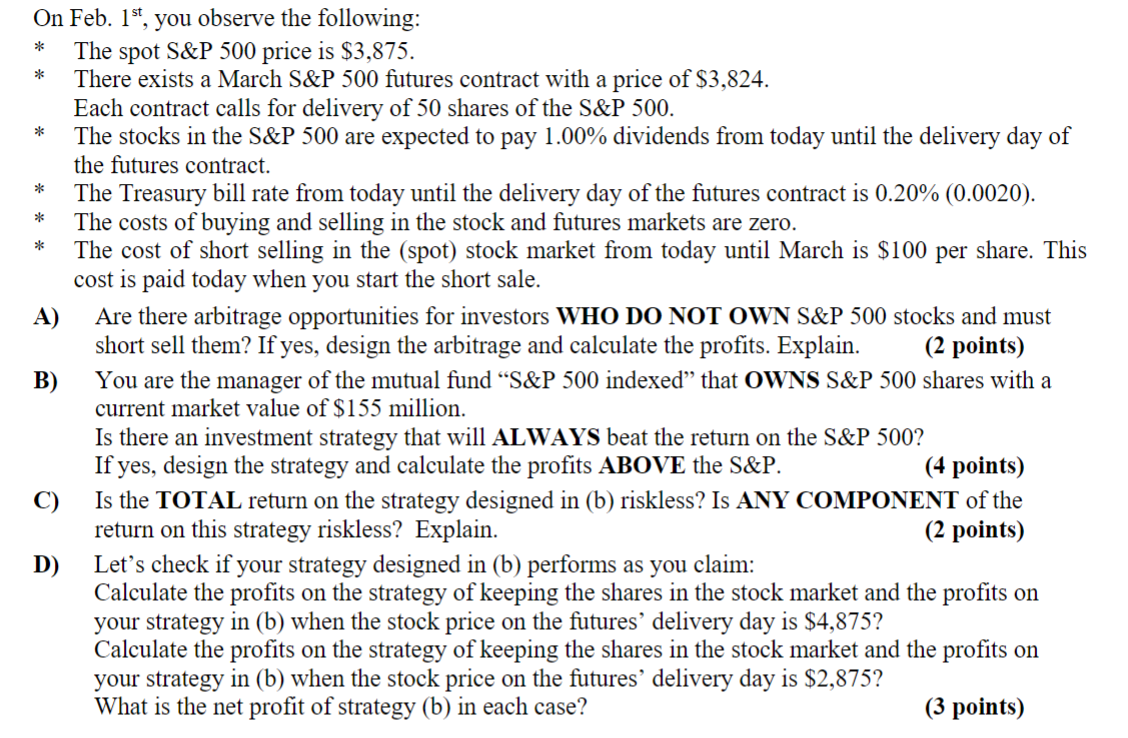

On Feb. 1st, you observe the following: * The spot S\&P 500 price is $3,875. * There exists a March S\&P 500 futures contract with a price of $3,824. Each contract calls for delivery of 50 shares of the S\&P 500 . * The stocks in the S\&P 500 are expected to pay 1.00% dividends from today until the delivery day of the futures contract. * The Treasury bill rate from today until the delivery day of the futures contract is 0.20%(0.0020). * The costs of buying and selling in the stock and futures markets are zero. * The cost of short selling in the (spot) stock market from today until March is $100 per share. This cost is paid today when you start the short sale. A) Are there arbitrage opportunities for investors WHO DO NOT OWN S\&P 500 stocks and must short sell them? If yes, design the arbitrage and calculate the profits. Explain. ( 2 points) B) You are the manager of the mutual fund "S\&P 500 indexed" that OWNS S\&P 500 shares with a current market value of $155 million. Is there an investment strategy that will ALWAYS beat the return on the S\&P 500? If yes, design the strategy and calculate the profits ABOVE the S\&P. (4 points) C) Is the TOTAL return on the strategy designed in (b) riskless? Is ANY COMPONENT of the return on this strategy riskless? Explain. ( 2 points) D) Let's check if your strategy designed in (b) performs as you claim: Calculate the profits on the strategy of keeping the shares in the stock market and the profits on your strategy in (b) when the stock price on the futures' delivery day is $4,875 ? Calculate the profits on the strategy of keeping the shares in the stock market and the profits on your strategy in (b) when the stock price on the futures' delivery day is $2,875 ? What is the net profit of strategy (b) in each case? (3 points)

On Feb. 1st, you observe the following: * The spot S\&P 500 price is $3,875. * There exists a March S\&P 500 futures contract with a price of $3,824. Each contract calls for delivery of 50 shares of the S\&P 500 . * The stocks in the S\&P 500 are expected to pay 1.00% dividends from today until the delivery day of the futures contract. * The Treasury bill rate from today until the delivery day of the futures contract is 0.20%(0.0020). * The costs of buying and selling in the stock and futures markets are zero. * The cost of short selling in the (spot) stock market from today until March is $100 per share. This cost is paid today when you start the short sale. A) Are there arbitrage opportunities for investors WHO DO NOT OWN S\&P 500 stocks and must short sell them? If yes, design the arbitrage and calculate the profits. Explain. ( 2 points) B) You are the manager of the mutual fund "S\&P 500 indexed" that OWNS S\&P 500 shares with a current market value of $155 million. Is there an investment strategy that will ALWAYS beat the return on the S\&P 500? If yes, design the strategy and calculate the profits ABOVE the S\&P. (4 points) C) Is the TOTAL return on the strategy designed in (b) riskless? Is ANY COMPONENT of the return on this strategy riskless? Explain. ( 2 points) D) Let's check if your strategy designed in (b) performs as you claim: Calculate the profits on the strategy of keeping the shares in the stock market and the profits on your strategy in (b) when the stock price on the futures' delivery day is $4,875 ? Calculate the profits on the strategy of keeping the shares in the stock market and the profits on your strategy in (b) when the stock price on the futures' delivery day is $2,875 ? What is the net profit of strategy (b) in each case? (3 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started