Question

On February 1, 2016, Cromley Motor Products issued 6% bonds, dated February 1, with a face amount of $40 million. The bonds mature on January

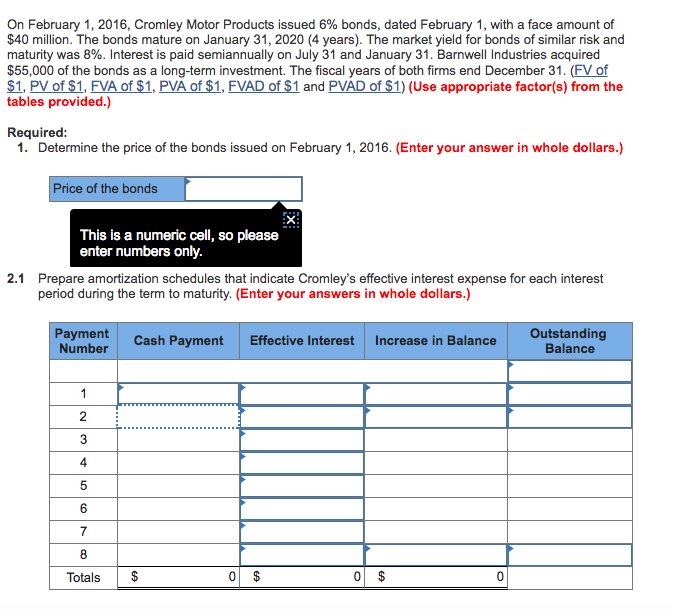

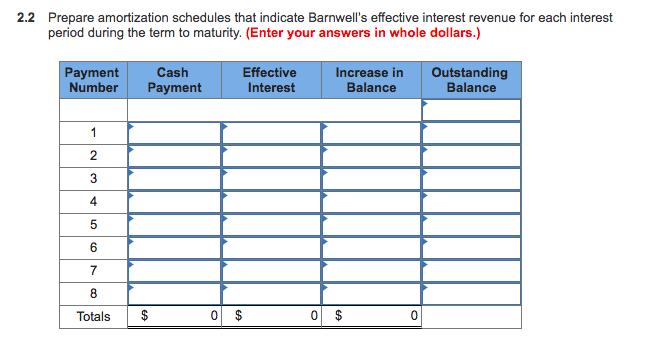

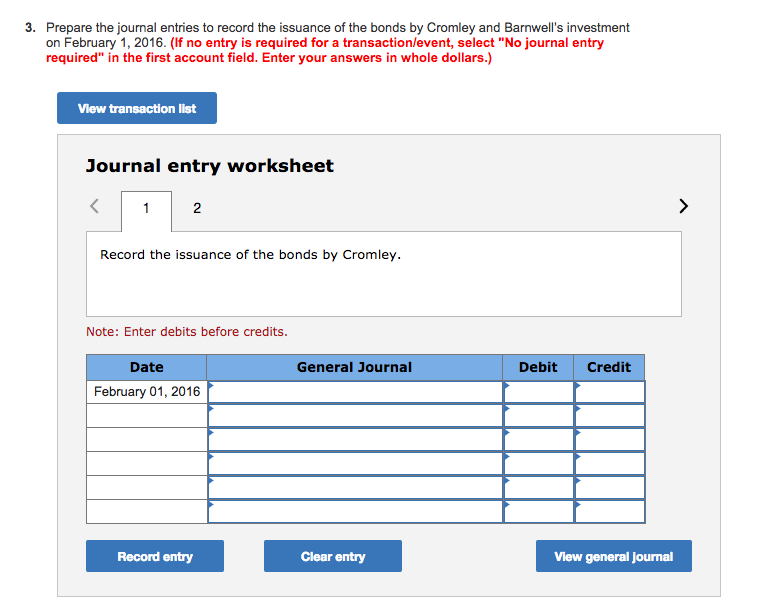

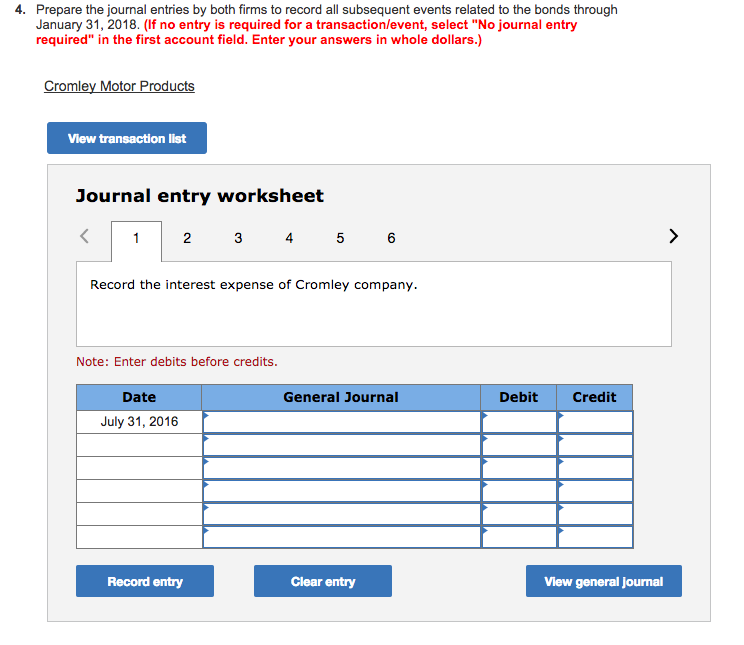

| On February 1, 2016, Cromley Motor Products issued 6% bonds, dated February 1, with a face amount of $40 million. The bonds mature on January 31, 2020 (4 years). The market yield for bonds of similar risk and maturity was 8%. Interest is paid semiannually on July 31 and January 31. Barnwell Industries acquired $55,000 of the bonds as a long-term investment. The fiscal years of both firms end December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Please show steps, thanks

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started