Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 1, 2017, Mar Contractors agreed to construct a building at a contract price of $15,400,000. Mar initially estimated total construction costs would

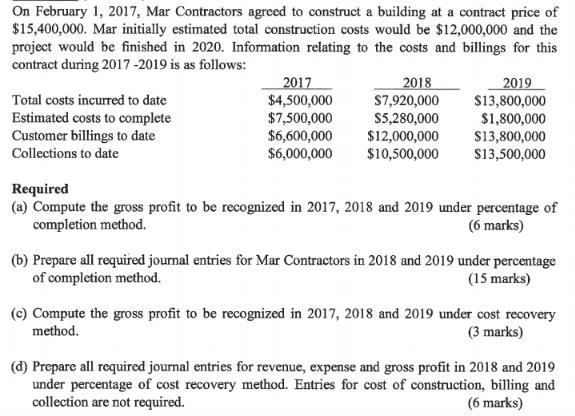

On February 1, 2017, Mar Contractors agreed to construct a building at a contract price of $15,400,000. Mar initially estimated total construction costs would be $12,000,000 and the project would be finished in 2020. Information relating to the costs and billings for this contract during 2017-2019 is as follows: Total costs incurred to date Estimated costs to complete Customer billings to date Collections to date 2017 $4,500,000 $7,500,000 $6,600,000 $6,000,000 2018 $7,920,000 $5,280,000 $12,000,000 $10,500,000 2019 $13,800,000 $1,800,000 $13,800,000 $13,500,000 Required (a) Compute the gross profit to be recognized in 2017, 2018 and 2019 under percentage of completion method. (6 marks) (b) Prepare all required journal entries for Mar Contractors in 2018 and 2019 under percentage of completion method. (15 marks) (c) Compute the gross profit to be recognized in 2017, 2018 and 2019 under cost recovery method. (3 marks) (d) Prepare all required journal entries for revenue, expense and gross profit in 2018 and 2019 under percentage of cost recovery method. Entries for cost of construction, billing and collection are not required. (6 marks)

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Estimated Total contract Cost Initial Revenue Agreed total cost incurred till date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started