Question

On February 1, 2018, a company borrowed $10,000 at 3% from the bank. Interest is payable every year on February 1st beginning February 1,

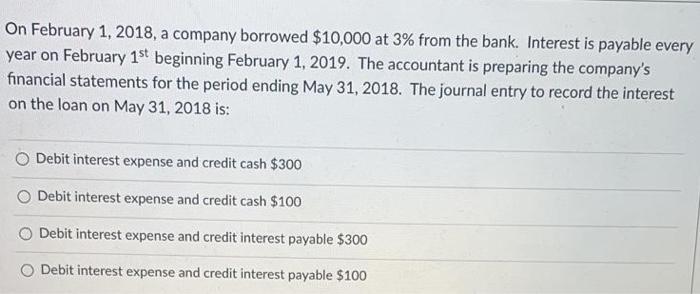

On February 1, 2018, a company borrowed $10,000 at 3% from the bank. Interest is payable every year on February 1st beginning February 1, 2019. The accountant is preparing the company's financial statements for the period ending May 31, 2018. The journal entry to record the interest on the loan on May 31, 2018 is: O Debit interest expense and credit cash $300 Debit interest expense and credit cash $100 Debit interest expense and credit interest payable $300 O Debit interest expense and credit interest payable $100

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

solution The Correct answer is option C date particulars debit credit 310518 Interest expense 300 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

9th Edition

125972266X, 9781259722660

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App